Russell Reshuffle May Spell Trouble for Highflying Meme Stocks

(Bloomberg) — The upcoming Russell Indexes reshuffle could pose a problem for the likes of AMC Entertainment Holdings Inc. and GameStop Corp.

FTSE Russell’s annual Reconstitution event, which moves stocks around in its U.S. indexes based on their updated market cap and other characteristics, is set to call attention once again to the rise in so-called meme stocks that have been favorites of the retail-trading crowd.

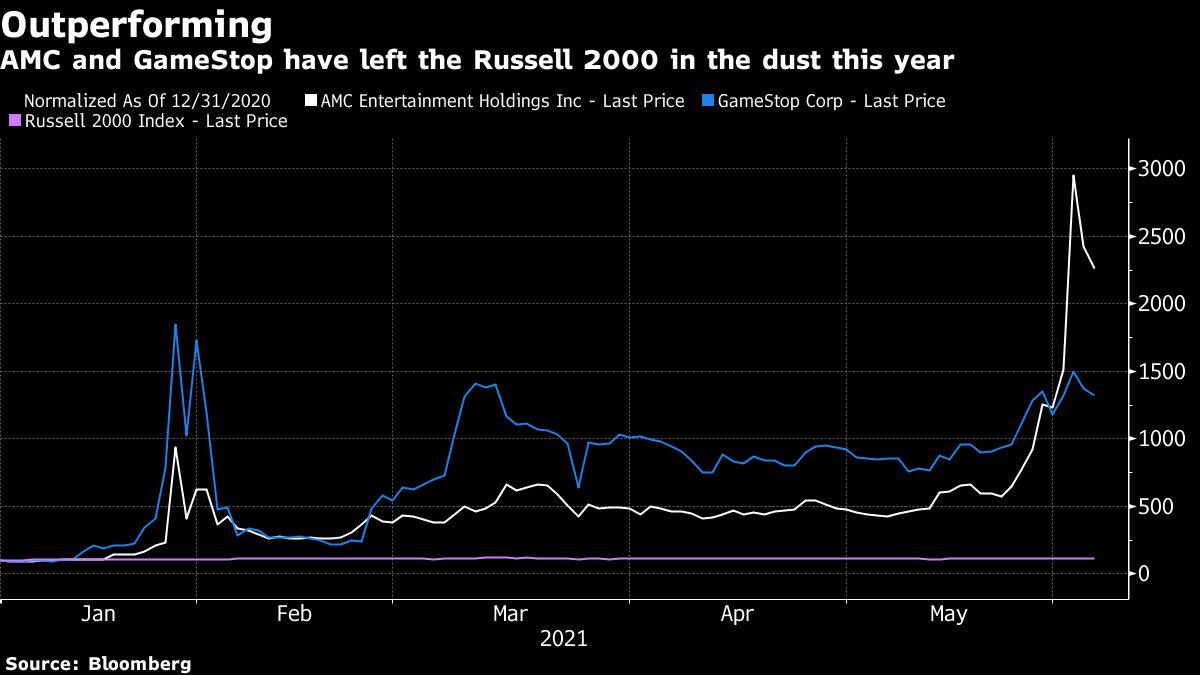

AMC is up more than 2,100% this year and GameStop over 1,200% — with commensurate increases to their weighting in the Russell 2000 small-cap stock index. The two together now make up more than 1.1% of that gauge. But their enlarged market caps, with AMC at $24.6 billion and GameStop at $18.4 billion, put them squarely in line for a move to the Russell 1000 index of the biggest American companies.

“The graduation of these high-fliers could be the beginning of the end of their epic run,” Wells Fargo analysts Christopher Harvey, Gary Liebowitz and Anna Han wrote in a note Friday. While there may be some buying beforehand from small-cap portfolio managers who are underweight those companies, that is likely to change for the stocks as the reconstitution takes effect, according to the analysts.

“Once they graduate, their index representation drops (i.e., less impactful),” and portfolio mangers will have another year to wait for a shakeout on the stock prices, they said.

AMC and GameStop have taken investors on a wild ride this year as they became darlings of retail traders. However, the stock action has boosted their prices well past where traditional Wall Street estimates would have put them.

AMC is more than 800% above the average forecast of analysts covering the stock tracked by Bloomberg, the most for any U.S. stock with a market cap over $1 billion. The company is planning additional share issuance, and numerous insiders have cashed in on the stock’s runup. GameStop’s closing price Friday of $248.36 leaves its average 12-month target price of $55.80 in the dust.

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.