Over the past few years, many fintech companies, including Betterment, Current and Credit Sesame, have started to offer checking accounts. This week, saving and budgeting app Digit is joining those ranks.

Currently, Digit primarily operates by having users link their external checking account, such as a Bank of America or Wells Fargo account, to the app. Digit then analyzes each consumer’s spending habits and automatically pulls extra money from their checking account into a Digit savings account.

But starting Tuesday, June 15, Digit will allow consumers to sign up for a waitlist to be among the first to start testing its new checking account format. The new banking features, including a Digit debit card, will officially launch publicly this fall.

The catch is that the new Digit service is more expensive. The cost of a Digit membership will increase to about $10 a month, up from the current cost of $5 per month.

Here’s a look at how the new features will work and how the cost compares to other accounts already on the market.

How the new Digit Direct works

Instead of simply offering checking and savings accounts, Digit’s latest offering, Digit Direct, will provide users with three separate accounts: one each for savings, bills and spending. The new service is powered by MetaBank, a bank partner that allows Digit to offer these types of accounts since Digit is not a bank itself.

“We’ve spent really about the last year building this new product, which is going from intelligent savings account to the intelligent bank account,” Ethan Bloch, founder and CEO of Digit, tells CNBC Make It. “Today, Digit works alongside any bank account you might have, and the new Digit replaces your bank account.”

For existing customers, the new Digit Direct will be offered as an upgrade for no additional cost during the beta phase from now until the public launch in fall, Bloch says. But they will have to sign up for the waitlist to upgrade to the new version of Digit. Existing customers can also downgrade if they decide the new features are not for them, Bloch says.

Once a deposit is made into Digit Direct, the app will analyze how much money is needed for a user’s bills and savings goals and automatically divide up the money. Any leftover funds will be available for spending. Digit users will receive separate debit cards and account routing information for their spending and bill accounts, so they can spend money and pay bills directly from the corresponding account.

