We put 6 more meme stocks’ numbers to the test and the differences are telling

The world of meme stocks is changing every day as traders communicating through Reddit’s WallStreetBets channel and other social media set their sights on new targets for short squeezes or find other downtrodden companies to bid up in price.

After last week’s look at financial results and projections for the four BANG stocks and four other meme companies, what follows is the same treatment for six more.

(The BANG stocks are BlackBerry Ltd. BB,

Short squeezes and meme stocks

Traders looking to group together on social media to make quick killings by pushing up share prices of companies at early stages or those going through difficult times have been setting up short squeezes.

Professional investors have traditionally short-sold shares of companies they believe will perform worse than most other investors or analysts expect. Shorting means borrowing a company’s shares and selling them immediately, in the hope of buying them back at a lower price, returning them to the lender and pocketing the difference. If you simply buy a stock hoping it will go up, all you risk is the money you invest. You might get wiped out. But if you short a stock, your risk potential is unlimited. You never know how high the price might rise if you have gotten the trade wrong.

“Covering” a short position is when you buy back the shares to return them to the investor who lent them to you. You are hoping to cover at a lower price than you sold the shares for, to make a profit.

To have a short position, you need to have a margin account with a broker — an account that lets you borrow to invest or trade. Because of the risk in taking a short position, if the share price goes against you (higher), your broker will keep increasing its collateral requirements. If you run out of cash as the price keeps rising, you will be forced to cover at a loss. That type of action among a large group of short-sellers pushes the price higher in a spiral — a short squeeze.

Six more meme stocks

The action changes daily. On June 9, for example, shares of Clover Health Investments Corp. CLOV,

Read: Newest meme stock darling Clover Health is popping. Is the SEC watching?

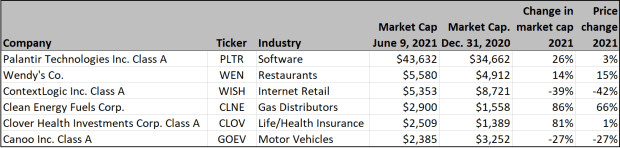

Here are the six additional meme stocks, following our initial group of eight, sorted by market capitalization as of the close on June 9:

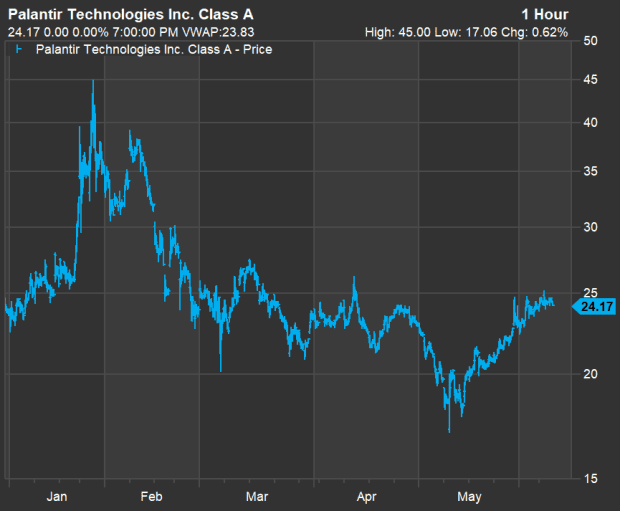

Palantir Technologies Inc. PLTR,

Palantir’s stock was up 3% for 2021 through June 9, but its market cap had increased by 26% because the company had been raising cash by selling additional shares to investors. The company’s following as a meme stock seems to spring more from its growth prospects than from short interest, which peaked at 8.5% of shares available for sale, according to FactSet.

Wendy’s Co. WEN,

Read: Wendy’s stock run-up prompts analyst downgrade but breakfast is driving growth

ContextLogic Inc. WISH,

Short interest

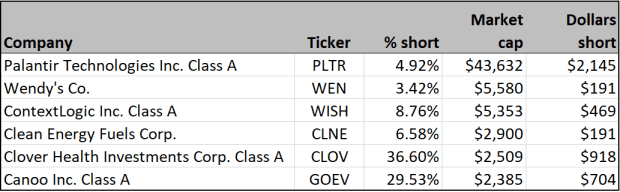

Keeping the group in the same order, here are levels of short interest as percentages of available shares and in dollars:

FactSet’s data on short positions as a percentage of shares outstanding is updated twice a month. The data was updated overnight between June 9 and 10. The second update takes place around the 25th day of the month.

