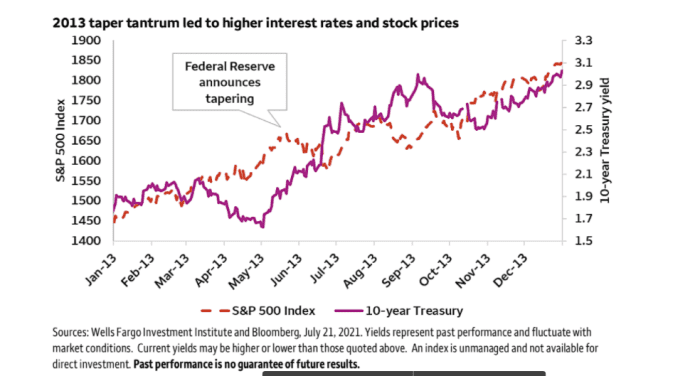

How the 10-year Treasury rate and S&P 500 performed when the Fed tapered in 2013

In the wake of the Great Recession, it took about five years for the U.S. central bank to start slowing down its controversial large-scale bond-buying program, ultimately making 2013 the year of the “taper tantrum.“

Federal Reserve officials have said they’d rather avoid a repeat of that episode, when it comes to eventually scaling back its $120 billion-a-month, pandemic-era asset-purchase program.

And while it felt like the U.S. stock and bond markets both freaked out in 2013, a review of the S&P 500’s SPX,

Following a roughly 6% pullback post-Fed taper announcement, the S&P 500 finished the year higher by about 30%, according to the Wells Fargo Investment Institute.

S&P 500 rose 30% in 2013.

Wells Fargo Investment Institute

At the same time, the 10-year Treasury yield TMUBMUSD10Y,

Check out: Foreign buying of U.S. corporate debt takes off, even with Fed no longer buying

“Higher inflation, rising long-term interest rates, and a less dovish Fed could potentially cause the market to pause,” Chris Haverland, Wells Fargo Institute’s global equity strategist wrote, in a Monday note.

“However, equities have historically performed well through these events, even if there was some initial selling pressure.”

Haverland thinks the Fed may announce plans to reduce its asset purchases later this year, which could lift longer-duration Treasury rates, including the 10-year, from its current 1.3% range. He also prefers to stick to his wheelhouse in equities over bonds.

“If the market corrects, we would view it as an opportunity to fill our equity positions that may be below strategic or tactical targets,” he said.

Read: Watch for the Fed to tiptoe toward tapering this week

During the pandemic, the Fed has been buying about $80 billion of Treasurys each month and $40 billion of agency mortgage-backed securities (MBS), while increasing its balance sheet to about $8.2 trillion.

Some Fed officials have been debating whether the time is right to start reducing the central bank’s agency MBS MBB,

The Federal Reserve kicks off a two-day policy meeting on Tuesday, with a statement due Wednesday at 2 p.m. Eastern, followed by Fed Chairman Jerome Powell’s press conference.

U.S. stocks drifted higher into record territory on Monday, with the Dow Jones Industrial Average DJIA,