‘Nice underpinning to the market’: Buybacks may prop stock market rattled after Fed meeting

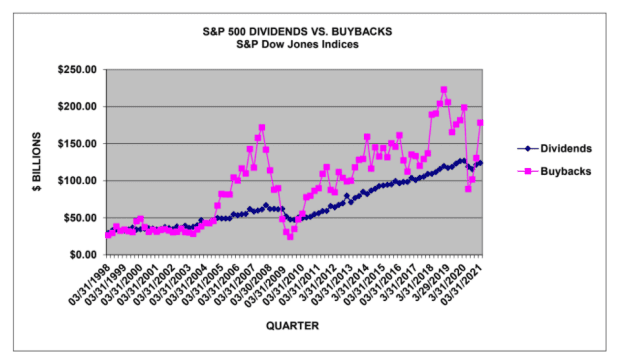

Stock buybacks are on a tear, with potential to help prop up a U.S. stock market startled by the Federal Reserve’s policy meeting this past week.

“Buybacks can be a nice underpinning to the market if we do see a pullback in the summer,” said Jack Caffrey, an equity portfolio manager at J.P. Morgan Asset Management, in an interview. “It’s very reasonable to think there will be more activity.”

Companies are resuming share repurchase programs after mostly shutting them down during the COVID-19 crisis last year, according to Howard Silverblatt, senior index analyst with S&P Dow Jones Indices. While buybacks are still dominated by a small group of companies in the S&P 500 index SPX,

Earnings of companies in the S&P 500 index rose to an “easy record” in the first quarter that has put them on pace for almost $1.5 trillion in 2021, according to Silverblatt. That would top the $1.3 trillion of earnings in 2019, the year before COVID devastated the economy.

“Buybacks rise with profitability,” said Caffrey. “Ideally, I would like those buybacks to be coming out of earnings power rather than borrowing.”

S&P Dow Jones Indices estimated in a report this past week that companies in the S&P 500 index did $178.1 billion of buybacks in the first quarter, up 36.5% from the final three months of last year. That’s double the volume seen in the second quarter of 2020, when the COVID-19 pandemic was wreaking havoc in markets, but still trails the level reached in the first three months of that year by 10%, according to the report.

While technology companies have dominated share repurchases, banks are poised to increase them after the Fed announced earlier this year that its temporary restrictions on them would end June 30, said Silverblatt. The Fed had clamped down on buyback activity in 2020, when companies were shoring up cash in the pandemic-induced lockdowns, and began loosening its ban in December.

Wall Street is already back at it.

The top 20 buybacks by companies in the first quarter included JPMorgan Chase & Co. JPM,

See: Here are the ‘most cash-flush’ industries with stock buybacks set to pick up, according to Moody’s

Cash-rich technology giants still standout for the biggest buybacks.

Among companies in the S&P 500 index, Apple Inc. AAPL,

But the pool of companies returning to the buyback market is expanding, says Silverblatt.

Consider that the top 20 buybacks among companies in the S&P 500 dropped to about 53% of the total in the first quarter, from 66% in the previous three months, according to S&P Dow Jones Indices. That’s still higher than the historical average of 44.5% before COVID, said Silverblatt.

Buying back stock isn’t exactly cheap for companies. The U.S. stock market remains not far off from all-time highs, even with major benchmarks sliding this past week after the Fed’s policy meeting surprised many investors with a hawkish tilt.

Meanwhile, the market remains supported by the Fed, which left its punchbowl in place. While Fed officials signaled at the meeting an earlier rise in interest rates than previously anticipated, their median forecast is to hold rates near zero until 2023. And the central bank is keeping up its $120 billion purchases of Treasury and mortgage bonds each month. In other words, the Fed is still accommodating markets even as its tone turned more hawkish thanks to the economic recovery.

See: Barclays moves up expectations for Fed tapering after FOMC meeting

Investors understand that “at some point the punchbowl goes away,” but in such an “extremely low interest rate” environment, they’ll keep hunting in the stock market for returns, said Matthew Tuttle, chief executive officer and chief investment officer of Tuttle Capital Management, in an interview. Meanwhile, buybacks, which push up share prices, should help support the stock market this year, Tuttle said.

Buybacks have remained heavy in the second quarter, according to Winston Chua, an analyst with EPFR, a tracker of fund flows and equity market data that’s part of Informa. Chua estimates that companies that trade on U.S. stock exchanges have done about $583 billion of buybacks through June 17, exceeding the $472 billion done in all of 2020.

“It’s a little quieter now,” Chua said in an interview. Regulatory restrictions on companies doing buybacks as they enter their quarterly earnings season creates a lull, explained J.P. Morgan Asset Management’s Caffrey.

Although they have come roaring back in 2021, buybacks probably won’t reach the record $1.1 trillion set in 2018, based on EPFR data, according to Chua. The pace tends to fall off later in the year, he said.

“Stock prices, in general, are up,” said Silverblatt, meaning companies “will need to spend more to get more shares” as they resume buybacks this year.

Buying stock back at elevated prices can draw criticism, particularly if company insiders are profiting from selling shares around the same high levels, according to Chua. “It’s a way to look like they’re earning more than they actually are,” he said.

Tuttle said he understands political concerns about companies using money to buy back stock when the cash could be used for other purposes, such as business investment. “But from an investor’s standpoint, it’s not a bad thing,” said Tuttle, as shareholders may benefit from buybacks increasing company stock prices.

Many companies undertaking buybacks to boost their earnings per share have the strength of sales and cash flow to do it, according to Silverblatt. “Otherwise you’re in trouble,” he said.

“You start borrowing money to do buybacks,” said Silverblatt, “It’s a bad sign.”

U.S. stocks dropped sharply Friday as investors continue to digest the outcome of the Fed’s meeting amid ongoing concerns over inflationary pressures. For the week, the Dow Jones Industrial Average DJIA,

There was no U.S. economic data Friday as the government observes the Juneteenth holiday. Next week, the U.S. economic calendar includes reports on home sales, personal income and the core PCE price index — the Fed’s preferred measure of inflation.