Chipmaker SiFive Is Said to Draw Intel Takeover Interest

(Bloomberg) — SiFive Inc., a startup that designs semiconductors, has received takeover interest from investor Intel Corp., according to people familiar with the matter.

Intel offered to acquire SiFive for more than $2 billion, one of the people said, asking not to be identified because the matter is private.

The San Mateo, California-based company has been in talks with potential advisers on how to handle the takeover interest, the people added.

The company has received takeover offers from multiple parties other than Intel, one of the people said. It has also fielded offers for an investment, which could be a preferable route, the person added.

Discussions are early, there’s no guarantee any deal will be reached, and SiFive may choose to remain independent.

SiFive was last valued at around $500 million when it raised funds in 2020, according to data provider PitchBook.

A representative for Intel declined to comment. A representative for SiFive didn’t respond to requests for comment.

ARM Rival

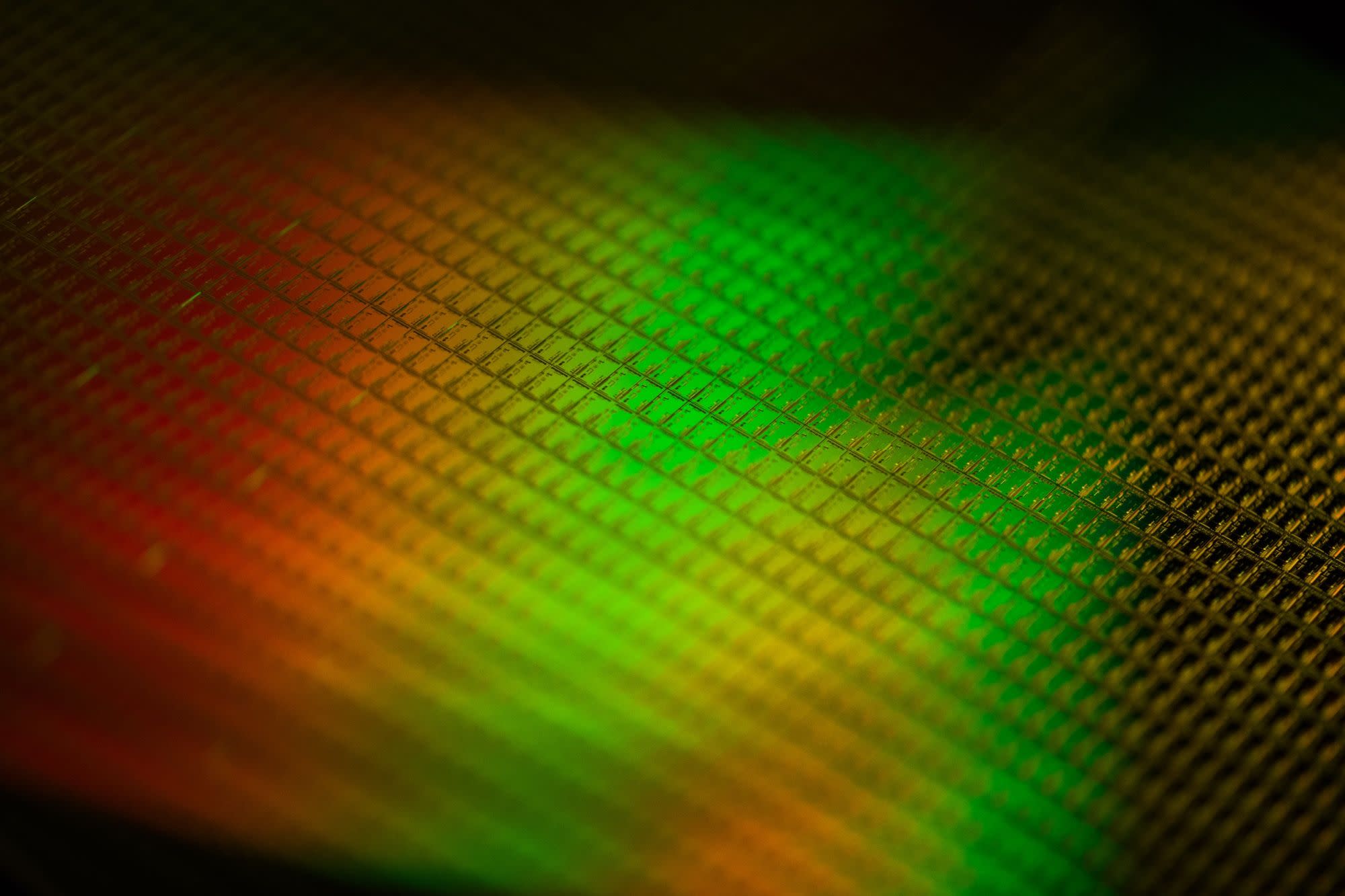

SiFive is a designer of chips that are based on the RISC-V architecture, an attempt to bring open-source standards to semiconductor design making it cheaper and accessible to customers.

Interest in SiFive has increased since Nvidia Corp. agreed in September to pay $40 billion for SoftBank Group Corp.’s Arm Ltd., which like SiFive, licenses chip and process designs.

SiFive Chief Executive Officer Patrick Little is a chip industry veteran. He joined SiFive last year from Qualcomm Inc. where he was a senior vice president in charge of their automotive business.

Read More: Silicon Valley’s Next Revolution Is Open Source Semiconductors

SiFive is seen as a potential beneficiary if Nvidia’s deal goes through because Arm’s customers are concerned the company might work less collaboratively with them, the people said.

The company’s investors include SK Hynix Inc., Spark Capital and Prosperity7 Ventures, the venture arm of Saudi Arabia’s state-owned energy producer Aramco. It also is backed by the venture arms of chipmaker Qualcomm and of hardware maker Western Digital Corp. It last raised $61 million in a funding round in 2020.

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.