Public pensions lose on hedge funds — again

One of these days I’m going to write about a bunch of retirees and future retirees who have just made a ton of extra money thanks to the financial brilliance of elite, exclusive, high-fee hedge funds.

Today, however, is not that day.

Instead, here comes more news about a public pension fund allegedly missing out on billions of dollars because of hedge funds and other high-fee funds.

And the news that retirement systems and other institutional investors continue to pour yet more money into the hedge fund racket—excuse me, “industry.“

Oh, and reports that the industry is allegedly posting great returns thanks to the reopening of the economy.

Phooey.

Here are the facts, although I don’t expect them to break through the Reality Distortion Field apparently surrounding the folks who keep investing in hedge funds.

Exclusive hedge funds that involve complicated and exotic financial maneuvers are performing worse this year than a basic portfolio involving five, or even two, Vanguard funds that anyone can buy.

And this was true last year. And the year before that. And over the last five years. And over the last 10.

And that’s true even if we rely blindly on the hedge fund industry’s own data—a debatable move given the industry’s disclosures.

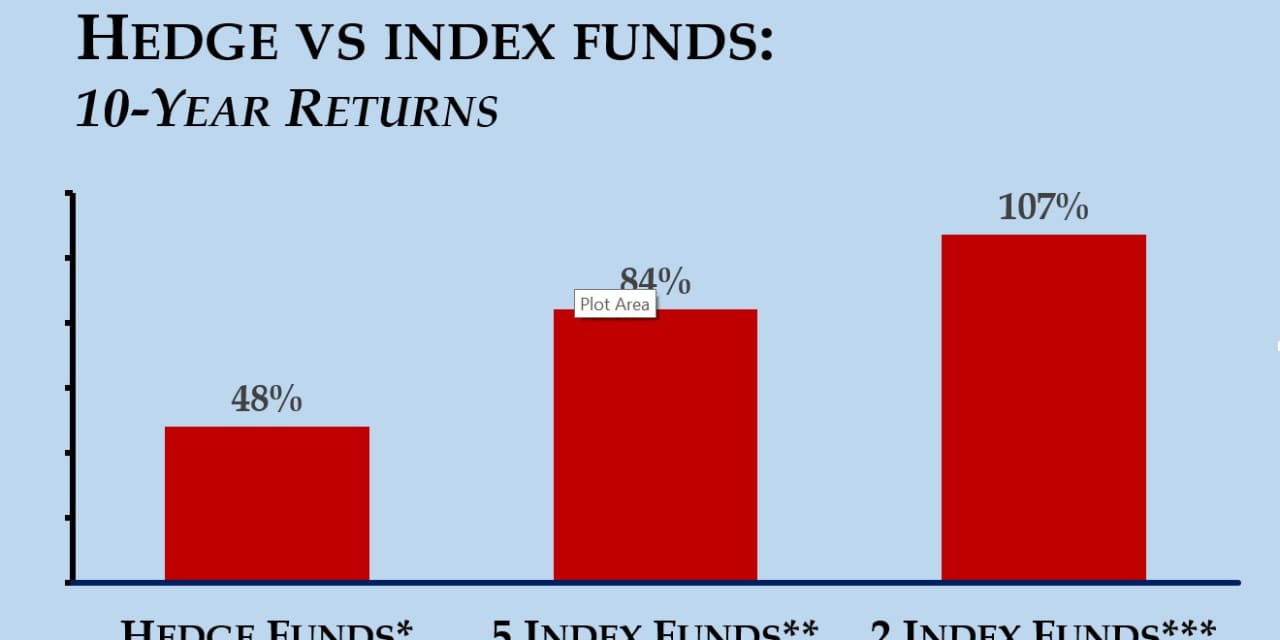

Check out the simple chart above.

On the left is the total return you’d have made over the past 10 years if you’d invested in Hedge Fund Research’s ”HFRI Asset-Weighted Composite Index“—the most widely used basic “index” of hedge fund returns.

The bar in the middle shows what you’d have made if you’d invested instead in a basic portfolio of five Vanguard (or comparable) index funds: Vanguard Total (U.S.) Stock Market Index Fund VTSMX,

On the right is what you’d have if you’d gone for an even simpler two fund portfolio: Vanguard Total World Stock VT,

These aren’t chosen with the benefit of hindsight. The standard benchmark investment portfolio has traditionally been 60% stocks, 40% bonds. So the two-fund portfolio is about as basic as you can get. As for the five fund portfolio? It’s the one I outlined 10 years and two months ago here, in another article about dismal hedge fund performance.

Meanwhile, so far in 2021, the hedge fund index is up just 6%. The five-fund portfolio is up 7% and the two-fund portfolio 8%.

The results are much the same even if you compare hedge funds to this much lower risk 10-asset portfolio, which I wrote about almost exactly seven years ago. Returns from that portfolio since then? About 55%. Hedge fund returns? Er…27%. Almost exactly half.

(Incidentally, if I wanted to use hindsight, I’d compare the hedge funds to a U.S.-only portfolio, because U.S. stocks have boomed this decade. So the Vanguard Balanced Index Fund VBINX, a one-fund portfolio that consists of 60% U.S. stocks and 40% U.S. bonds, has risen 160% in the past decade. That’s more than three times the returns you’d have earned from hedge funds.)

There’s no great mystery to this. Hedge funds typically charge about 2% annual fees, plus 20% of any profits.

I remember sitting down a decade ago and doing the math. I was visiting the hedge fund industry’s annual jamboree at the time—appropriately enough in Las Vegas, where the house always wins.

A fund’s investments have to beat the stock and bond markets by about 50% a year just to cover the vig.

Oh, and if a hedge fund actually knows how to do that—like Renaissance—why would they bother cutting you in anyway? They’d just invest their own money.

Hedge-fund managers make us, the middle-class American taxpayers, two-time suckers.

First they leech off us through the public-sector pension funds, which pour money into hedge funds year after year for no discernible reason. Most public pension funds are in the red, which means ultimately they’re going to be making up the difference by picking the pockets of you-know-who.

Then the hedge-fund managers barely even pay any tax on their loot either. Thanks to the ‘carried interest loophole,’ a legal tax treatment whose more accurate names would be unprintable, they pay very little tax down the road and almost nothing today.

You see how this works? They take our tax dollars, and they don’t even pay in. It’s like we’re an occupied country and we’re paying hedge-fund managers tribute.

The key thing to understand about hedge funds is that they are fabulous vehicles for making people rich — so long as you’re a fund manager, not an investor.

The problem isn’t that it’s impossible for hedge funds to beat the market. It’s that they can’t beat the market in aggregate, after fees. And, just as importantly, that any hedge funds which can beat the market after fees are not going to take outside money.

But hope springs eternal. As P.T. Barnum might have said, there’s a hedge-fund investor born every minute.