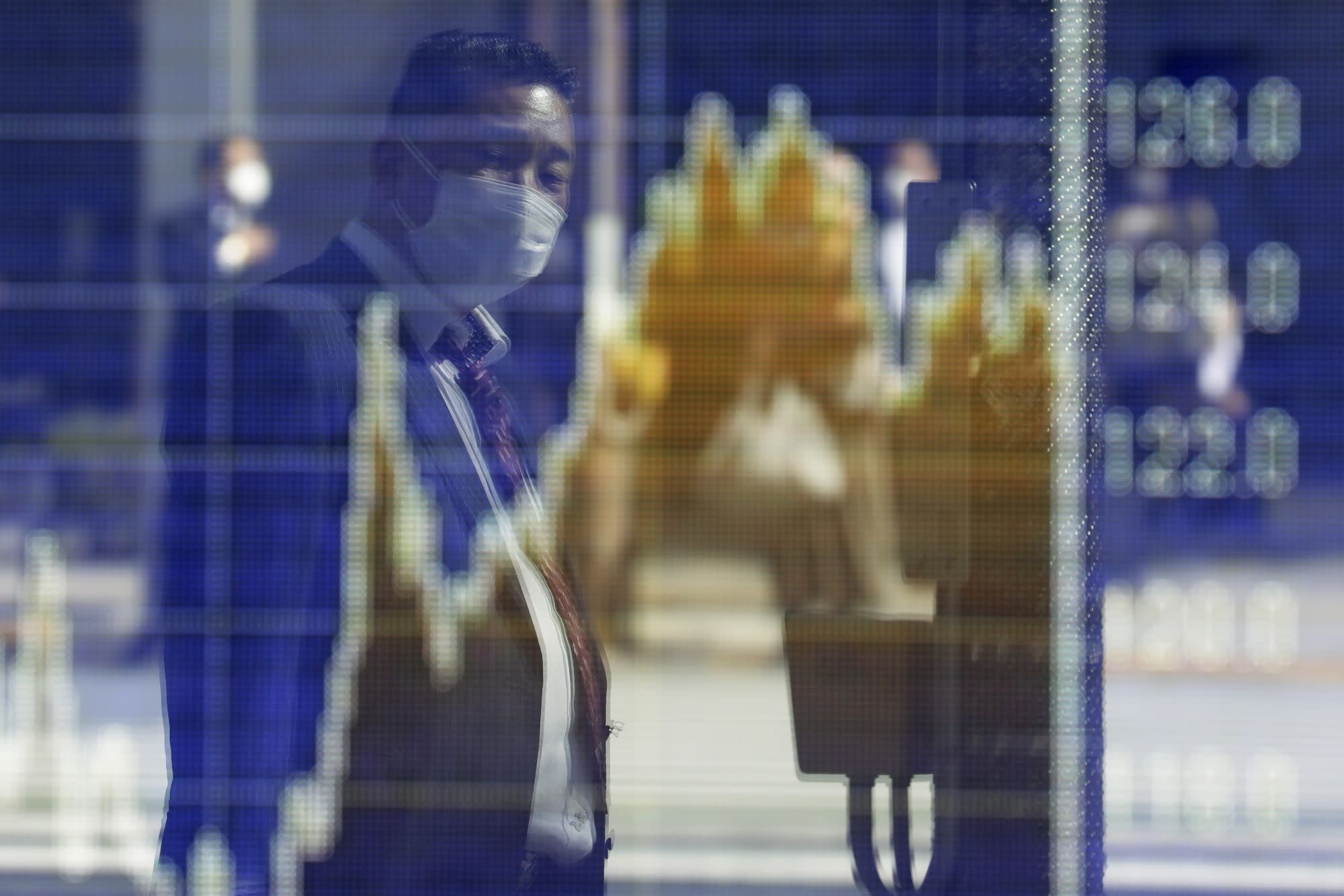

U.S. Stock Futures, Bonds Slide on Taper Fear: Markets Wrap

(Bloomberg) — U.S. equity futures fell, extending a bout of volatility ignited by surprise hawkishness at the Federal Reserve that may be exacerbated Friday by the mass expiration of stock options. Commodities slumped and the dollar touched a two-month high.

Futures on the Dow Jones Industrial Average slide about 1% as investors stepped back from trades tied to expectations for hot economic growth and inflation. The S&P 500 was poised to drop for a fourth day. Treasuries erased earlier gains after St. Louis Fed President James Bullard said on CNBC that the central bank has started discussing scaling back the pace of pandemic bond-buying.

“Investors believe the Fed will keep inflation in check, while U.S. activity is peaking,” Barclays Plc strategists led by Emmanuel Cau wrote in a note to clients. “This is driving rotation away from reflation plays and back to growth stocks.”

Markets that are clearly benefiting from the reopening are seeing a pullback, with copper on course for its worst week since the start of the pandemic.

Oil fell for a second day, with Brent crude slipping from this week’s 2018 high. An advance in the dollar this week has made commodities that are priced in the U.S. currency more expensive, driving declines across the complex. The Bloomberg Dollar Spot Index was little changed Friday.

Some volatility may be possible later when options and futures on indexes and equities expire, an event known as “triple witching.”

European shares fell the most in a month, with the longest streak of gains since 1999 brought up short by the Fed’s hawkish tilt.

Read: Stock-Market Doldrums Face Shake-Up With Friday’s ‘Witching’

For more market commentary, follow the MLIV blog.

These are some of the main moves in financial markets:

Stocks

Futures on the S&P 500 fell 0.7%, falling for the fourth straight day, the longest losing streak since Feb. 22 as of 8:46 a.m. New York timeFutures on the Nasdaq 100 fell 0.5%Futures on the Dow Jones Industrial Average fell 0.9%, falling for the fifth straight day, the longest losing streak since Jan. 27The Stoxx Europe 600 fell 1.2%, more than any closing loss since May 19The MSCI World index fell 0.4%, falling for the fourth straight day, the longest losing streak since Sept. 21

Currencies

The Bloomberg Dollar Spot Index rose 0.1%, climbing for the sixth straight day, the longest winning streak since March 23, 2020The euro fell 0.2% to the lowest since April 7The British pound weakened 0.5%, falling for the fourth straight day, the longest losing streak since April 9The Japanese yen was little changed at 110.27 per dollar

Bonds

The yield on 10-year Treasuries was little changed at 1.51%Germany’s 10-year yield was little changed at -0.19%Britain’s 10-year yield was little changed at 0.78%

Commodities

West Texas Intermediate crude fell 1.1% to $70.27 a barrelGold futures rose 0.2% to $1,777.50 an ounce

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.