Gold price hits 10-week low, heading for worst month since 2016

[Click here for an interactive chart of gold prices]

The highly contagious virus strain that originated in India is fast becoming dominant in France and Germany. It has also become the main variant in South Africa’s commercially important Gauteng province, and close to half of Australia’s population is now in lockdown as it struggles to contain the delta variant.

A gauge of the US dollar strengthened on growing haven demand, adding pressure to bullion, which is widely seen as an alternative to the major currency.

The strength in the greenback “is a major drag on gold,” Commerzbank AG analyst Carsten Fritsch told Bloomberg on Tuesday.

“Gold repeatedly failed to overcome the 100-day moving average in recent days, which was a bearish sign. There is a risk now that so far patient ETF investors jump on the bandwagon and sell their holdings. This would amplify the downward move,” he added.

“Gold repeatedly failed to overcome the 100-day moving average in recent days, which was a bearish sign”

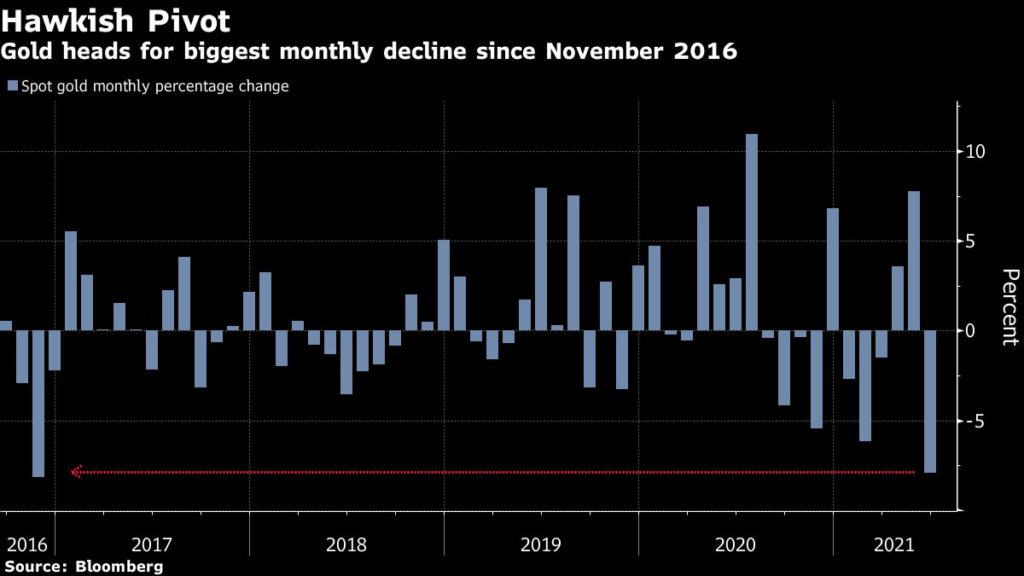

Bullion is headed for its biggest monthly drop in more than four years after the Federal Reserve pulled forward its forecasts for interest rate hikes.

Gold slipped below $1,800 an ounce this month, with traders now turning their focus on the timing of when policy makers may start dialing back stimulus.

“Market participants are reluctant to build new positions due to gold’s repeated failure to break above the psychologically important $1,800 level, upcoming labour market data and inflation,” Fritsch said in a separate note to Reuters.

Investor holdings of gold-backed exchange-traded funds remained steady this month after rising 1.6% in May, according to data compiled by Bloomberg.

(With files from Bloomberg and Reuters)