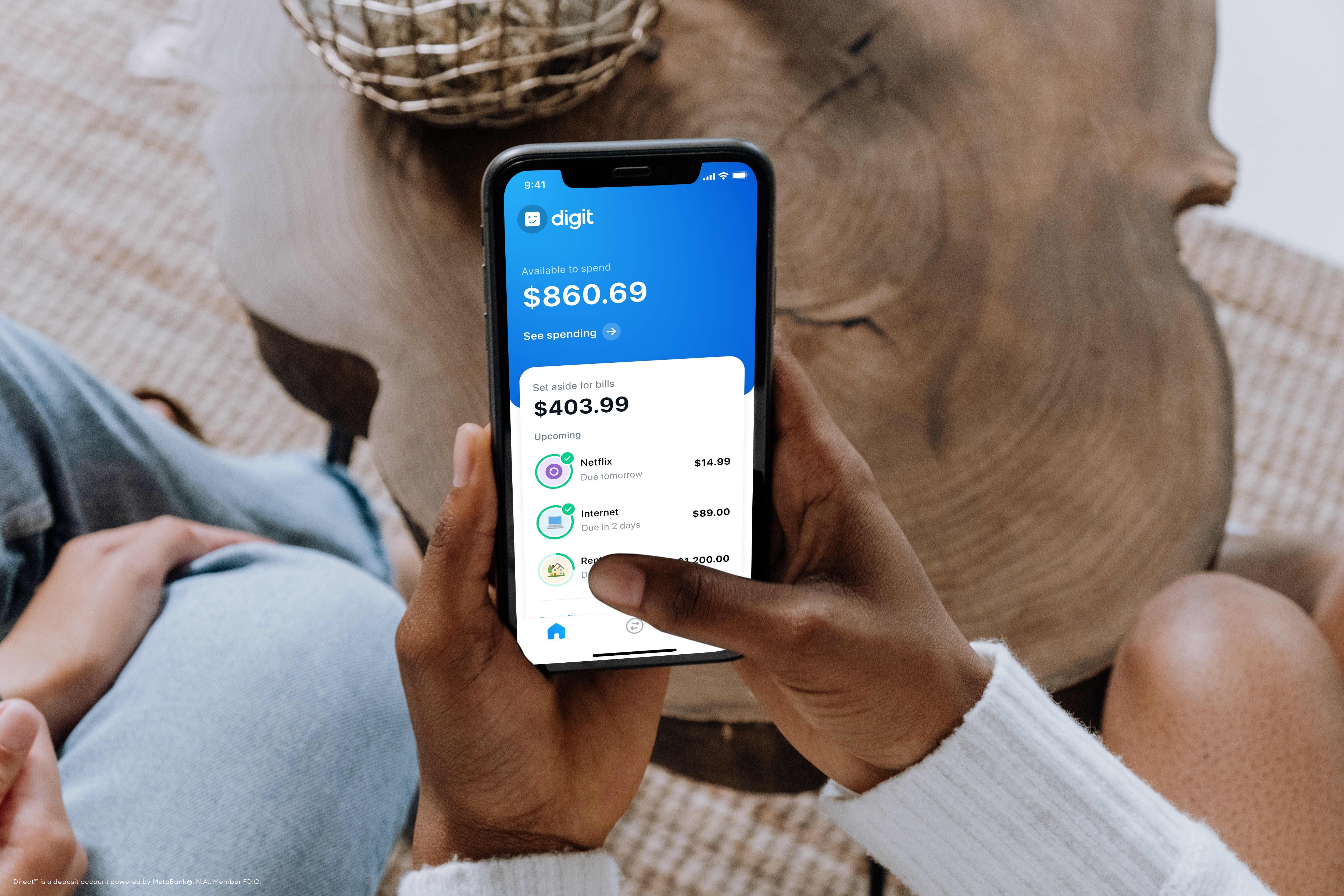

How the new Digit Direct will look on users’ app screens. Consumers can start signing up for the waitlist June 15, 2021.

Source: Digit

Say you bring in $5,000 a month, or $2,500 each paycheck, and your monthly bills, including rent, utilities, cable and your phone, add up to $2,225. Whenever a paycheck hits your spending account, Digit will analyze which bills you have coming up and apply that pay toward what you owe.

Say your electricity bill and phone bill, which are about $125 combined, are due on the 15th of every month, but the rent and cable bills, the other $2,100, are due on the 1st of every month. When your first paycheck hits, Digit Direct will automatically take the $125 out of the spending account and put that money in your bills account.

Then toward the end of the month, perhaps after your second paycheck hits, Digit will automatically allocate $2,100 of your spending account’s balance to your bills account to cover the upcoming rent and cable bills. Essentially, Digit will prioritize what needs to be paid first and gradually take funds out of your spending total to cover upcoming bills.

The same automatic prioritization happens when you add savings goals to the app. Say you want to fund an emergency savings, set up a travel fund and start putting some money aside for end-of-the-year holiday gifts. You can set up separate savings goals in the app, noting how much you want to save and when you want to have the money by.

If you want to save $5,000 for a vacation in May 2022, Digit will let you know it will try to save around $25 to $50 each day to help you reach that goal. The app will then automatically allocate funds toward that goal, as well as any others, throughout the month as your paychecks or direct deposits are added to your account.

Once your bills and savings are allocated, the remainder of of your deposits will be available in a separate account for you to spend on things like groceries, household necessities, dining out and entertainment. If you’re running low on cash toward the end of the month to pay upcoming bills, Digit Direct’s algorithms may, for instance, skip taking out money out for a savings goal and instead put it toward a bill that needs to be paid.

“The key value really is that it budgets your paycheck for you,” Bloch says. “Even if you don’t get paid frequently, and you just deposit money into the account whenever you can, the underlying AI helps figure out how much of this should go aside for bills — and truly keeps it aside for bills — and how much should go toward savings.”

Digit’s ability to automatically designate the funds needed to cover bills will be especially helpful for users who have inconsistent or irregular paychecks, Bloch says. “You never have to do that mental math of, ‘When do I get paid next, when’s that bill due, how much do I need in this account,'” he adds.

What the new Digit Direct costs

Starting Tuesday, consumers can sign-up for a waitlist to get early access to Digit Direct before the public launch in Fall 2021. However, the new features come with a steep price tag.

Currently, after a 30-day free trial, Digit costs users $5 a month. However, the new banking options will cost $9.99 a month or $95 annually.

That’s on par with many of the monthly maintenance fees you’ll find at major brick-and-mortar banks in the U.S., which typically charge between $5 and $15 a month. However, most major banks usually offer options to waive the fee by maintaining a minimum balance, setting up a direct deposit or by using your debit card a certain number of times a month. Plus, many of these accounts pay interest.

Meanwhile, most online banks and neo banks do not charge monthly maintenance fees. Ally, Axos, Betterment, Chime and Wealthfront, for example, all offer free checking accounts and all except Chime even waive overdraft and ATM fees.

Digit Direct provides users with spending, savings and bill accounts.

Source: Digit

With Digit Direct, there’s currently no way to waive the monthly fee. And that’s intentional, Bloch says, because it allows Digit to have more freedom to design features and services that users really want, as opposed to what drives revenue.

“We really believe by having a membership it enables us to stay focused on the customers’ financial health versus transaction volumes,” Bloch says. “If we were to make money on interchange like other banks and other neobanks do, it works, but you get really focused on transaction volume, it drives the whole business.”

Digit Direct will not charge out-of-network ATM fees, overdraft fees or any foreign transaction fees. “Aside from the membership fee, there’s no other fees in the Digit experience,” Bloch says.

Sign up now: Get smarter about your money and career with our weekly newsletter

Don’t miss: The huge diversity issue hiding in companies’ forced arbitration agreements