Top News

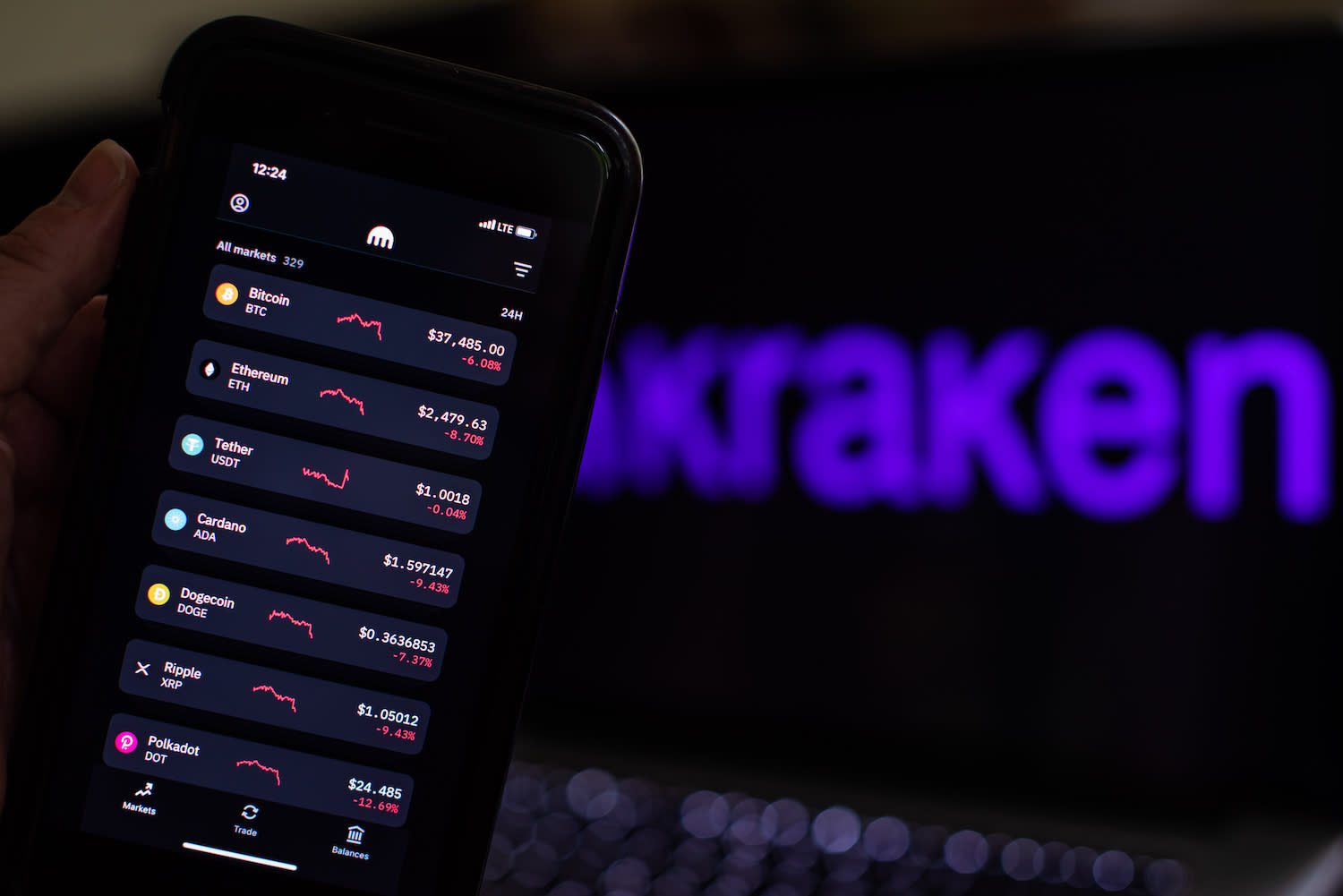

Kraken to No Longer Offer Margin Trading for US Investors Who Don’t Meet ‘Certain’ Requirements

Reuters

Saudi Aramco raises $6 billion with debut sukuk

Saudi Arabian oil giant Aramco locked in another $6 billion on Wednesday to help fund a large dividend as it returned to the international debt markets with its first U.S. dollar-denominated sukuk sale, a document showed. The debt issuance, which will help fund a $75 billion dividend commitment that will mostly go to the government, comprises tranches of three, five and 10 years, a document from one of the banks arranging the deal and seen by Reuters showed. Aramco sold $1 billion in the three-year tranche at 65 basis points (bps) over U.S. Treasuries (UST), $2 billion in the five-year portion at 85 bps over UST and $3 billion in 10-year paper at 120 bps over UST.