Mining stocks in broad sell-off as copper, gold prices pull back

Iron ore prices held up well, consolidating above the $200 a tonne mark with the price of Fastmarkets MB, benchmark 62% Fe fines imported into Northern China assessed at $210.99 on Thursday, down from a record high of $237 a tonne reached mid-May.

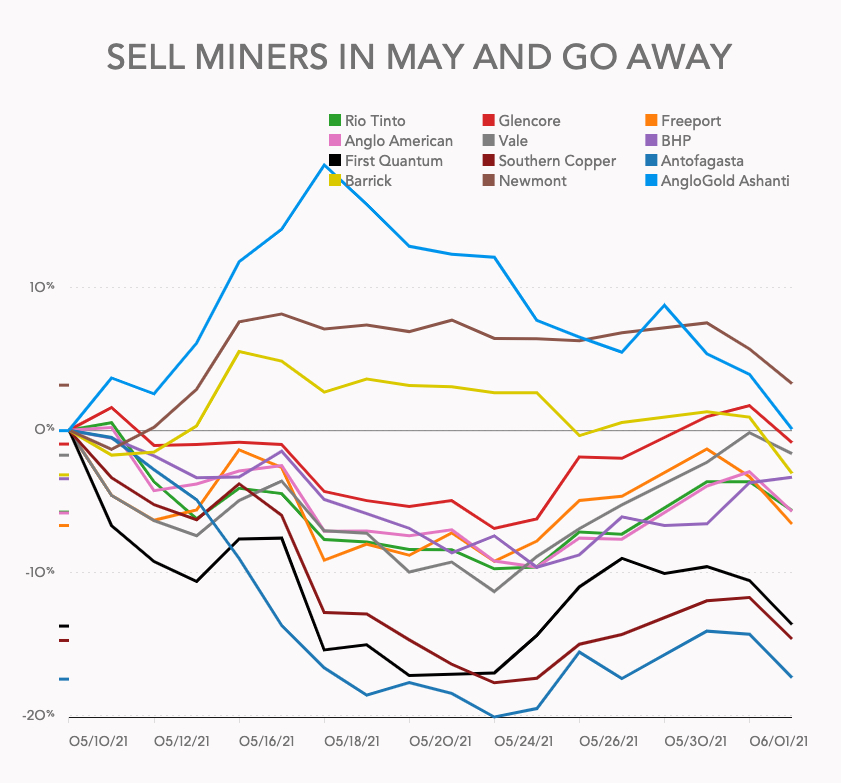

Losses were heaviest among gold stocks, wiping out most of the sector’s strong gains in May with AngloGold Ashanti, Yamana, Gold Fields all dropping more close to 5% in New York. Top producers Newmont and Barrick were down 2.2% and 3.8% respectively after regaining some lost ground in afternoon trade.

Copper stocks also came in for a beating with Freeport down 3.5%, Southern Copper giving up 3.4% and First Quantum sliding 4.3%.

Among the major diversified Anglo American was hardest hit, retreating more than 3% but iron ore’s big three Rio Tinto, Vale and BHP managed to limit losses to less than 2% by mid-afternoon. Glencore lost 2.7% of its value on Thursday but year to date it’s the best performer of the diversified majors with a 45% advance.

Units of iron ore pure play Fortescue trading in the US escaped the carnage on Thursday, but year to date the counter is one of only a handful of stocks showing a decline.