Cathie Wood Funds Rally as Gene Editing Edges Closer to Reality

(Bloomberg) — Two Cathie Wood funds are back in the spotlight after adding about $1 billion in market value on Monday following a promising advance in the field of gene editing.

Wood’s Ark Investment Management LLC is a top holder of companies operating in this area after the active investor made an early bet on Crispr Therapeutics AG, Intellia Therapeutics Inc. and Editas Medicine Inc.– three companies using a technology for editing the human genome called Crispr. Ark is also the second largest holder in Beam Therapeutics Inc., another company working on fixing genetic mutations.

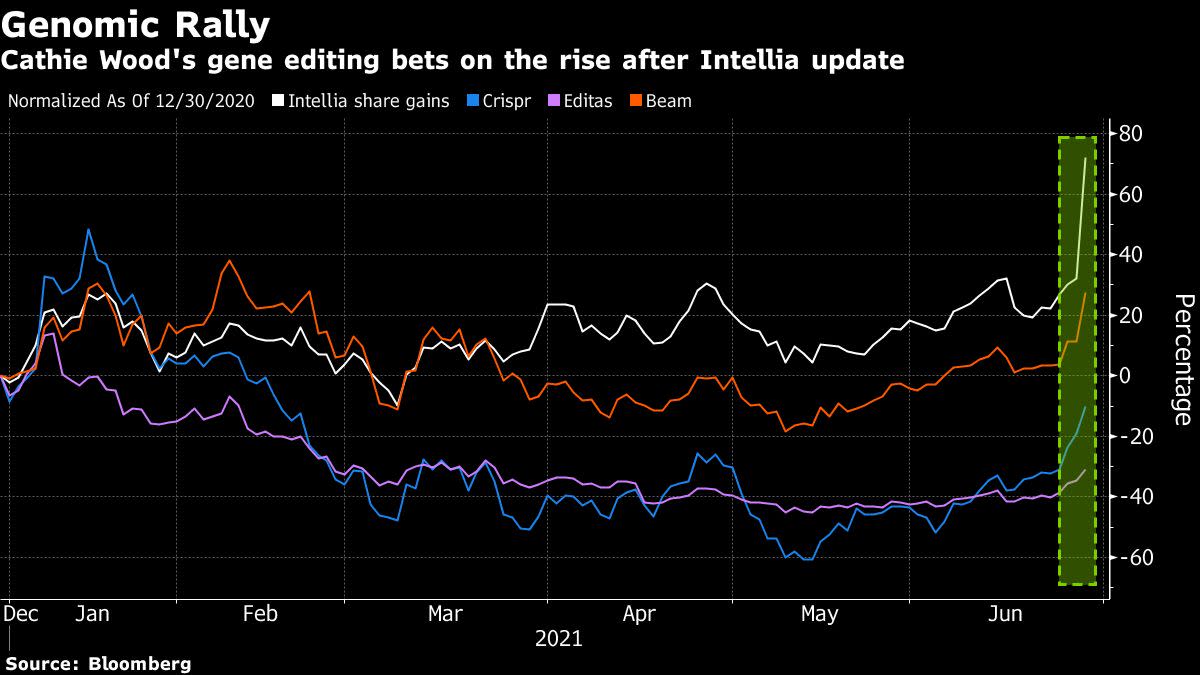

All four stocks rallied after Intellia and Regeneron Pharmaceuticals Inc. produced the first study of a Crispr treatment to alter genes inside the body, driving up the stocks of gene editing and other biotechs working with therapies around human DNA. The move marks a rebound for Editas and Crispr, as well as a pair of Wood’s actively managed exchange traded funds, which were hammered earlier this year as investors turned away from more speculative growth stocks to value safe havens.

The Ark Genomic Revolution ETF rose 3.4% on Monday while the nearly $25 billion Ark Innovation ETF rallied 3.6% as of midday in New York.

“This may sway the FDA to be more constructive toward running gene editing trials in the U.S.,” said Benjamin Burnett an analyst with Stifel. Intellia’s trial was also a good sign for Precision BioSciences Inc., he told clients in a research note, and the stock climbed as much as 12%.

Intellia led the gains, soaring as much as 63% to a record in Monday trading, while Editas gained as much as 20% and Crispr climbed 10% at the high trade. Beam jumped as much as 21%.

“We believe this data will enter the history books, signifying that in vivo gene editing and one-time cures are possible,” Ark analyst Ali Urman wrote after Intellia’s update. “The only question remaining is will it be durable?”

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.