Time can be a powerful investment tool.

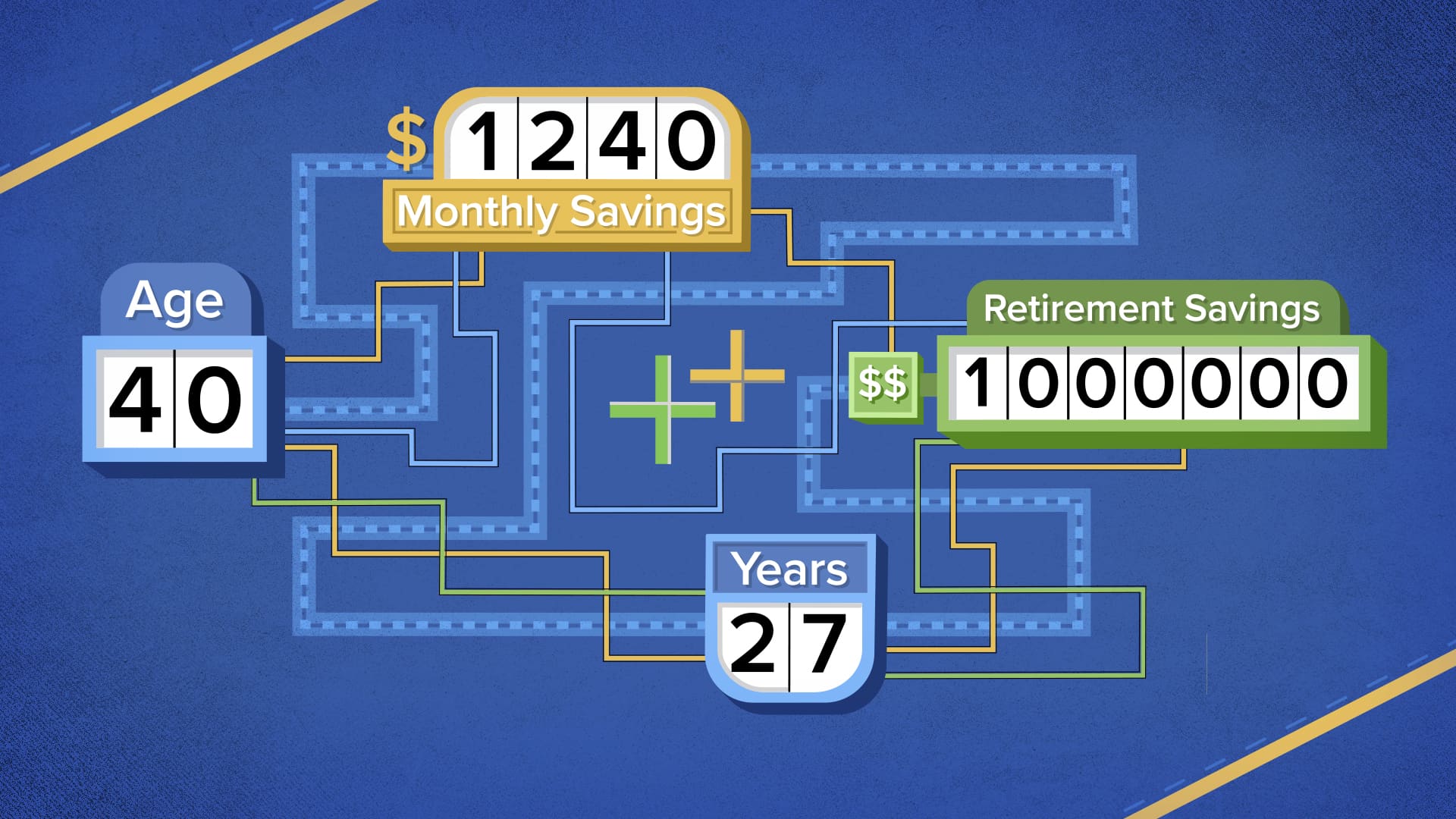

Saving early in your career will give your money time to grow in the market, but you can retire with $1 million even if you get a late start.

You’ll need a few tools to hit your goal.

Savings plans to help you reach that mark could include your employer’s 401(k), which is a tax-advantaged retirement savings account, or a Roth IRA or traditional IRA. Investment options include low-cost index funds.

Check out this video to dive into the figures.

More from Invest in You:

Josh Brown: Sometimes the best returns come from CEOs you’ve never heard of

The power of compounding can help you double your money, again and again

Here’s what your budget should look like if you make $40,000 per year

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.