Americans are leaving old 401(k) accounts behind — and paying the price

Remember that 401(k) from your first job? What happened to it? If you’ve lost track of your old accounts, you’re not alone; millions of Americans leave 401(k) accounts behind in their old employers’ plans every year.

It’s not hard to come across statistics highlighting how inadequate our collective savings are. While some of that is an unfortunate reality of income inequality and our modern labor market, much of it comes down to the friction that’s embedded in our retirement savings system — in particular, the fact that our retirement accounts like 401(k)s are tied to our employers. And we often do the wrong thing with them when we change jobs, like cash them out or forget about them.

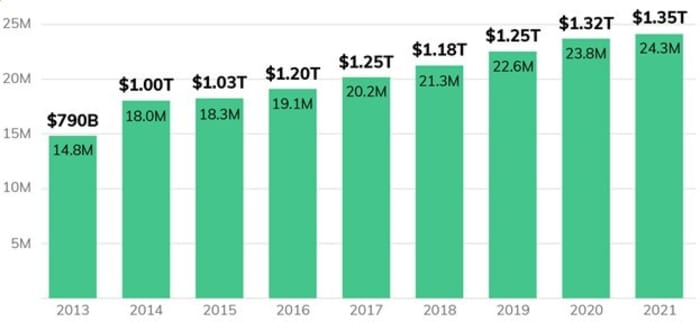

Leaving old 401(k) accounts behind is more common than you might think. In some recent analysis we did with the Center for Retirement Research at Boston College, we estimated that there are over 24 million forgotten 401(k) accounts holding $1.35 trillion in assets, and another 2.8 million accounts left behind annually. This isn’t hard for me to believe — I’ve left behind accounts myself, as have plenty of friends and family members.

So how did we get here?

401(k)s are popular, Americans have saved over $6.7 trillion in 401(k) accounts. These accounts are “employer-sponsored,” meaning they’re provided by our employers. While 401(k) plans are great for saving money, there’s one major limitation: many people change jobs every few years, forcing us to decide what to do with 401(k) savings we’ve accumulated.

We have a few choices: we can roll them over into a new retirement account like an individual retirement account (IRA), cash them out (paying hefty taxes and penalties), or leave them behind with the old employer. Job transitions are busy times, so it’s not surprising that many leave their 401(k) accounts behind. As a result, our old 401(k) plans can pile up as we move throughout our careers.

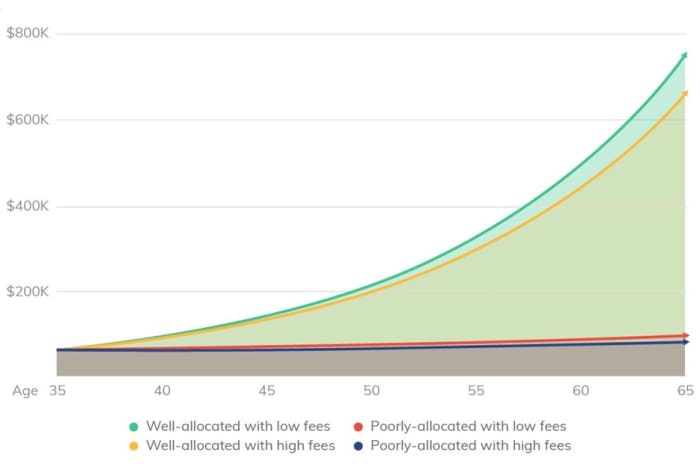

Some of those accounts are deliberately left behind because people like their old 401(k) plan, and that’s great. Unfortunately, though, the majority of them are left behind out of convenience. And the risk is that those ignored, forgotten accounts will cost us in foregone savings. Our analysis suggests left behind 401(k)s could cost Americans $116 billion in foregone retirement savings each year, and up to $700,000 for a single individual over the course of their life.

The two main reasons for that potential underperformance are the risk of higher fees, and the risk of us forgetting what our money is invested in.

Many 401(k) accounts charge meaningful fees, but many of us don’t realize it; a recent survey found that 73% of people don’t know how much they pay in 401(k) fees. While many 401(k) plans charge reasonably low fees, industry data show that there’s a wide range across 401(k) plans. Median 401(k) plans in 2020 cost participants about 0.85% a year, though some plans were as high as 1.5%. Ultimately, the risk is that an individual’s forgotten 401(k) account is stuck in a high-fee plan and they don’t realize it.

The most significant potential impact comes from suboptimal investment allocation. Here, the risk is that an old 401(k) account is sitting in a low-return instrument rather than a diversified, higher-return portfolio.

Unfortunately, this risk isn’t hypothetical. Many 401(k) plans still default to either a money market mutual fund or a stable value fund — an average of 13% did so between 2010 and 2019. Typical money market mutual fund returns are below 1%, while a stable value fund might deliver a slightly better 2-3%. Alternatively, a well-allocated, diversified retirement account should generate meaningfully better returns over time. That portfolio might be in a managed 401(k) or IRA, or maybe an automated IRA created by a roboadvisor. Those robo accounts have returned almost 9% annually over the past three years, while popular S&P 500 SPX,

Consider an account with a $55,000 balance: a retirement account charging a reasonable fee and returning healthy gains could yield nearly $700,000 more to use toward retirement over 30 years than a 401(k) stuck in a high-fee, low-return account. To put $700,000 into perspective: the USDA estimates raising a child to age 17 on average costs $233,610.

Of course, many 401(k) plans have reasonable fees and offer good investment options; however, even a 401(k) that was initially well-allocated needs to be monitored and regularly updated over time. The chances of that happening decline the longer a 401(k) account remains left behind.

These forgotten 401(k) accounts also lead to higher costs for employers — we estimate about $700 million annually. These costs result from paying administrative fees for former employees who remain in the plan, exposure to lawsuits over their fiduciary responsibility, and use of valuable HR time to communicate with former employees.

Going forward, private and public sector initiatives can meaningfully reduce the number and cost of these accounts to the benefit of individuals and employers. First, we can make it easier to locate old 401(k)s. There’s currently no national database for lost-and-found 401(k) accounts, despite Congressional proposals in the past. Second, we can simplify the complicated and outdated rollover process so it’s easier to move 401(k) accounts at the point of job change into another 401(k) or an IRA. Finally, employers should provide departing employees with user-friendly tools instead of the jargon-filled paperwork that’s common today. Giving users modern tools to understand their options and move their money is more likely to lead to informed decisions and fewer forgotten 401(k) accounts.

By highlighting the size and cost of the problem, we hope to bring more attention to one of the largest and most underappreciated reasons for why retirement savings in America are not what they should be.

If you’re interested in learning more about our research methodology and findings, we encourage you to check out this report with more details.

Gaurav Sharma, is chief executive and co-founder of Capitalize, which helps people transfer retirement assets.