The focus is now on the transition to steady-state operations and the ramp-up over the second half of 2021, with operational readiness workstreams, employee training programmes and risk management workshops well advanced, according to an MVV press release. MVV’s first shipment of concentrate is targeted for November.

MVV had in February secured a $140 million project finance debt facility, the largest independent greenfield mining project finance transaction announced since the beginning of 2020 and the onset of covid-19.

MVV’s first shipment of concentrate is targeted for November.

Serrote will produce an average of about 22,000 tonnes per annum of copper-equivalent over an initial 14-year mine life from a low-strip, open-pit mine supplying a 4.1 million tonnes per year processing plant.

This initial mine plan is underpinned by total mineral reserves of 52.7 million tonnes grading 0.6% copper and 0.1 grams per tonne gold.

MVV is now working towards unlocking more upside by defining a larger mine plan based on the 108.9 million tonnes measured and indicated resource at Serrote and developing strategies to extract value through the known oxide resource and nearby satellite deposits currently being drilled and expanded.

The current copper outlook further enhances the attractive economics of the project, with MVV expected to produce at an all-in sustaining cash cost of $1.41 per lb. copper and generate annual earnings before interest, tax, depreciation and amortisation margins above 60%.

Critical copper supplies

Completion of the mine comes days after Ivanhoe Mines (TSX: IVN) declared the start of production at its Kamoa-Kakula project in the Democratic Republic of Congo (DRC), a significant development for the copper market. Most of the current top producing mines are decades old. Except for rare exceptions such as SolGold’s Cascabel in Ecuador and Anglo American’s Quellaveco project in Peru, there haven’t been significant discoveries in many years.

However, Ivanhoe’s achievement was marred a day later by the DRC government announcing another ban on copper concentrate exports, except if companies obtained waivers, something Ivanhoe has applied for but not yet received.

The copper industry needs to spend upwards of $100 billion to close what could be an annual supply deficit of 4.7 million tonnes by 2030.

CRU Group

Taken together with ongoing strike action BHP’s Escondida and Spence copper mines in Chile, it becomes clear the supply side of the equation is under pressure when the unprecedented global stimulus is adding a new layer of demand to already tight fundamentals.

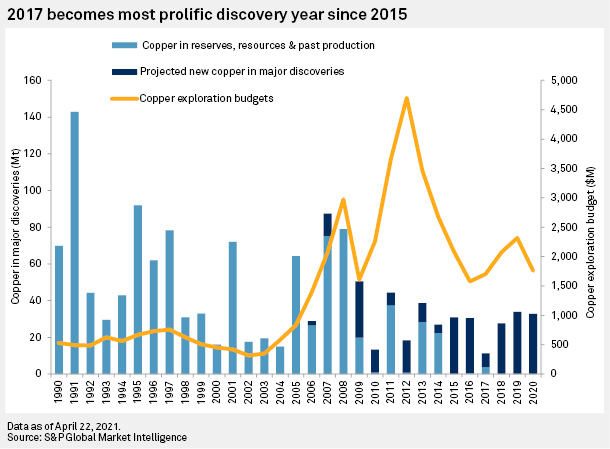

A recent S&P Global analysis of significant copper discoveries between 1990 and 2020 shows that of the 229 deposits discovered in the period, only three were found in the past three years.

Click here for an interactive chart of copper prices and click here to download Mining Intelligence’s Top 10 copper mines by production.

Commodity trader and miner Glencore (LON: GLEN) is expected to restart operations at its DRC operation in 2022. Mutanda is the world’s biggest cobalt mine and also produces large amounts of copper.

While copper projects are in the pipeline, producers are also wary of repeating oversupply mistakes of past cycles by speeding up plans at a time when mines are getting a lot trickier and pricier to build. It is but one reason why copper prices have traded near decade highs at above $10,000 a tonne.

According to estimates from CRU Group, the copper industry needs to spend upwards of $100 billion to close what could be an annual supply deficit of 4.7 million metric tonnes by 2030, according to estimates from CRU Group. The potential shortfall could reach 10 million tonnes if no mines get built, commodities trader Trafigura has said.