Waiting for AMC to Pop Meant Living Through Seven Corrections

(Bloomberg) — Think it was easy holding on for five months for the meme mafia to finally succeed in jacking AMC Entertainment Holdings Inc. skyward again? Seems like a breeze today. But that’s not how it felt along the way.

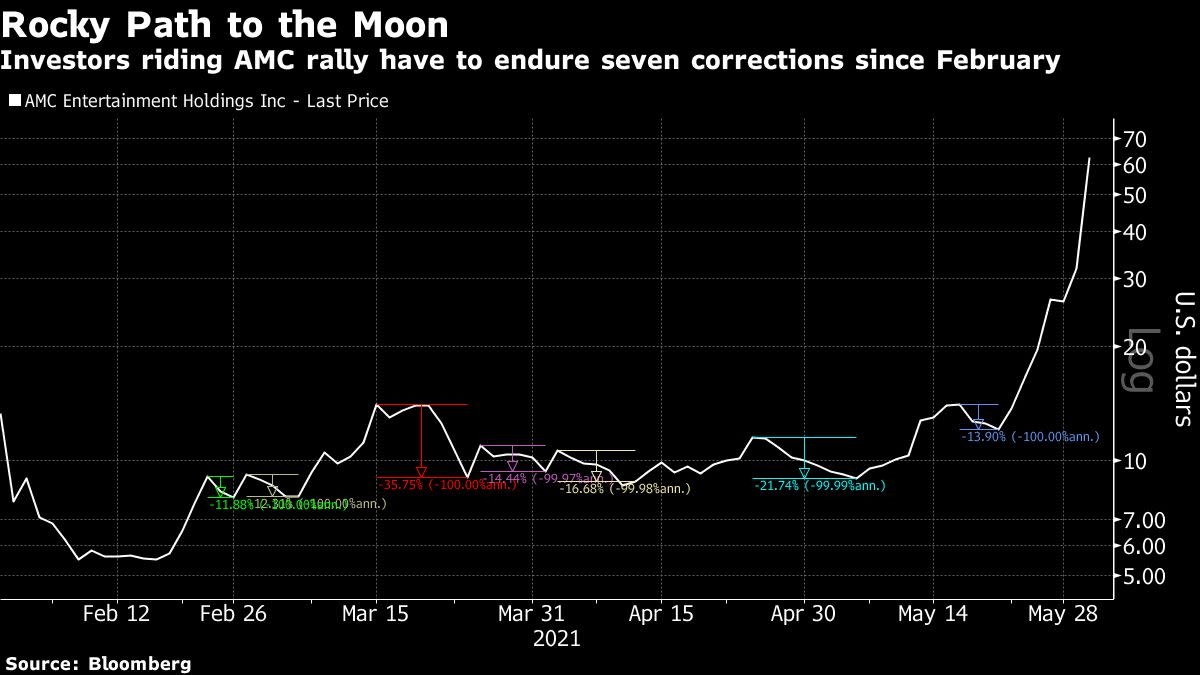

An AMC bull saddled with the stock at the Feb. 9 low has had to endure not one, not two, but seven separate corrections of 10% or more en route to Wednesday’s big revival. The selloffs had similar traits: Each was swift and violent, lasting six days on average, with losses reaching as much as 36%.

Or, maybe you didn’t wait. You sold, convinced you could buy the stock back once it resumed the ascent everyone on Reddit apparently knew it would. Perfect timing — that is, timing that spared a buyer the aforementioned volatility — required ignoring seven different rallies of 10% or more that fizzled since the start of February.

The point isn’t to rain on anyone’s payday. Buying and holding AMC required nerves of steel and people who pulled it off have earned their reward. It’s simply to point out the hoary investment truth that everything seems easy in retrospect, whereas in real time it wasn’t.

“I’m sure there’s quite a few people out there who are doing really well now. The question is, do they wake up tomorrow and find themselves doing less well? And how sustainable is it all?” said Ben Johnson, Morningstar’s global director of ETF research. “What you’re doing here is keeping your fingers and toes crossed that you’re going to find somebody who is going to pay more for those shares than you did.”

Shares of AMC have rallied almost 3,000% this year as day traders flocked to the cinema chain that was on the brink of bankruptcy just months ago and isn’t expected to make a profit before at least 2023.

Fear of missing out is fueling a mania that has sent the stock deviating from the fundamental story like never before. AMC has taken note, announcing earlier on Wednesday that it will reward its loyal shareholders with goodies such as special movie screenings and free popcorn.

Closing at $62.55 on Wednesday, AMC shares stood at roughly 12 times the level analysts see it trading a year from now: $5.11. The premium tops all Russell 3000 stocks that have enough of an analyst following to generate a price target, according to Bloomberg data, and is more than double that of GameStop — the next over-valued stock.

“I’m afraid the recent trading is merely the greater-fool theory,” said Matt Maley, chief market strategist for Miller Tabak + Co. “Even if AMC is making some positive changes for its future, it is still trading at a level that is well beyond anything that can be justified by the fundamentals. Many of these investors will be trading free popcorn for some significant losses before long.”

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.