These two bitcoin bear market indicators may tell investors when cryptos will bounce back, says J.P. Morgan

Bitcoin and other crypto assets have had a rough ride over the past month.

While the leading crypto got a boost on Wednesday after news that lawmakers in El Salvador voted to approve bitcoin as legal tender, its price remains nearly 40% below highs of around $60,000 from as recently as a month ago.

Our call of the day, from strategists led by Nikolaos Panigirtzoglou at investment bank J.P. Morgan, is that two key measures indicate that bitcoin BTCUSD,

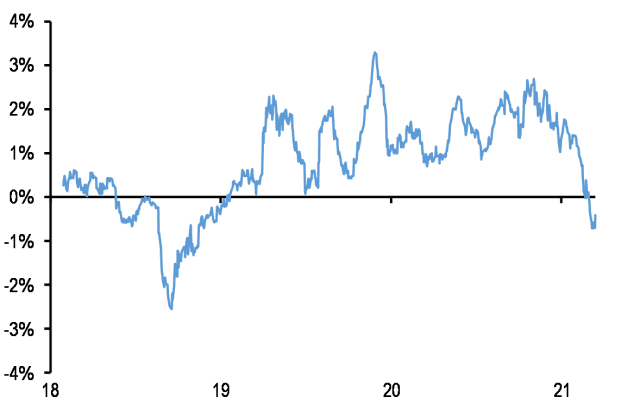

The first red flag is that bitcoin futures have shifted into “backwardation” for the first time since 2018, the strategists said. Backwardation is when the current price of an asset is higher than the price trading in futures markets. Futures for the other leading crypto asset, ethereum ETHUSD,

“This is an unusual development,” said the J.P. Morgan team. “And a reflection of how weak bitcoin demand is at the moment from institutional investors that tend to use regulated CME futures contracts to gain exposure to bitcoin.”

Normally, when demand for bitcoin futures isn’t weak, the futures trade at a higher price than the spot price—typically around a 10% futures to spot spread. However, when price expectations for bitcoin turn bearish, the futures curve slips backward, and this was the case for most of 2018, according to the strategists.

“We believe that the return to backwardation in recent weeks has been a negative signal pointing to a bear market,” said Panigirtzoglouand his team. “We are thus reluctant to abandon our negative outlook” on bitcoin, they said, until the 21-day rolling average of the 2nd CME bitcoin futures spread over spot shifts back into positive territory.

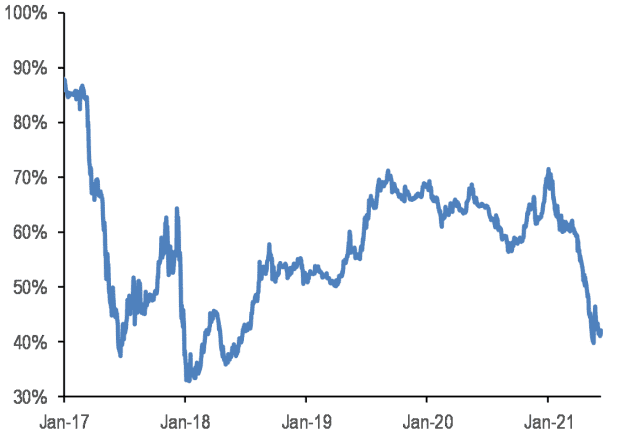

The second red flag is the low share of bitcoin in the wider crypto market. The same strategists wrote in May that the sharp decline in the share of bitcoin during April and May—from around 60% towards 40%—was a bearish signal. They said that it echoed the individual investor-driven “froth” of December 2017—when the share of bitcoin fell from around 55% to below 35%.

“We believe that the share of bitcoin in the total crypto market would have to normalize and perhaps rise above 50% (as in 2018) to be more comfortable in arguing that the current bear market is behind us,” said the J.P. Morgan team.

The buzz

The U.S. business of JBS JBSS3,

On the U.S. economic front, 376,000 Americans filed for unemployment last week, slightly more than the 370,000 expected by economists. There were 3.5 million continuing jobless claims in the week of May 29. The U.S. Consumer Price Index—CPI—rose 0.6% in May, slightly more than the 0.5% expected and less than 0.8% in the month prior. Core CPI, which excludes food and energy, rose 0.7%, ahead of expectations of 0.5% but down from 0.9% int he month prior.

U.S. President Joe Biden and British Prime Minister Boris Johnson are set to ease transatlantic COVID-19 travel restrictions. With Biden in the U.K. for this week’s Group of Seven meeting, the two leaders are expected to announce a new task force with the goal of reopening U.S.-U.K. travel as soon as possible.

Company actions to address climate change have yet to have a critical aggregate effect, with none of the major stock market indexes on track to hit the widely-used target of keeping global warming below 2°C above pre-industrial levels, according to a report. In fact, the British FTSE 100 and American S&P 500 are on temperature pathways of 3°C or above.

The markets

U.S. stocks DJIA,

European equities SXXP,

The chart

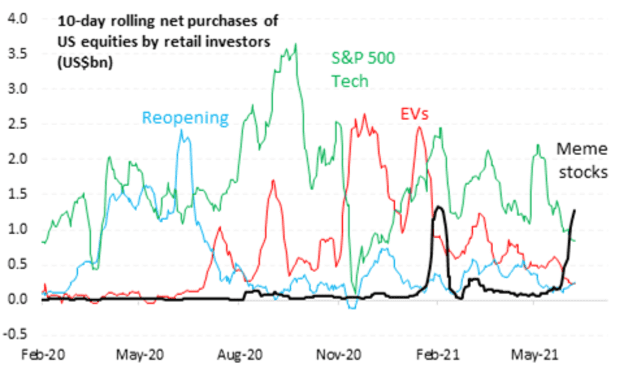

In case there was any doubt, the meme trade—epitomized by stocks like GameStop GME,

“First, it was the reopening, then tech, then EVs, then meme stocks, then tech, and now meme stocks again,” Batnick said. “I expected trading to die down once the economy reopened and people started leaving their homes. I was wrong. This is here to stay.”

Random reads

Farmers with renewable energy sources, like those run off cow manure, can make 10 times more money running crypto mining machines than from selling energy to providers.

“Baywatch” star David Hasselhoff is saving lives again, but not as a lifeguard. The actor has been recruited by German health authorities to encourage people to get vaccinated against COVID-19.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.