Fed Throws China a Curveball Just When It Seeks Stability

(Bloomberg) — China’s capacity to maintain stability in its financial markets is being tested by the Federal Reserve’s sudden hawkish shift.

Beijing has repeatedly voiced concern that liquidity-fueled bubbles overseas would burst when monetary conditions finally started to tighten. Bullish speculation domestically already prompted intervention by Chinese authorities, particularly in commodities. As such, a move by the Fed that starts to head off such a risk would be welcomed by the Communist Party, if its 100th anniversary wasn’t days away.

The resulting volatility in global markets threatens to spill into China and overshadow Party pageantry on July 1. President Xi Jinping — who is expected to seek a third term in a leadership shuffle next year — is scheduled to deliver a speech and hand out medals at a ceremony on the day. Preparations have included military-aircraft rehearsals for an aerial show in Beijing and bus loads of visitors shipped to “red sites” to learn about Party history.

So far, Beijing’s ability to keep its markets steady appears to be working.

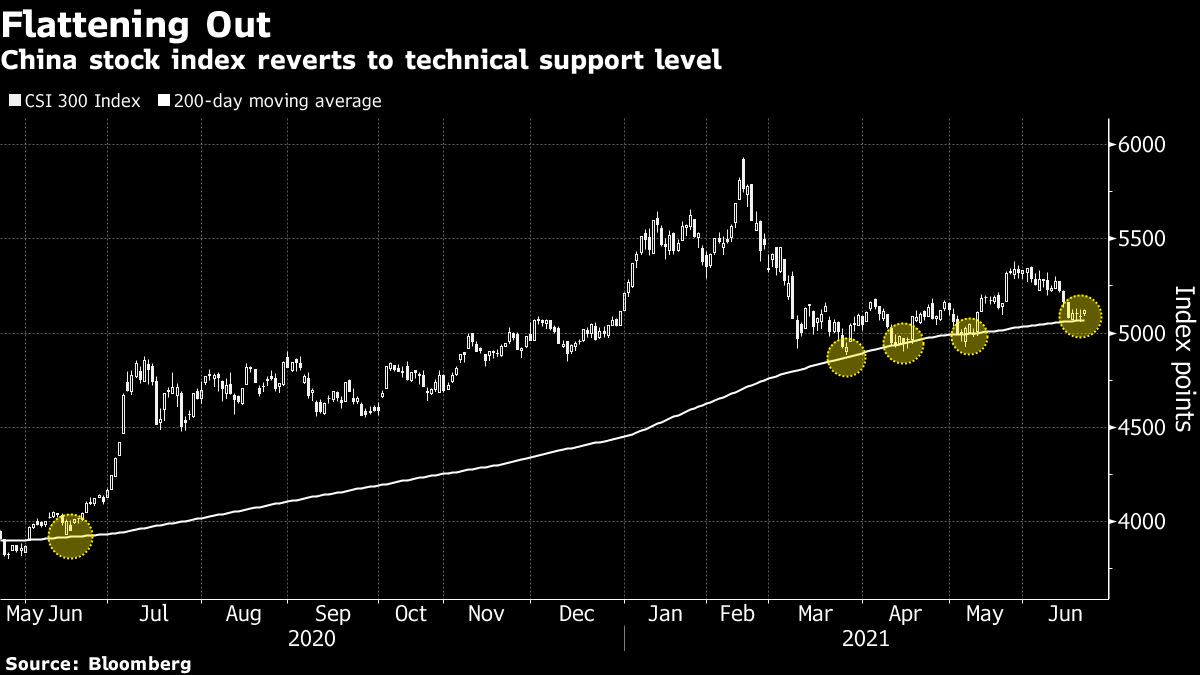

The CSI 300 Index of stocks barely budged this week even as the Fed’s pivot whipsawed benchmarks in Tokyo, London and New York. More broadly, volatility in China’s $12 trillion stock market remains low — with the gauge trading near its 200-day moving average — after officials helped suppress frenzied trading earlier this year.

“We do not expect Chinese markets to be particularly volatile into the CCP anniversary,” said Gary Dugan, chief executive officer at asset manager Global CIO Office in Singapore.

While the yuan has turned wilder — and weaker — Beijing had already been trying to restrain appreciation after the currency rose to a three-year high against the dollar. In the past month, authorities forced lenders to hold more foreign currencies in reserve and expanded a quota for funds to invest overseas to a record $147 billion. The Chinese currency now has depreciated about 1.7% in June but is anchored near its 100-day moving average.

Traders have brought forward their expectations of U.S. tapering after seven Fed officials last week projected an interest-rate hike as soon as 2022, up from four. On Tuesday, Fed Chair Jerome Powell said the central bank would be patient in waiting to lift borrowing costs.

The second half of the year may see more risks to market stability, according to Citigroup Inc. economists. They predict the economic impact of China’s credit-tightening measures will become more visible, while a recovery in global production may pressure the country’s exports.

“The overall macro backdrop is likely to turn less friendly for risk assets post the CCP’s centennial celebration in July,” wrote Citi economists including Xiangrong Yu in a note last week. “We think policy tightening could become more pronounced.”

(Updates with Wednesday market moves throughout, adds latest Powell comments in eighth paragraph. Clarifies language of QDII quota in seventh paragraph.)

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.