[Click here for an interactive chart of gold prices]

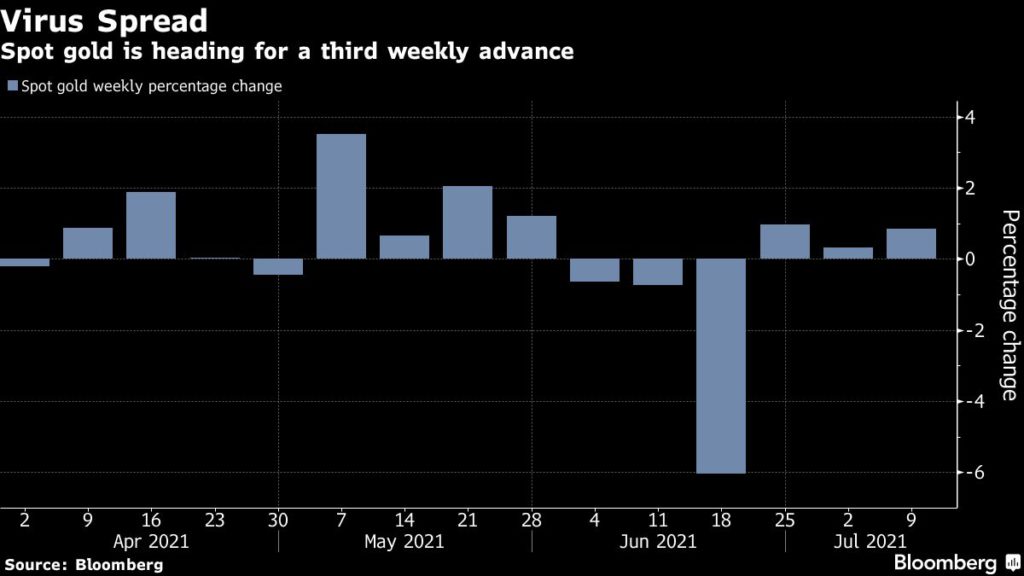

Bullion is coming off its worst month in recent history in June, during which prices hit a 10-week low and tanked nearly 7% by month-end. Additionally, flows into global gold ETFs remained mostly flat for the month, according to data from the World Gold Council.

However, gold is gradually winning back investors thanks to a sharp decline in US treasury yields, which burnish the appeal of the non-interest bearing metal.

Renewed virus fears around the world have taken the edge off the so-called reflation trade, causing global stocks to drop. The risks to the recovery were underscored this week by Federal Reserve minutes that highlighted continued uncertainties, and on Thursday by a rise in US jobless claims.

Meanwhile, China also loosened its lending requirements for financial institutions, a sign policy makers there see the need for economic support to be stepped up.

“Commodities came under pressure as policy makers around the world flagged risk to their economies from rising cases of covid-19 variants,” Australia & New Zealand Banking Group Ltd. said in a note to Bloomberg.

“Demand for safe haven assets rose following a lift in US initial jobless claims,” it added.

Next week, investors will turn their attention to US CPI data due Tuesday for signs prices are rising despite sluggish growth.

Gold often benefits when interest rates are kept low while inflation expectations rise, which causes real bond yields to decline.

(With files from Bloomberg)