Micron Sales Forecast Meets Estimates; TI to Buy Utah Chip Plant

(Bloomberg) — Micron Technology Inc., the largest U.S. maker of memory chips, gave a revenue forecast the current quarter that was in line with analysts’ projections, indicating solid demand for semiconductors that store data in computers and phones.Sales will be about $8.2 billion in the period ending in August, Micron said Wednesday in a statement. That compares with analysts’ average estimate of $7.85 billion, according to data compiled by Bloomberg. Profit, excluding certain items, will be about $2.30 a share, the Boise, Idaho-based company said. Analysts projected $2.17.

The chipmaker also said it’s selling its Lehi, Utah, plant to Texas Instruments Inc. The previously announced sale of the memory-chip manufacturing site, a former joint venture with Intel Corp., will bring in $900 million in cash and about $600 million in value from assets including equipment, Micron said.

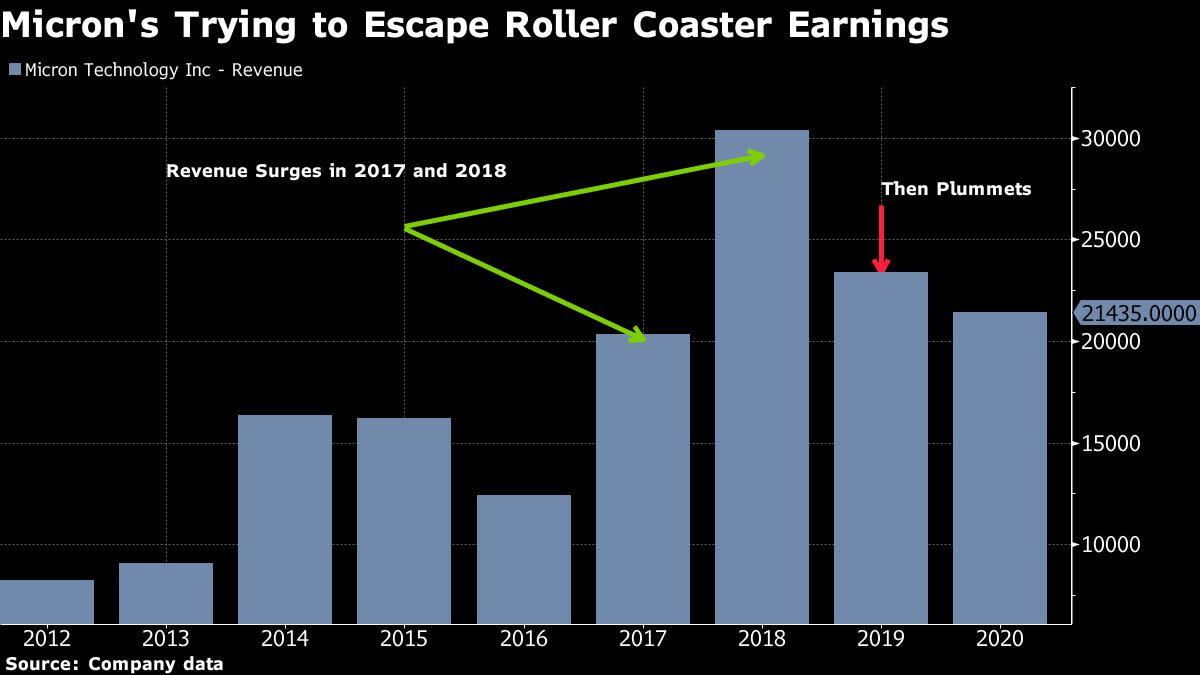

Under Chief Executive Officer Sanjay Mehrotra, Micron is trying to break with past cycles of boom and bust, in which surges in revenue have rapidly heralded slumps that often caused losses. Mehrotra has said his company will become more profitable and predictable in line with the rise of novel uses for memory chips and new products that are more than easily interchangeable commodities.Micron’s shares have lagged behind an overall run-up on chip stocks this year. Some investors are concerned that a spike in orders for laptops needed for work and study at home during the pandemic will slow as people return to offices. There is also unease that smartphone makers in China have growing unused stockpiles of components. Micron’s leaders had maintained that they don’t see any slowdown in demand and that customers are not ordering more than they need to accumulate inventory.

The stock was little changed in extended trading following the announcement. It had earlier closed up 2.5% at $84.98 in regular New York trading, leaving it up 13% this year compared with a 20% advance by the Philadelphia Stock Exchange Semiconductor Index.

Prices of dynamic random access memory, or DRAM, have risen amid shortages caused by limited investment in new production by Micron and its rivals over the last two years. Micron has warned that its competition’s spending on manufacturing capacity for Nand flash, another type of storage chip, would likely cause a glut later this year if continued.

In the three months ended June 3, Micron posted revenue of $7.4 billion, up 36% from a year earlier. Net income was $1.74 billion, or $1.52 a share.

Micron competes with South Korea’s Samsung Electronics Co., SK Hynix Inc. and Japan’s Kioxia Holdings Corp. in a memory chip market that has consolidated over the past decade. Samsung dominates production of both major types of chips, making it the world’s second-largest overall chipmaker behind Intel. DRAM chips hold data temporarily, helping processors crunch data. Nand flash memory acts as permanent storage in phones and computers.

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.