Hertz Roller Coaster Resumes in Wild Return After Bankruptcy

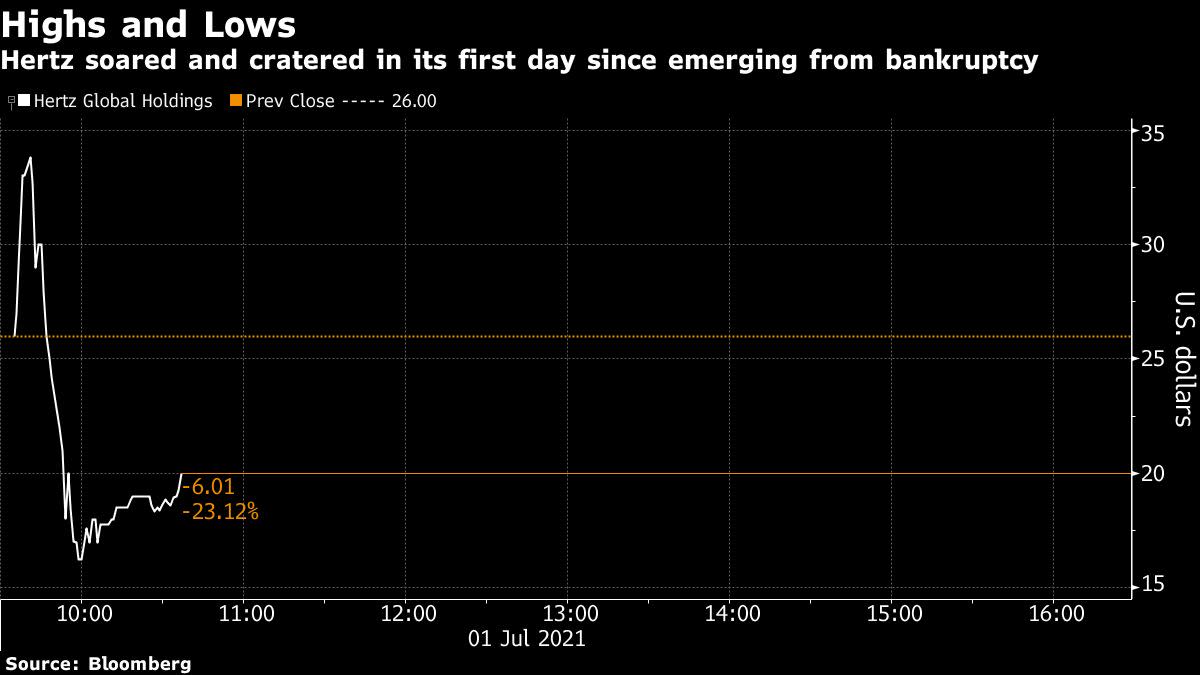

(Bloomberg) — Hertz Global Holdings Inc. shares swung violently in their first session since the company emerged from bankruptcy on Wednesday.

The stock, which resumed trading over-the-counter under a new ticker “HTZZ”, bounced between massive gains and losses on Thursday before closing up 23% to $26.99. It opened at $22 and almost immediately surged more than 50% to $35 before reversing direction and tumbling to as low as $16, then rising again.

Volatility is nothing new for Hertz as the stock has been on a wild ride since the company filed for bankruptcy a year ago and its trading on the New York Stock Exchange was suspended in October.

Many investors are anxious to see when the shares will be listed on a formal stock exchange, which would mean improved access to capital, more liquidity and increased accountability. A Hertz spokeswoman declined to comment on listing plans.

Vehicle Shortage

The stock had been trading over-the-counter under the ticker “HTZGQ” for the past eight months as the shares soared from penny-stock status. Hertz rallied more than 500% in the first half of 2021 as investors bet on the company’s successful rebound from bankruptcy.

Hertz’s return couldn’t come at a better time. Americans are gearing up to take trips for the July 4 holiday, and the cost of renting cars is at eye-popping levels. The company could be held back by a shortage of available vehicles like the rest of the industry, but there’s plenty of pent-up demand for rentals.

Hertz’s surge over the past year was largely credited to retail investors, who have propelled different pockets of the stock market recently. A group of amateur stock pickers placed numerous risky bets on the company despite it filing for bankruptcy in May 2020, a trend that puzzled Wall Street pros last summer.

The company’s emergence from bankruptcy comes at a time when amateur trading has gone completely mainstream, with Morgan Stanley strategists even suggesting that Wall Street pros follow their smaller peers. Trading in so-called meme stocks is expected to continue gripping the market as corporate executives and investors adjust to the new normal.

A basket of 37 companies whose wild volatility forced Robinhood to impose trading restrictions in January has nearly doubled this year, posting gains that are more than six-times the return of the S&P 500.

Unresolved Issue

For bondholders, Hertz’s emergence from bankruptcy wasn’t so simple.

One dispute between noteholders and the company was left unresolved by the reorganization plan that Hertz implemented this week: should the company pay a so-called redemption price for paying off company notes as part of the restructuring.

A trustee for noteholders is demanding about $272 million. A U.S. bankruptcy judge will rule on the issue at a later date.

(Updates share movement in first two paragraphs)

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.