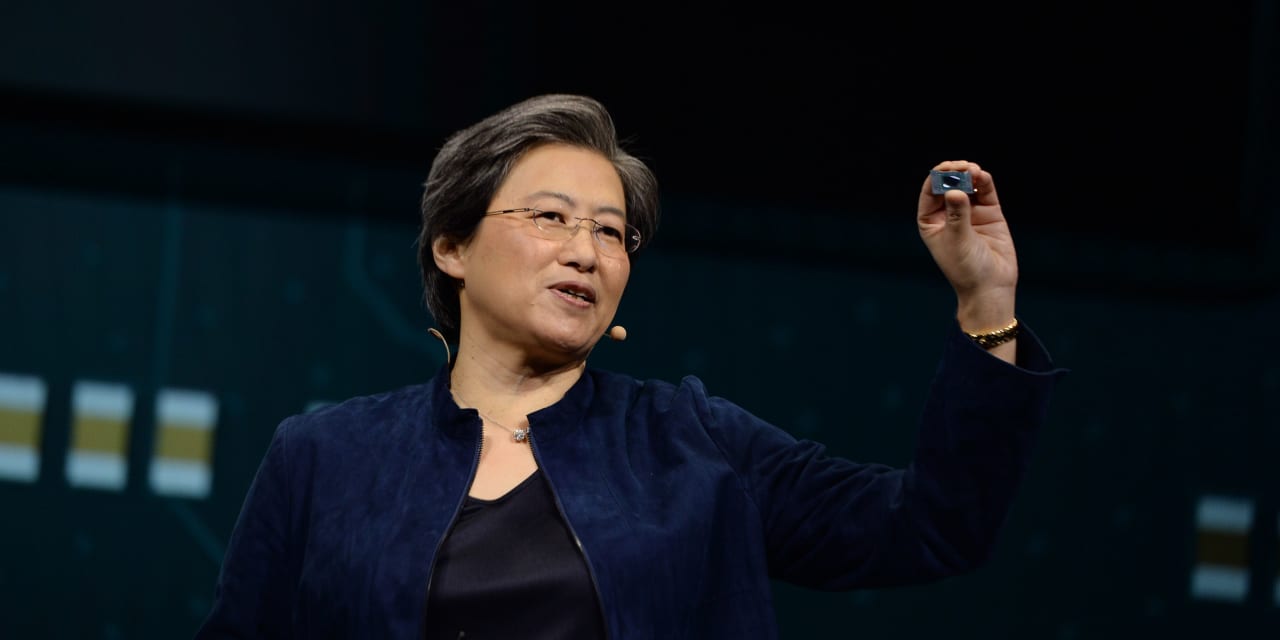

Hey Intel, AMD’s CEO is also ready to ‘fight for every socket,’ while producing strong growth

Intel Corp. promised to fight Advanced Micro Devices Inc. for the crucial data-center market, but AMD Chief Executive Lisa Su isn’t scared.

“We will always fight for every socket,” Su said on AMD’s AMD,

Su’s statement comes from a stronger position, however, after AMD hiked its annual forecast Tuesday on expectations its sales to cloud providers would be even better in the second half of the year. In fiscal second-quarter results released Tuesday afternoon, sales from enterprise embedded and semi-custom chips — the unit that includes data-center and gaming-console revenue — nearly tripled to $1.6 billion, compared with $565 million a year ago.

See also: Intel appears to be feeling the competitive heat from AMD

Analysts surveyed by FactSet expected $1.44 billion. Traditionally, AMD has not broken out data-center sales separately from gaming sales.

On the conference call with analysts, however, Su provided some clarity on those figures. On the call, Su said data-center sales were greater than 20% of AMD’s second-quarter revenue — which would equal more than $770 million, or roughly half of the $1.6 billion in data-center/gaming segment sales — and that percentage is expected to grow.

“We believe that the data-center business will continue to be a strong driver for us into the second half of the year,” Su told analysts. “It will be a larger percentage of our overall revenue in the second half of the year.”

Last week, Intel reported a better-than-feared 9% decline in data-center sales, but its forecast did little to bolster confidence amid a global chip shortage.

Read: Intel changed the name of its chips, but analysts say the story hasn’t changed

Concerning the global shortage in chips and chip-making capacity, Su said AMD has made progress in securing “extra” resources in the second quarter, and that it expects to continue doing so. “It enabled us to exceed the original guidance as we go into the second half of the year,” Su said. “Which is leading to the full-year guidance raise that we have.”

Some analysts suggest AMD may be getting preferential treatment from its silicon-wafer supplier Taiwan Semiconductor Manufacturing Co. TSM,

AMD hiked its guidance for the full year yet again, and now projects sales to grow about 60% year over year compared with a forecast of 50% growth in the previous guidance. AMD reported revenue of $9.67 billion last year, so that suggests sales of about $15.47 billion this year, while analysts were forecasting revenue of $14.65 billion, according to FactSet.

AMD expects third-quarter revenue of $4 billion to $4.2 billion, while analysts had been projecting $3.82 billion, according to FactSet.

The company reported second-quarter net income of $710 million, or 58 cents a share, compared with $157 million, or 13 cents a share, in the year-ago period. After adjusting for stock-based compensation and other factors, the Santa Clara, Calif.-based company reported earnings of 63 cents a share, compared with 18 cents a share in the year-ago period. Revenue rose to $3.85 billion from $1.93 billion in the year-ago quarter.

Analysts surveyed by FactSet had forecast adjusted earnings of 54 cents a share on revenue of $3.62 billion, after AMD projected between $3.5 billion to $3.7 billion. Shares rose as much as 2% in after-hours trading but were muted for the most part, following a 0.9% decline in the regular session to close at $91.03.

Read: The chip crunch marches on, but one sector could be in store for relief

In its computing and graphics segment, AMD reported second-quarter sales of $2.25 billion, up from $1.37 billion last year, compared with analyst expectations of $2.17 billion.

The chip sector is dealing with supply shortages, and more results will be revealed this week, with Qualcomm Inc. QCOM,

Over the past 12 months, AMD shares have gained 32%. In comparison, the PHLX Semiconductor Index SOX,