Want to get in on hot energy stocks? Wall Street favors these 20 picks for gains up to 40%

The energy sector has been the best performer in the U.S. stock market this year, but it isn’t too late to jump in, as the setup is still attractive for the reopening of the economy.

On June 1, oil prices rose to a two-year high. And an analysis by GasBuddy showed gasoline demand in the U.S. at close to normal levels, possibly poised to hit record levels this summer.

Energy recovery has a long way to go

The S&P 500 energy sector SP500.10,

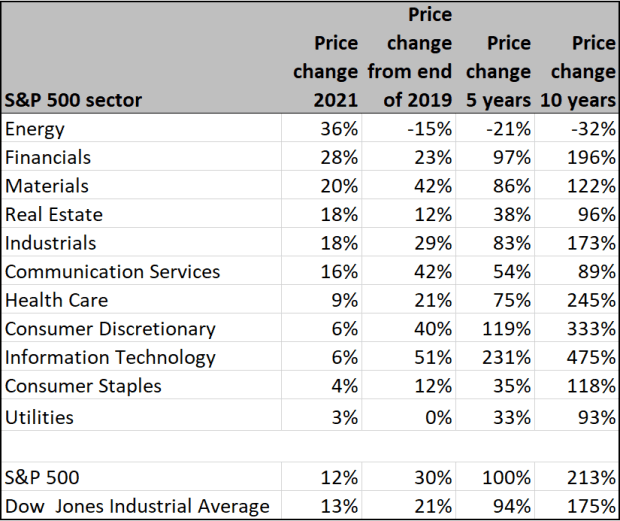

Stretching out the timeline paints a different story:

Figures exclude dividends.

(FactSet)

If we look at price changes from the end of 2019 — before the coronavirus pandemic hurt demand for West Texas crude oil CL00,

The long-term figures are even worse, underscoring how shares of energy producers haven’t yet returned to their levels before the great oil-price crash that began during the summer of 2014.

The table includes price changes for the full S&P 500 SPX,

Economic cycle

There has been a shift to cyclical sectors of the stock market this year, as some investors have become afraid that rising consumer prices may cause the Federal Reserve to reverse its stimulative policies that have helped prop up the U.S. economy, and kept interest rates and borrowing costs down.

Consumer prices rose 0.8% during April from the previous month and 4.2% from a year earlier. That was the largest year-over-year jump in prices in 13 years.

During an interview last week, Michael Arone, the chief investment strategist for State Street Global Advisors’ U.S. SPDR exchange traded fund business, said investors should keep an eye on the labor market for signals of when the Federal Reserve might begin curtailing its bond purchases and allowing long-term interest rates to wise. He expects our current expansion cycle that favors energy stocks and other cyclical sectors to continue until early 2023.

Energy stock screen

For a list of energy stocks, it helps to expand beyond the S&P 500. The energy sector now comprises only 2.8% of the index’s market capitalization, down from 7.1% five years ago.

To broaden the list beyond the 23 stocks in the S&P 500, we began with the S&P Composite 1500 Index SP1500,

Pipeline partnerships

We then added another group of energy stocks — master limited partnerships, or MLPs, which are primarily income vehicles. As limited partnerships, these investments pass income (and capital losses) from pipelines, fuel storage and transportation businesses through to unit holders, who receive K-1 forms instead of 1099 dividend forms to report income. That makes tax preparation more complicated. MLPs aren’t included in the S&P indexes.

One way to invest in this group of energy stocks is the Alerian MLP ETF AMLP,

Wall Street’s favorites

Starting with our full list of 79 energy stocks (the 62 in the S&P Composite 1500 Index and the 17 held by AMLP), here are the 20 that are covered by at least five analysts polled by FactSet, with majority “buy” or equivalent ratings, that have the highest upside for the next year implied by consensus price targets:

Scroll the table to see all the data. The list is sorted by the implied 12-month upside based on consensus price targets. Dividend yields are in the right-most column.

The listed company with the highest 12-month upside potential implied by the price targets is Renewable Energy Group Inc. REGI,

Chevron made the list. The stock’s dividend yield remains attractive at 5.16%, despite a 23% increase for the shares this year through May 28. But Chevron’s arch rival Exxon didn’t make the list, following last week’s big victory for activist investors who gained seats on the company’s board in an effort to push Exxon to change its strategy toward one better-suited for a long-term switch away from fossil fuels.

The second company on the list is Energy Transfer LP ET,

One pipeline operator that didn’t make the list is Williams Cos. WMB,

It’s important to keep in mind that even at this stage of the economic recovery, dividend payouts can be reduced. And even though the analysts at brokerage firms favor these stocks, the price targets only go out 12 months, per tradition. That’s actually a short time frame for such a difficult, volatile sector.

Before committing money to any of these energy companies — or to any investment for that matter — you should do your own research and form your own opinion.

Don’t miss: Amazon and Facebook as defensive plays? Yes, along with these other stocks that are cash-flow winners