U.S. Futures Drop With Stocks on Geopolitics, Fed: Markets Wrap

(Bloomberg) — U.S. equity futures dropped with European stocks on Thursday as fresh geopolitical tensions added to investor concerns over inflation and a potential reduction in stimulus.

S&P 500 and Nasdaq 100 contracts fell to session lows after Russia said it will eliminate the dollar from its National Wellbeing Fund in an attempt to reduce exposure to U.S. assets amid threats of sanctions. The greenback pared gains, and European stocks also dropped.

Earlier, Asian shares traded mixed after President Joe Biden unveiled plans to amend a U.S. ban on investments in companies linked to the Chinese military, which may expand scrutiny to a wider set of enterprises.

Traders also absorbed comments from Philadelphia Fed President Patrick Harker, who said Wednesday that the U.S. central bank should begin discussing the time frame for paring back its bond-buying program. Ten-year U.S. Treasury yields hovered around 1.60%.

With global equities locked in a tight range for the past month, investors are on the lookout for any signs that central banks may start to withdraw emergency support. While Fed officials have mainly stuck to the message that stimulus will remain in place, inflation is perking up, with global food prices surging to the highest in almost a decade. Friday’s payrolls data could add another twist to the debate in the wake of Harker’s remarks.

The various comments from officials help “the Fed to communicate early and communicate often so that the public gets so comfortable with the idea of tapering,” Kristina Hooper, Invesco chief global market strategist, said on Bloomberg Television.

Also in the picture is the potential for speculative fervor to reemerge in so-called meme stocks such as AMC Entertainment Holdings Inc., which pared a pre-market rally after filing to sell up to 11.55 million shares.

Elsewhere, Bitcoin traded at about $39,000, holding its advance this week after May’s cryptocurrency rout.

Key to watch this week will be the May U.S. employment report on Friday.

These are some of the main moves in markets:

Stocks

Futures on the S&P 500 fell 0.6% as of 7:11 a.m. New York timeFutures on the Nasdaq 100 fell 0.9%Futures on the Dow Jones Industrial Average fell 0.6%The Stoxx Europe 600 fell 0.6%The MSCI World index was little changed

Currencies

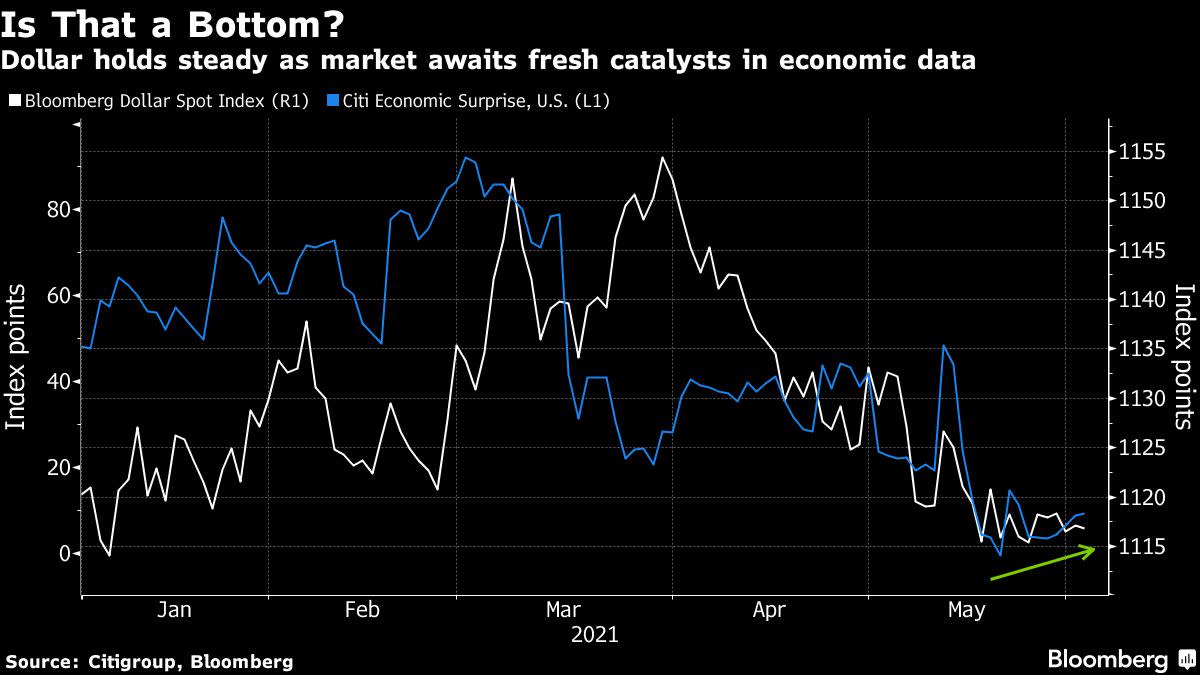

The Bloomberg Dollar Spot Index rose 0.1%The euro fell 0.1% to $1.2194The British pound rose 0.1% to $1.4187The Japanese yen fell 0.2% to 109.75 per dollar

Bonds

The yield on 10-year Treasuries advanced two basis points to 1.60%Germany’s 10-year yield advanced one basis point to -0.19%Britain’s 10-year yield advanced three basis points to 0.83%

Commodities

West Texas Intermediate crude was little changedGold futures fell 0.7% to $1,896 an ounce

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.