Clover is the most heavily shorted stock on the list. Brad Lamensdorf, CEO of ActiveAlts in Westport, Conn., who runs long and short investment strategies, said previously that a short percentage “over 30% to 40% is outrageously high.” (Lamensdorf co-manages the AdvisorShares Ranger Equity Bear ETF HDGE,

A high percentage of shares sold short makes a stock especially dangerous for the short-sellers, because it can increase the intensity of any short squeeze.

We have shown the short interest as a percentage of market cap in order to provide context. Tesla Inc. TSLA,

Canoo Inc. GOEV,

Clean Energy Fuels Corp. CLNE,

Fundamentals

We’ll look back at sales results for this group of six meme stocks and then look ahead at sales estimates through 2023.

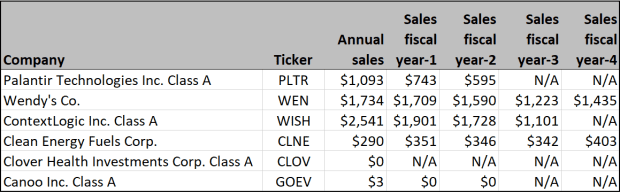

Looking back

First, here’s a comparison of annual sales, in millions of dollars for the past five reported fiscal years (where available):

You can see clear growth paths in recent years for Palantir, Wendy’s and ContextLogic, while Clean Energy Fuels had understandable challenges from lower natural gas prices in 2020.

Clover was incorporated on Oct. 18, 2019. It hasn’t yet reported annual revenue. For the first quarter, the company reported $200.3 million in sales, up from $165.5 million in the first quarter of 2020. Clover merged with Social Capital Hedosophia Holdings Corp. III (a SPAC) on Jan. 7.

Looking ahead — sales

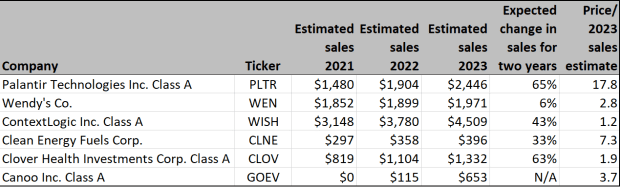

Starting from a baseline of calendar 2021, here are sales estimates going out through 2023 among Wall Street analysts polled by FactSet:

Double-digit or better sales growth is expected for all of the companies over the next two years except Wendy’s. Price-to-sale ratios, based on closing share prices on June 9 and the 2023 estimates, are included. In comparison, the S&P 500 trades for 2.5 times its weighted aggregate consensus sales estimate for 2023.

Looking ahead — earnings

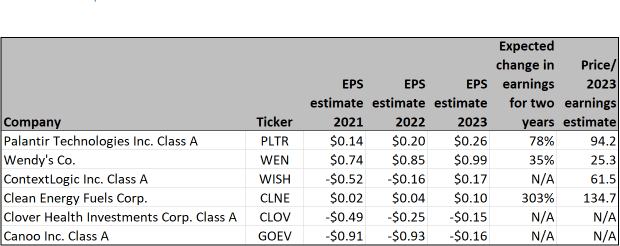

Here are earnings-per-share estimates going out to 2023:

You might not have expected the EPS projections to be particularly useful, but they underscore how high these stocks are trading. The S&P 500 trades for 18.4 times its consensus EPS estimate for 2023.

The estimates show expected improvement for Palantir, if it manages to maintain its rapid sales growth. Wendy’s is expected to improve EPS significantly even with modest sale growth, in part because of stock buybacks.

Wall Street’s opinion

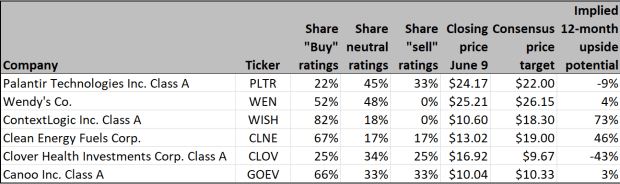

Here’s a summary of opinion for this group of meme stocks among Wall Street analysts:

So the Wall Street analysts have the most love for ContextLogic, with 82% “buy” or equivalent ratings. Second place goes to Clean Energy Fuels. For that company, the timing, in a year of economic and fuel-price recovery, not to mention the desire among many investors to help lower carbon emissions, seems perfect.

Wall Street is skeptical of Palantir and Clover Health, but it would seem for different reasons, as Palantir already has a history of rapid sales growth.

More meme-stock coverage:

- Meme stocks stumble after GameStop discloses SEC probe into the frenzy

- GameStop names Amazon executives as its new CEO, CFO, surprises market with plans to sell more shares

Don’t miss: Here are the hottest stock sectors for Wall Street right now — and analysts’ favorite ways to play them