Ahead of Tesla results, Cathie Wood says Wall Street’s valuing it all wrong

It’s looking like a jittery start to the week, with stock futures falling, and China and Hong Kong stocks slumping amid a technology crackdown. Bitcoin is headed the other way, thanks in part to a help-wanted ad from Amazon.com.

Speaking of tech, we’ve got all the heavy hitters rolling out results this week — Apple AAPL,

Our call of the day comes from Cathie Wood, founder of ARK Invest, whose flagship ARK Innovation exchange-traded fund ARKK,

In the first of a series of interviews that published Monday on Real Vision, Wood zeroed in on shortcomings of Wall Street, which she said needs more specified technology analysis. She highlighted its approach to Tesla as one example.

Wood’s base case calls for shares of the EV giant to hit $3,000, which is viewed as “crazy,” given shares are closer to $700, she noted.

“We believe the reason there is such a big inefficiency in Tesla’s valuation is the short-term time horizon of analysts and the wrong analysts following it,” said Wood, who explained that Tesla is a multifaceted technology company, but being covered by Wall Street auto analysts.

“Tesla is a technology company, but it’s not just one technology company,” she said, pointing to energy storage, robotics, artificial intelligence and software-as-a-service. “So we have three analysts building the Tesla model,” she said.

How big is her overall disruptive and innovative vision overall? She said market capitalization in public equity markets focused on transformative innovation was about $7 trillion in 2019, then doubled in 2020 to $14 trillion.

“And we believe that number is going to $75 trillion plus during the next five to 10 years and probably will account…for more than all of the appreciation in the equity markets because..the other side of disruptive innovation is creative destruction, so the traditional benchmarks today are being increasingly populated by value traps cheap for a reason because they are going to be disrupted or destroyed,” said Wood.

It will be “critically important to get innovation right and I do not believe traditional research departments are set up to do that right now,” said the money manager. You can check out part one of her interview here.

Big tech trouble in China and Bitcoin busts out

China 000300,

China is also blaming the U.S. for a stalemate in relations between the two at the start of high level bilateral talks.

Bitcoin BTCUSD,

Share of defense group Lockheed Martin LMT,

In deal news, diagnostics group PerkinElmer PKI,

Lucid Motors stock is set to trade on the Nasdaq Monday after the electric car group’s merger with a blank-check company was approved Friday.

The markets

Dow futures YM00,

The chart

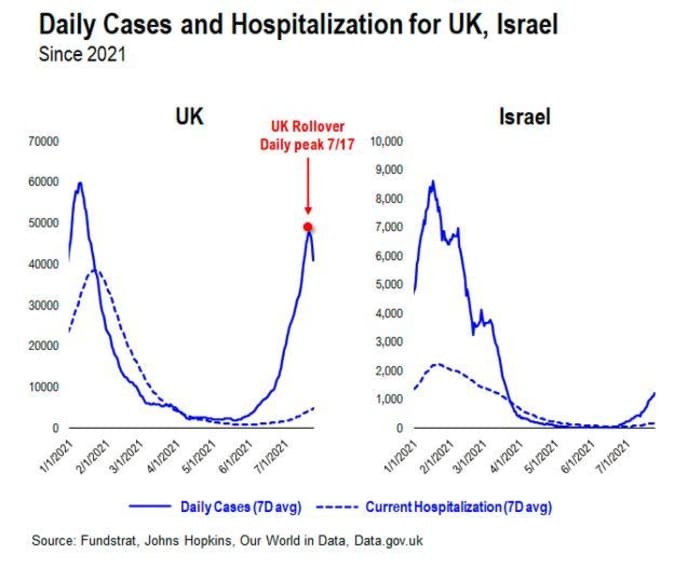

On the COVID-19 front, a drop in the U.K.’s delta-fueled cases is raising some hopes that there is an end in sight for climbing infections elsewhere.

“The U.K. saw a relentless parabolic surge in cases. This lasted 45 days. And even without any mitigation measures, the UK cases have been falling now for the past week,” Thomas Lee, founder of Fundstrat Global Advisors, told clients in a note. ” If the U.S. follows the template of the UK, daily cases in USA might be peaking in the next 12 days.”

Random reads

Secrets of a stone buffet in Spain.

13-year old takes away Olympic gold in skateboarding.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.