Iron ore price retreats on news of further restrictions in China

On Wednesday, China announced a plan to sell state reserves of copper, aluminum and zinc in an effort to curb a strong price rally in commodities.

China’s state planner said on Friday that it had jointly launched an investigation into coal prices with the market regulator and will crack down on speculation and hoarding.

“Environmental protection measures in Tangshan have not been relaxed in the short term and have become more stringent,” SinoSteel Futures said in a note, adding that the room for higher demand had hit a bottleneck.

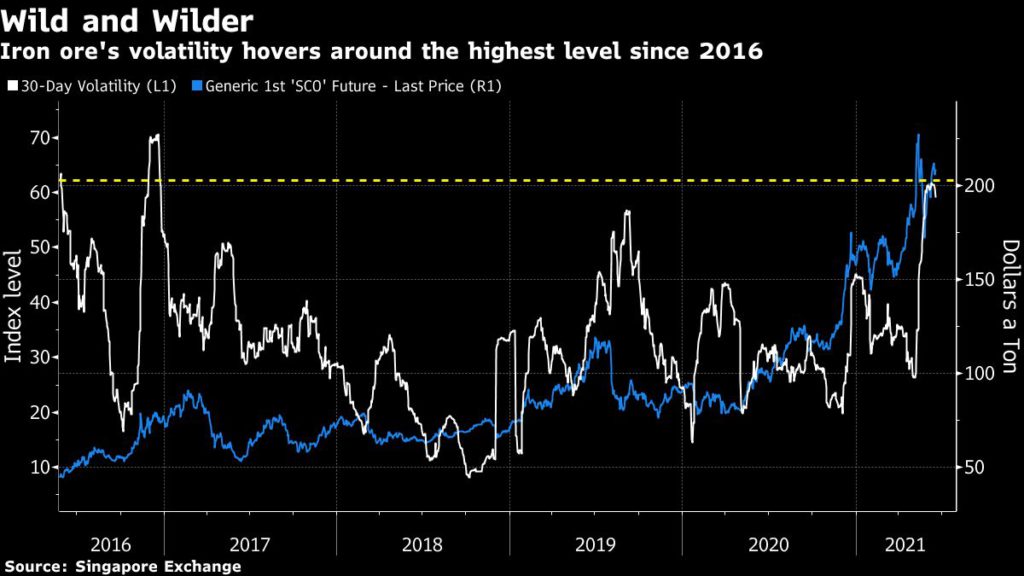

Iron ore is being buffeted largely by confusion over how government policy will affect demand from steel mills in China.

Both bulls and bears are keeping a close eye on China’s simultaneous goals to contain the inflationary pressures stemming from high commodity prices and to make its vast steel sector greener. The country’s steel output is still on track to smash another record this year, which might prompt further actions from authorities to restrict production and whipsaw iron ore yet again.

“China wants to cut steel production but control prices, and to reduce investment but maintain employment,” Tomas Gutierrez, an analyst at Kallanish Commodities told Reuters.

“As policy shifts to keep the desired balance between these goals, the outlook for steel will improve or worsen accordingly,” he said.

(With files from Reuters and Bloomberg)