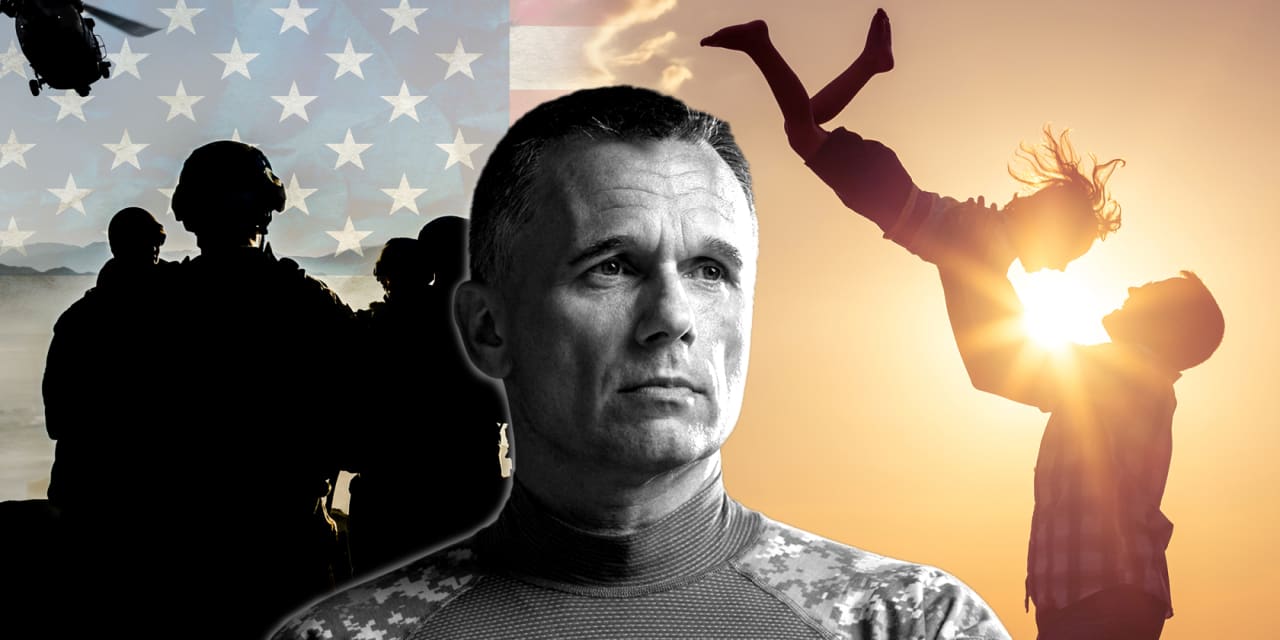

I’m 40, and a single, military dad of 2; I have rental income, $100K in retirement savings and expect at least $3K a month in retirement — what am I missing?

Dear MarketWatch,

I am 40 years old and am a single, military father. My kids are 9 and 7. I signed over my Post-911 GI bill benefits to my children so they should be mostly fine there.

I’ll be eligible for retirement in the summer of 2024. If I choose to retire at that point I’ll have a net monthly income of $3,000 (or $4,000 if my VA disability is approved) and this includes my family’s healthcare premium as well as survivor benefits of $2,200 a month if I were to die before they reach adulthood.

I have a rental property I’ve been paying extra principal on so that the mortgage is satisfied a month before my retirement eligibility. The monthly rent is $1,300 and the property value is $300,000. I’m paying extra on my primary home (valued at $520,000) and I’ve targeted the payoff to be my youngest’s high school graduation month.

My monthly living expenses are roughly $2,500, including $300 a month for a newly installed solar roof, which will be satisfied before my retirement. I do not have any car notes. Property taxes and insurance run roughly $8,000 a year between the two properties.

I have roughly $60,000 in a military thrift savings plan and I contribute $400 a month to it. I have roughly $40,000 in a Roth that I’m not currently contributing to. I have $14,000 in savings and that grows by about $2,000 a month.

I want to retire and spend the limited time I have with my children. It’s been the three of us since my youngest was only a few months old. My excel spreadsheet says that if I retire at my 20 year point, as long as I stay the course with my spending I should be fine and free from mortgages by 2032. However, if I find a new job netting $6,000 a month (should be fairly easy to do so) I should be able to have the primary mortgage paid around Christmas of 2026 if I deplete my projected savings at that time.

