Apple, Amazon, ARKK, and other big names indicate a market correction is coming, strategist says. Here’s why.

Stocks are near all-time highs, and though U.S. futures suggest a softer open on Thursday, it’s much easier to find bulls than bears these days.

But a technical indicator showing itself in five high-profile stocks and two funds suggests that a market correction is coming, according to strategist Michael Kramer of Mott Capital Management, in our call of the day.

The relative strength index, or RSI, measures the speed and change of recent price movements and is one of the most renowned technical signals. It allows investors to evaluate whether a security is overbought or oversold—i.e. overvalued or undervalued. A reading of 70 or above is considered overbought, while 30 and below is oversold.

A look back at 2018 is enough to tell investors why they should watch this indicator, according to Kramer, who noted on January 29, 2018 that high RSIs for some of the biggest names signalled that the stock market was ready to fall. “Things got really ugly after that through February 8,” he said.

In those 10 days early in 2018, Dow industrials DJIA,

Now, “the same thing is emerging,” Kramer said, “with the biggest stocks all reaching very overbought reading.”

Apple AAPL,

By the end of Wednesday, Apple had an RSI of more than 80, with Amazon at 70, Microsoft at 76, and Google-owner Alphabet at 73 and showing a rising pattern, Kramer said. He noted that Nvidia’s RSI was in the process of breaking a near-two month rise up to 83.

Ark Innovation ETF’s RSI was sitting at 76, while the QQQ was above 75. “When the QQQ RSI gets this high, the outcomes are not good most of the time, including January 2018,” Kramer said.

The buzz

Netflix NFLX,

On the U.S. economic front, investors can expect initial jobless claims at the same time as continuing jobless claims for the week of July 3. The Empire state and Philadelphia Fed indexes for July as well as a basket of measures from June are also due. Plus, Federal Reserve chair Jerome Powell is set for his second day of Congressional testimony on the state of the economy.

The head of the world’s largest asset manager said that there have been “fundamental” and “foundational” changes in how policymakers view inflation. Larry Fink of BlackRock BLK,

Chinese economic growth slowed but remained strong at 7.9% in the second quarter of 2021 as the country’s rebound from the effects of COVID-19 levelled off from blowout 18.3% growth in the first quarter of the year.

Binance, the exchange for bitcoin BTCUSD,

The tweet

Jackson Palmer co-created dogecoin DOGEUSD,

“The cryptocurrency industry leverages a network of shady business connections, bought influencers and pay-for-play media outlets to perpetuate a cult-like ‘get rich quick’ funnel designed to extract new money from the financially desperate and naive,” he wrote in a must-read Twitter thread that doesn’t pull any punches.

The markets

U.S. stock market futures were indicating a soft open, with Dow industrials YM00,

Stocks fell across Europe SXXP,

The chart

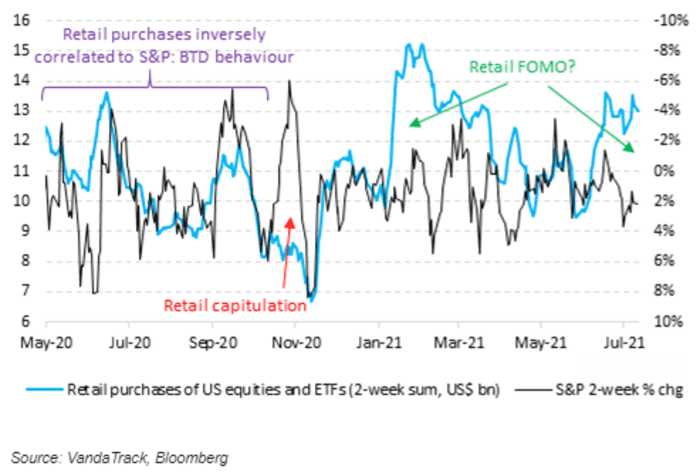

Daily equity purchases by individual investors has averaged $1.3 billion a day since the middle of June—much higher than the average since the pandemic began—in a peak similar to February’s meme stock frenzy.

Our chart of the day, from VandaTrack Research, shows that purchases are negatively correlated with stock prices, i.e. individual investors tend to buy more dips than rallies.

“One thing that the current retail buying binge has in common with the February peak is that they both happened in rising markets, which is something unusual,” said Ben Onatibia and Giacomo Pierantoni, noting exceptions in October 2020 and in the first quarter of 2021. “From a market-timing perspective, you couldn’t have asked for a better contrarian indicator.”

Random reads

Big Weiner, meet Big Bun: Heinz Ketchup’s petition for hot dogs and buns to come in equal packs has gained nearly 30,000 signatures. Weiners are in packs of 10 and buns of eight, and the mismatch is “one of the stupidest things on earth,” one signee said.

I saw a Tiger: A federal appeals court has thrown out the 22-year prison sentence for Joe Exotic in his 2019 murder-for-hire conviction—the alleged plot to kill his rival, Carole Baskin. But “Tiger King ”Joseph Maldonado-Passage isn’t free yet: the federal court in Oklahoma will review his case for resentencing.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.