Since 2008, this has been the biggest signal for stock direction. Here’s where it’s telling investors to go now.

The summer lull is real for investors right now, as stock catalysts seem few and far between. Thursday’s update on consumer prices could bring the next one, after May data spooked markets last month.

With equities SPX,

They should start by keeping an eye on what has been the most reliable indicator for stock direction since 2008 — the 10-year bond yield TMUBMUSD10Y,

Since the 2008-09 financial crisis, “the bond market has been determining, or at least coincidentally signaling” which groups of stocks will be the winners and losers, he told clients in a note. That has been particularly true for several popular themes including cyclicals, growth investing, small-caps, etc.

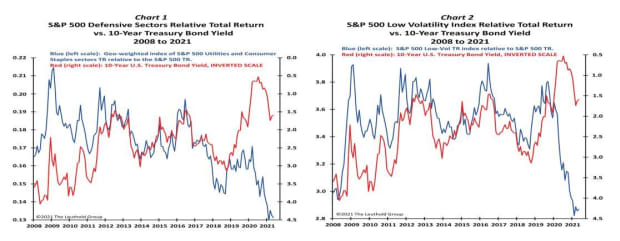

For example, via the below charts he showed how defensive sectors, such as utilities and staples or low-volatility investments, only do well when bond yields are headed lower:

The Leuthold Group

So should the yield on the 10-year, currently hovering at 1.561%, make another run at 2%, that group is likely to underperform, he said. But if the economy is headed for overheat pressures and yields are set to rise, history has shown the most volatile stocks are often winner, he added.

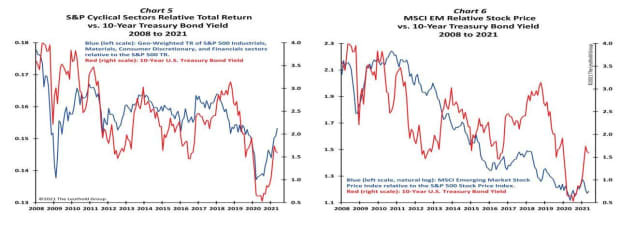

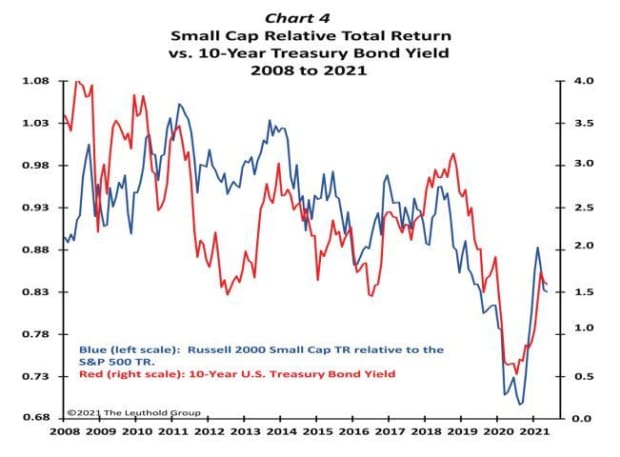

Paulsen pointed to the below charts of small-cap stocks, cyclical sectors and emerging markets that are “often the winners during periods in which rising yields cause stock market mayhem.”

The Leuthold Group

The Leuthold Group

And the strategist is among those who do indeed see yields rising.

“The recent pause in the 10-year yield despite escalating inflation expectations has been puzzling. Moreover, if yields continue to trend sideways or retrace part of their recent advance, defensive investments, including growth stocks, will likely be stock market leaders,” wrote Paulsen.

He expects another leg higher for that yield, pushing it above 2%, likely by the end of 2021. And that means “stock investors should heed the bond market’s message and drive a few of those fast ‘cyclical’ stock cars!”

Read: Why markets are stuck and what will likely get them moving again

Bitcoin blues and billionaires and taxes

U.S. stocks are trading flat, which was the same for Europe SXXP,

Also read: Bitcoin faces fresh scrutiny as police call for new powers to freeze crypto assets in the U.K.

On the data front, the National Federation of Independent Business index fell for the first time this year, as hiring woes hit small-business owners. The trade deficit narrowed in May and job openings data is still to come.

Major global websites including Amazon.com, CNN and Bloomberg have been hit by outages on Tuesday. Shares of Fastly FSLY,

Billionaires including Amazon AMZN,

Shares of the electric car maker TSLA,

Back in May 2020, a U.S. government report on COVID-19 origins was urging an investigation into the theory that it leaked from a Wuhan laboratory.

Damaging carbon dioxide is 50% higher than at the dawn of the industrial era, according to the National Oceanic and Atmospheric Administration (NOAA).

Random reads

Got my tight pants on. Levi’s boss says many of us don’t fit into our clothes, post-pandemic.

Hunting murder hornets. The job that makes you appreciate your job.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.