Bonterra shares advance on key resource update

The inferred resource estimate also increased 27% to 1.78 million oz., held in 9.17 million tonnes at 6.05 gram per tonne.

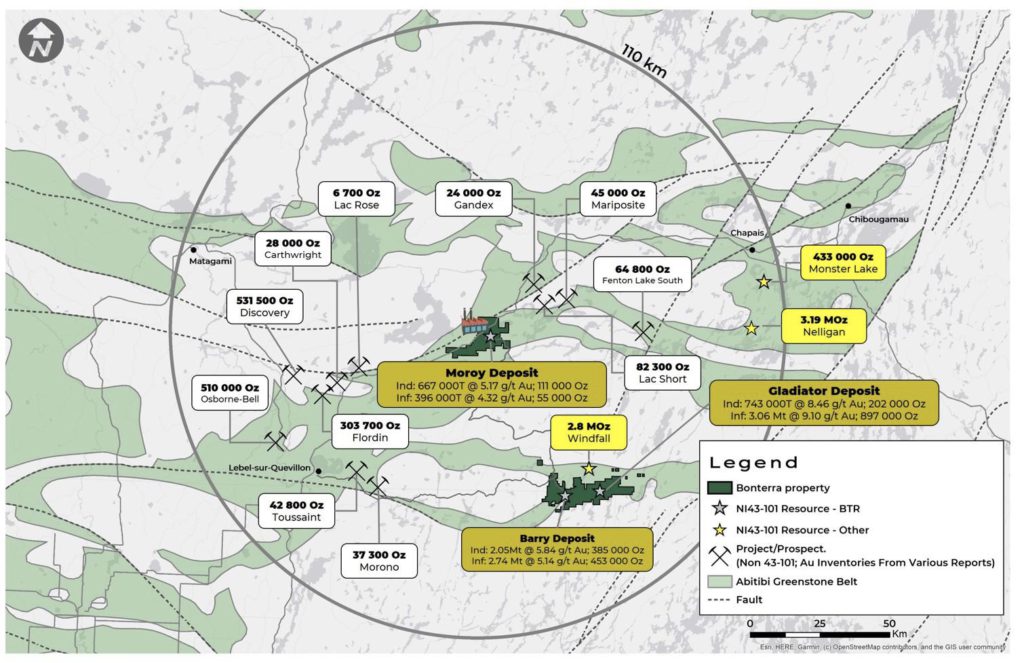

The Gladiator, Barry, and Moroy and Bachelor deposits now collectively host 1.24 million oz. M&I, and 1.78 million oz. inferred.

Prepared by SGS Canada, the current resource estimate is expected to underpin a preliminary economic study scheduled for release later this year.

Gladiator, Barry, Moroy and Bachelor are potential satellite deposits that could feed the only permitted and operational gold mill in the region, which Bonterra already owns, in a hub-and-spoke operating model. The mill is said to be about 75% through the permitting process to expand from 800 to 2,400 tonnes per day.

The resource estimate is the first step in the company’s three-pronged strategic approach to transition from advanced exploration to a development company over the next 18 to 24 months. The second is publishing the PEA, and the third, completing the mill expansion permitting before year-end.

Interest in the company has been on the up, given the resource expansion momentum. The company’s equity has gained 30% in value in the past 12 months.

In November last year, Bonterra rejected an “opportunistic” non-binding letter of intent from a third party regarding an all-share acquisition of the company valuing it at about C$1.60 per share.

Following review, the Bonterra board determined that the offer “significantly undervalued the company and its long-term prospects.”

Shares in the company last traded at C$1.39, capitalising the company at C$143.61 million.