Fate of Biogen’s Stock Rides on Alzheimer’s Drug Decision

(Bloomberg) — For Biogen Inc., the Food and Drug Administration’s expected decision Monday on its Alzheimer’s drug is what a JPMorgan Chase & Co. analyst called “the mother of all binary events” — one that could send its shares veering sharply in either direction.

If regulators give the company approval to market the drug, called aducanumab, the stock could surge to as much as $450, up from its $272.55 close on Thursday, according to Wall Street analysts. Or it could tumble to $200 if the treatment is shot down, according to Cory Kasimov, the JPMorgan analyst who follows the company.

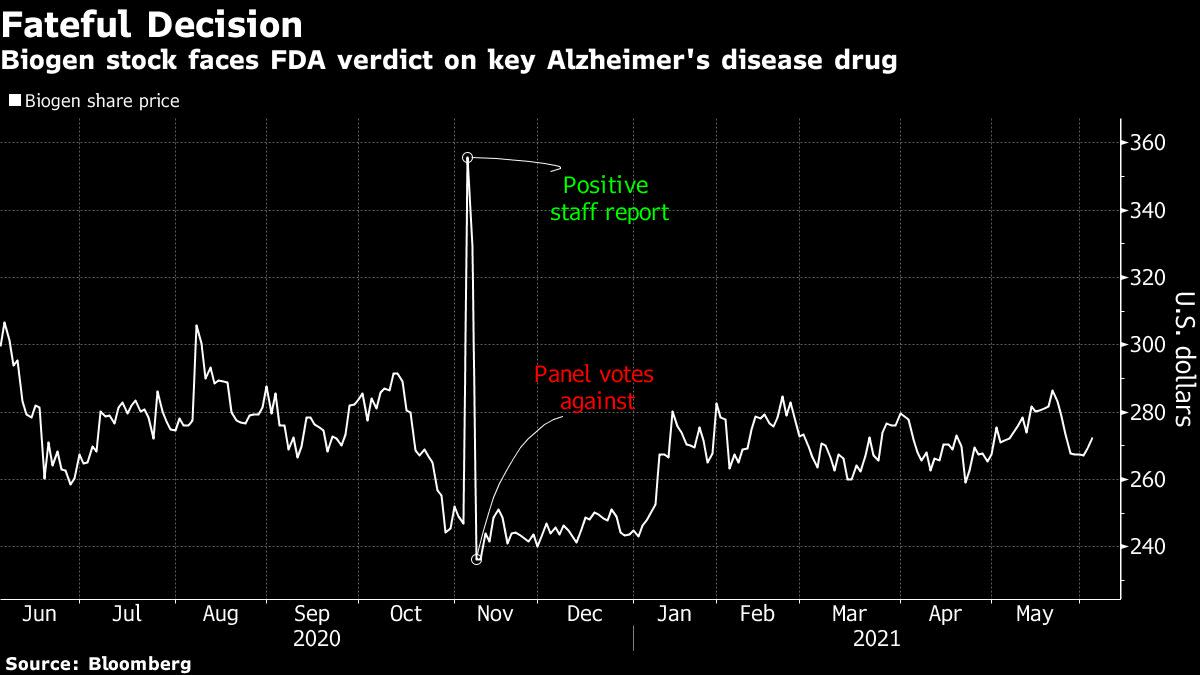

The forecasts reflect how heavily Biogen’s outlook is tied to the drug, the first that’s thought to slow the progression of the disease in people who show early signs of cognitive impairment. That’s left Wall Street analysts and investors trying to weigh whether regulators will hasten its approval despite mixed reviews that whipsawed the company’s stock late last year.

“The data package is insufficient, and with almost any other indication, we suspect regulators would be asking for another confirmatory trial pre-approval,” Kasimov wrote in a note to clients.

“But this isn’t any other indication. It’s Alzheimer’s. And the unmet need is rather unprecedented,” he wrote. “It’s anyone’s guess as to what happens next.”

Biogen’s stock has traded sideways since November, when it surged on an FDA staff report that said aducanumab appears effective, only to then tumble when an outside panel of agency advisers said the data from a single trial wasn’t sufficient. But activity in bullish Biogen calls has picked up recently, suggesting the market is positioning ahead of the June 7 decision date.

The stock rose as much as 1.1% to $275.43, the highest since May 24, in Friday trading.

The decision may also affect other drugmakers. Eli Lilly & Co. is working on its own early Alzheimer’s drug, donanemab, which could be seen as having an easier path if Biogen’s is approved. More volatile small-cap drugmakers are also pursuing their own treatments, including Cassava Sciences Inc., Annovis Bio Inc., Anavex Life Sciences Corp. and Prothena Corp.

The FDA decision is one of three near-term events that could help turn around sagging investor sentiment on the biotech industry, according to stock analysts. The other are depression trial results from Biogen and partner Sage Therapeutics Inc. and data expected from from Vertex Pharmaceuticals Inc. on [A THERAPY FOR?] genetic disorder.

The SPDR S&P Biotech ETF, which closely tracks smaller biotechs, has dropped 27% from February’s record as investors shifted out of growth stocks that were highly favored during the depths of the pandemic.

“Buckle up for what’s likely to be a very important month for biotech investing,” Kasimov said in a research note.

Jefferies analyst Michael Yee also saw room for a sector turnaround ahead of the three catalysts. “If net positive, we could see sentiment get better as these are generally very liquid well-trafficked names and could cause the group to rally.”

If the three events are negative? He said the sector could fall by another 10%.

(Adds shares in seventh paragraph)

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.