Thoughts on this or things I may be overlooking?

Thanks in advance for your time!

-CC

See: The military is giving me retirement and disability pay — but will it be enough to retire at 48?

Dear CC,

Congratulations on really planning for your retirement. That alone is a wonderful feat. Your children are lucky to have you.

It looks like you’re already well on your way to being comfortable in retirement, what with your rental income, retirement assets and savings. Still, there’s always room for improvement — here’s what the financial advisers said.

First, you might want to focus on boosting that emergency savings before you retire. “The biggest thing that struck me was the liquidity,” said Curtis Sheldon, president and lead planner of C.L. Sheldon & Company, a veteran who now specializes in working with transitioning service members. That’s because you may be penalized if you try to take out any retirement assets from your thrift savings plan before age 59½. You might be fine to withdraw from the principal in your Roth account, but it never hurts to have a lofty emergency account to draw from instead. Along with that $2,000 you are contributing, you might want to consider pausing the extra payments to your mortgage right now so you can build up the liquidity in your savings account, Sheldon said.

Another avenue for savings could be a traditional brokerage account — yes, you’d have to pay the tax on any withdrawals, but the money could potentially grow more than an emergency savings account, and at least you wouldn’t be penalized if you were to need the money in the time until you turn 59 ½, he said. (Of course, you need to invest with the right asset allocation for your goals and time horizon).

Sheldon wanted to make one quick note about your thrift savings plan, though it may or may not apply to you: if you were contributing to that account while deployed to a combat zone, there’s a possibility a portion of your balance may be tax-exempt. That money is not coded as pre-tax or Roth — it’s specifically known as “tax-exempt” — which means it would be difficult to roll over into another account. Whatever portion of the account was deemed “tax-exempt” could be directly distributed to you should you want to roll over the rest of your assets in that plan, Sheldon said. “It’s something to look out for,” he said.

If the figures you sent along are accurate, it doesn’t look like you’ll have a cash flow problem in retirement, the financial advisers said. You may decide in a year or two after retirement that you’d like to work in some capacity, in which case there are plenty of programs out there to help veterans find jobs.

But your plan to fully retire and be with your kids is a solid one, said Spencer Reese, author of the site “The Military Money Manual,” and a book by the same name to be published in August. “You have a unique opportunity to retire or slow down your pace of work when your kids are 12 and 10. That means you can be there for them through their teen years and set them up to become successful young adults,” Reese said. “I urge you to consider pausing your work life and spending time with your kids. If you find yourself with too much free time, a part-time job might be the trick.”

Also see: ‘Retirement? How?’ I’m 65, have nothing saved and am coming out of bankruptcy

You asked what you may be overlooking. I’m not sure how in-depth you’ve gotten in your post-retirement planning, but depending on where you live or move to, your retirement pay may be subject to state income tax. Some states do not tax veterans, but of course you should consider it in your budgeting so it doesn’t come as a surprise later on.

As for your benefits, begin documenting any health concerns and issues you have before you separate, Reese said. “He should really go now and start documenting all lingering medical issues so his record is accurate,” he said. Veteran service organizations, such as the Veterans of Foreign Wars and the American Legion, can help walk you through your disability claims and provide advice.

You mentioned transferring over your GI Bill rights to your children, which is wonderful, but you might also want to look into Chapter 35 benefits if your disability claim is approved. According to the Department of Veterans Affairs, dependent children of a veteran are eligible for these education benefits if the veteran is permanently and totally disabled due to a service-connected disability. These benefits include money for tuition, housing, books and supplies.

Finally, make sure your estate plan is up to date. You might want to look into term life insurance before separating from service as you have two young children relying on your income and support, Reese said. “The survivor benefit is a good start but they may need a lump sum if you were to pass away while they were still young,” he said.

At least, take the time to create or update important documents, such as a will and healthcare proxy. If you got that paperwork done while on base, that’s great, but you still might want to have an estate attorney or professional look everything over to ensure it meets legal guidelines should it ever be reviewed in court.

I hope this helps. And as always, thank you for your service.

Readers: Do you have suggestions for CC? Add them in the comments below.

Have a question about your own retirement savings? Email us at HelpMeRetire@marketwatch.com