How oil soaring to $100 a barrel could be bad for this boom-bust sector and the economy

Oil companies often find religion in the wake of a boom-and-bust cycle, including after last year when crude prices crashed into negative territory for the first time on record.

But with oil prices recently back near $70 a barrel, and some analysts speculating on the return to $100 during the COVID recovery, investors fear wildcatting and other risky financial behavior by energy companies will make a comeback.

“We lost a lot of our weakest companies,” Andrew Feltus, co-director of high-yield at Amundi US, said of the ripple effects of oil futures going negative in April 2020 as demand collapsed with the first waves of COVID outbreaks and oil-producing giants Saudi Arabia and Russia waged an ugly price war.

“No one can exist in that type of situation for long,” Feltus told MarketWatch. “If you don’t have enough money to survive, you are gone.”

Company executives took those lessons for the U.S. energy complex to heart after pandemic shutdowns depressed oil demand and, for a period, led to higher borrowing costs in the sector. It also led to greater prudence.

But there’s no telling how long the latest stretch of “good” energy company behavior — actions preferred by their risk-wary lenders and investors — will last. That’s particularly true if prices shoot dramatically higher and breach $100 a barrel.

As Feltus said, “$50 oil is the price we want. $70 is just gravy. With $100 oil, they will be dancing in the streets of Dallas.”

Prices for U.S. benchmark West Texas Intermediate crude for July delivery CL00,

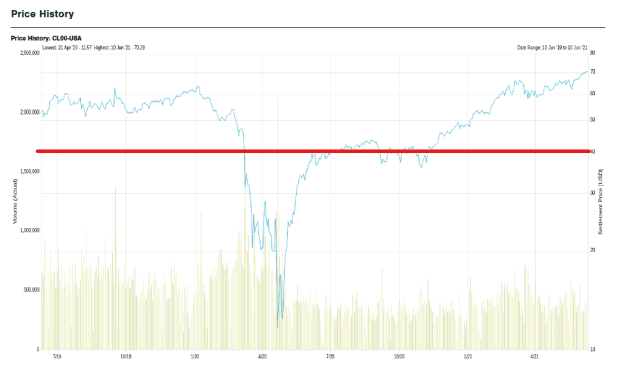

This chart tracks the plunge and recovery of WTI since April 2020, with the red line highlighting the stretch in which prices stayed below $40 a barrel.

$40 oil often brings pain.

FactSet

Keeping up?

Prices saw a boost Friday from the International Energy Agency, which said global oil demand would return to pre-COVID-19 pandemic levels by the end of next year.

IEA also forecast demand to reach 100.6 million barrels a day by the end of 2022, while indicating that producers will need to boost output to keep up with demand.

Read: Here’s what sparked the latest talk over $100 oil prices

The changing landscape for oil, including the increased focus by investors and the Biden administration on encouraging more environmentally sustainable practices, comes as a U.S. rig count has hovered at about half of pre-COVID levels, said Steve Repoff, portfolio manager at GW&K Investment.

But that’s not without its own set of concerns as vaccinations in the U.S. increase, demand for oil climbs and the economy opens more broadly, including over the summer. And the post-COVID travel season could turn costly for drivers.

“It seems these companies, for now, have demonstrated capital discipline, in a sector notorious for being unable to display capital discipline,” Repoff told MarketWatch.

“But if we see demand of 100 million barrels a day return, that feels very ominous to me,” he said, adding that it’s unclear if U.S. producers will struggle to ramp up production.

“What if all the best shale, in aggregate, has been drilled already?” Repoff said, while explaining how higher oil prices can be good for the oil industry, but also deflationary, even as the Federal Reserve expects the cost of living in America to overshoot its 2% inflation target for awhile during the recovery.

“When applied to the broader economy, it’s effectively a tax on businesses and consumers, and at the systemwide level is ultimately deflationary,” Repoff said of booming oil prices.

$100 oil is a mixed blessing

It took no time for COVID shutdowns to rattle the booming U.S. high-yield bond market last year, with defaults quickly jumping to a 10-year high of almost 5% and helping prompt the Fed to launch its first program ever of buying up corporate debt.

Recently, as the sector has recovered, including with yields on the overall ICE BofA U.S. High Yield Index plunging near all-time lows of 4.1%, the Fed said it would sell its remaining corporate bond exposure.

See: Is the Fed ‘tightening cycle’ already happening?

As a result, the so-called “junk-bond” market ended up with its highest-quality mix of companies by credit rating in at least a decade, but perhaps even 20 to 30 years, according to Feltus at Amundi, even while energy remains the sector’s biggest exposure at about 13% of its benchmark high-yield index. That compares with a roughly 3% slice for energy in the S&P 500 index SPX,

“ ‘$50 oil is the price we want. $70 is just gravy. With $100 oil, they will be dancing in the streets of Dallas.’ ”

While energy has long been a key part of the U.S. high-yield market, oil booms haven’t always been great over the long run for bond investors who help finance the sector.

“History says it depends on what else is going on in the market,” said Marty Fridson, chief investment officer at Lehmann Livian Fridson Advisors, particularly when oil prices rise and fall around times of economic crisis.

Starting in the summer of 2007, oil prices quickly advanced over eight months from $70.68 on June 29 to $101.84 on Feb. 29, 2008. But when Fridson looked at how the energy component fared over that stretch, it outperformed the ICE BofA US High Yield Index, returning 3.88% compared to negative 3.32%.

Then, in the more protracted recovery phase, oil went from $70.61 on Sept. 30, 2009, to $96.07 on Feb. 28, 2011, while energy underperformed the index, 23.57% to 26.38%.

Amundi’s Feltus also pointed out that companies “got religion for like six to 12 months of discipline,” after each recent oil bust. “This time breaks the record. But we can’t let up the pressure.”