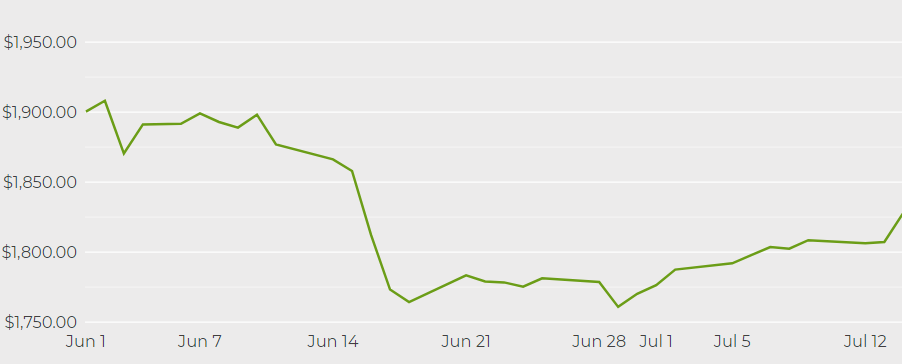

Gold price pulls back from 1-month high as dollar, yields fluctuate

[Click here for an interactive chart of gold prices]

Benchmark US 10-year treasury yields, meanwhile, edged up from one-week lows, and the dollar index was bound for a strong weekly gain.

TD Securities commodity strategist Daniel Ghali told Reuters that gold’s inability to benefit substantially from weaker US real yields suggested that it remains vulnerable to a further pullback.

“Although gold’s valuation is more attractive on a relative basis to US treasury inflation protected securities (TIPS), the reason gold is trading at a discount to it is because it does not have the same carry advantage,” he said.

Earlier this week, Federal Reserve Chair Jerome Powell reiterated that the US central bank would remain accommodative and stuck to the view that recent price spikes were transitory. His dovish remarks ultimately sent gold to a one-month high on Thursday.

Uncertainty around a potential spike in covid-19 delta variant cases in the US could force the Fed to remain accommodative for longer, according to Phillip Streible, chief market strategist at Blue Line Futures in Chicago.

US equities also remain susceptible to a further pullback, which could strengthen gold’s appeal and potentially helping it climb to $1,850 in the near term, Streible added.

(With files from Reuters)