How would Biden’s tax hikes hit the wealth of Jeff Bezos, Elon Musk and other billionaires? First, they’d have to die, experts say

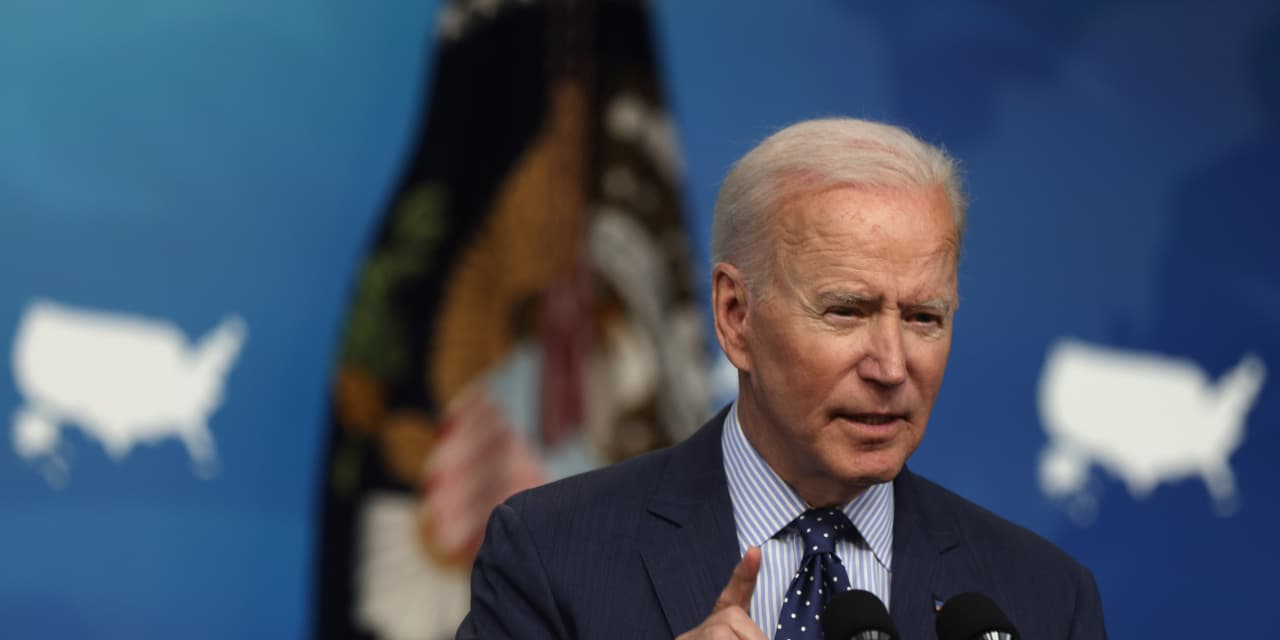

Long before an investigative news outlet sifted through high-profile billionaires’ tax returns to reveal that their income tax bills were a mere fraction of their wealth, Joe Biden — first on the campaign trail and then in the White House — was saying the rich need to pay more taxes.

So how would Biden’s tax hike proposals potentially address the allegedly tiny income tax tabs that ProPublica said business icons such as Jeff Bezos and Elon Musk paid on their vast pools of wealth?

Biden wants to nudge the top income tax rate from 37% to 39.6% and he wants to increase the capital gains rate to 39.6% for millionaires — but what will that do to the super-rich who live off their riches, borrow against their wealth and pull down nominal salaries?

Tax policy experts said one important way Biden’s proposals would dig into billionaire wealth is by taxing assets above $1 million that are just sitting there, gaining value and going untaxed at the time a person dies.

“The whole exposé is really an argument for the Biden proposal to tax unrealized capital gains at death,” said Steve Wamhoff, director of federal tax policy at the left-leaning Institute on Taxation and Economic Policy, speaking about the ProPublica investigation.

“I do think if you tax gains at death, it would be a huge step forward. You can’t really say we fixed our tax code unless you do that,” he added.

The proposal is one part of Biden’s $1.8 trillion American Families Plan.

Erica York, economist at the right-leaning Tax Foundation, agreed that the revelations about billionaire tax avoidance highlighted Biden’s plans for capital gains taxation at death. She doesn’t think it’s a good idea though.

“There would be more productive ways to change our current system,” York said. One idea is a national sales tax that gets bigger for the richer taxpayers, assessing more tax the more a person spends, she said.

The ProPublica story sparking the discussion — and now a leak investigation — said there have been several years recently where A-listers like Bezos, the founder of Amazon AMZN,

“The IRS records show that the wealthiest can — perfectly legally — pay income taxes that are only a tiny fraction of the hundreds of millions, if not billions, their fortunes grow each year,” the ProPublica story said.

These elite taxpayers accomplish this feat by using a tax code that tucks in all kinds of deductions and levies capital gains tax only when an asset is sold, or “realized,” the story said.

But if there’s no sale, there’s no tax event. And, as the ProPublica story said, many of the super-rich “sit on mountains of what are known as unrealized gains, the total size of which fluctuates each day as stock prices rise and fall.”

Current tax rules can defer capital gains taxation even further down the line. Under President Donald Trump’s Tax Cuts and Jobs Act, the 40% federal gift and estate exemption kicks in at a much higher point than it historically did through 2025. (It’s now $23.4 million for a couple.)

Meanwhile, rules about the so-called “step up in basis” say if heirs received an appreciating asset and sell it, the capital gains tax is pegged to the value at the time they received it, not the asset’s original value.

Biden isn’t calling for changes to estate tax rules, but what he would do is interrupt the tax-free generational handoffs by taxing the “unrealized” gains.

The first $1 million, or $2 million for a couple, are shielded from taxation, Howard Gleckman, senior fellow at the Tax Policy Center, said. The rate would be 43.4% Gleckman noted. That’s the elevated 39.6% capital gains rate, plus the 3.8% net investment income tax.

The think tank said Biden’s campaign pledges on the idea would rake in $373 billion over 10 years, Gleckman noted.

But there’s a long way before the idea becomes law. For one, there’s the super slim Democratic majority in the Senate and also the way that more taxes arriving at the time of death can strike a political nerve, Gleckman said.

“This is going to be a tough sell,” Gleckman said.

Privacy protections?

ProPublica’s reporting on billionaire taxpayers also throws a spotlight on a totally different Biden proposal, said Sen. Mike Crapo, a Republican from Idaho.

Speaking at a Senate Finance Committee hearing, Crapo noted that Biden’s focus on more taxes and stricter tax enforcement for the rich includes an idea for more reporting from financial institutions on the money flowing in and out of accounts.

That would mean more places reporting more highly sensitive data to the IRS. In light of the story, which relied on leaked tax returns, “how can [the IRS] protect people from that kind of violation of their own privacy?” he asked.

Charles Rettig, the tax agency’s commissioner, said, “The IRS is one of the largest data warehouses in the world, presently.”

Rettig said the IRS is launching a leak investigation into how returns for Bezos, Musk and other billionaires made their way to reporters, and added, “For the volume of data that we have, and that gets exchanged, I think the IRS has been very successful in protecting that data, but we’re not insensitive to your comments, sir.”