In the employer struggle to find workers, there may be a $12 billion fintech opportunity

A growing interest among younger workers to access their pay more quickly could create a $12 billion market for payroll providers and earned-wage upstarts that seek to disrupt the traditional idea of pay periods.

Fintech companies see a big opportunity to speed up access to earned wages, especially for hourly employees with tighter cash-flow needs and a greater proclivity to use costly and predatory options like payday loans to make ends meet. The technology, which can allow workers to receive their wages at the end of a shift, may drive the biggest change to the payroll industry in decades following a long stretch of monthly and then biweekly pay cycles.

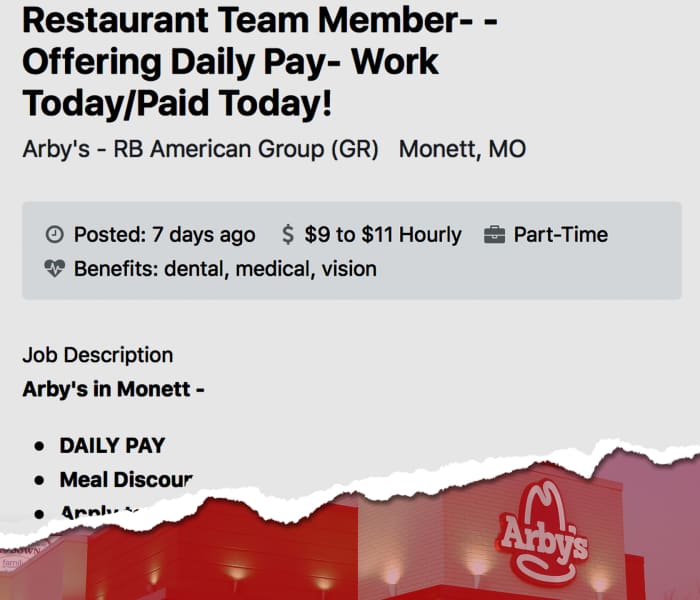

Companies providing access to on-demand wages say they’re seeing a surge of corporate interest given the current labor market as businesses in sectors like retail and restaurants struggle to recruit workers. One Missouri Arby’s location lists “DAILY PAY” as the first bullet point in its job posting for a team-member position. DailyPay, a startup recently valued at upwards of $1 billion, says it works with some Arby’s franchises to provide this service.

Mizuho analyst Siti Panigrahi attributes the trend partly to a gig-worker mentality, and companies like Uber Technologies Inc. UBER,

The total addressable market for these services could be $4.2 billion to $12.2 billion in the U.S., according to Baird analyst Mark Marcon.

See also: Why online-travel giant Booking is getting into the fintech game

On-demand pay is currently most prevalent among workers in industries like grocery, restaurants, and hospitality, where there is a strong need for quicker access to wages, but DailyPay Chief Executive Jason Lee expects that companies will gradually give the option to salaried workers as well, given a general move in the financial-services industry to get people their money more quickly. We’re used to picking up the tab for a friend’s coffee and immediately receiving reimbursement through services like Venmo, he said, and he believes more people will start having a similar expectation of their employers as well.

“We have squeezed the toothpaste out of the tube and it’s hard to put it back in,” he told MarketWatch.

“ “On-demand pay is happening and becoming table stakes. My belief is that companies won’t be able to get on the rankings of the top companies to work for if they don’t offer some flexible pay arrangement.” ”

Employers typically run payroll every two weeks before sending money off to employees, but DailyPay integrates with various back-office software systems to figure out elements like how much an employee has worked in a given day and what that person’s deductions are. Then when workers request on-demand access to their wages, DailyPay will fund these requests off its own balance sheet, and the employer eventually reimburses the fintech company.

Read: PayPal steps up efforts to make money off Venmo with new fee changes

Though startups have led the charge on earned-wage access, the trend has caught the attention of established payroll providers like Automatic Data Processing Inc. ADP,

Ceridian has seen “parabolic” growth of its Dayforce Wallet earned-wage service since its May 2020 launch, according to Seth Ross, the wallet’s general manager. In the early days of Dayforce Wallet, employers looked at it as an “altruistic” way to help get workers their pay more quickly during the pandemic, but now they’re viewing it as a way to attract and retain employees in a competitive labor market, he said.

“On-demand pay is happening and becoming table stakes,” he told MarketWatch. “My belief is that companies won’t be able to get on the rankings of the top companies to work for if they don’t offer some flexible pay arrangement.”

Don’t miss: This fintech has big plans for the U.S. with a focus on helping expats send money to family back home

Companies offering on-demand payroll solutions structure their business models in a number of ways, but their services are far cheaper than payday loans, which can carry an APR of 400% or more, according to Mizuho’s Panigrahi. Some providers of earned-wage options charge a fee to the employer or employee, which can run at around $1 to $3 for each time a worker takes advantage of the feature, per Panigrahi’s analysis.

Baird’s Marcon wrote that a $3 fee per transaction when an employee accesses earned wages would be 80% less expensive than the $15 in fees one would pay to get a $100 payday loan and 91% less than the $35 one might be charged for a bank overdraft.

Others have found a different model, including Ceridian’s Dayforce Wallet, which provides on-demand wages through a linked debit card and monetizes the program through interchange, or the fees that a merchant’s bank pays the card issuer’s bank. By participating in the general economics of card transactions, Ceridian is able to make money off the feature without charging workers to use it. The company earns more interchange revenue the more that consumers spend on their debit cards.

Through Ceridian’s model, workers can opt to load some or all of their earned wages onto the Dayforce Wallet debit card for immediate spending, and then they get the rest on their traditional payday. Ross said that Ceridian’s service is differentiated because it’s embedded within the company’s broader human-resources system that shows when a worker clocks in and out and what the worker’s deductions and benefits are.

Panigrahi estimates that the Dayforce Wallet could add at least $500 million in incremental revenue for the company by 2026.

Many providers of earned-wage access are looking to extend beyond the modernization of paychecks. The “holy grail” for neobanks is access to users’ direct deposits, said Ross. Ceridian, a payroll company, is essentially able to get that access when workers opt to shift pay to their Dayforce Wallet accounts rather than traditional bank accounts.

“The ambition for us is that the Dayforce Wallet card is not just a vehicle for advancing funds when they need it but that it becomes that user’s trusted financial hub for everything they want to do,” he said. “It’s early days but that’s where we’re going.”

Branch, a startup in the space that works with partners like Domino’s and Pizza Hut franchises, sees a similar path. About a quarter of the company’s users switch their direct deposits to Branch, which offers a free checking account without monthly minimums, said Atif Siddiqi, the company’s chief executive. Branch sees opportunity to continue offering bank accounts, including to its unbanked users, while also expanding into adjacent areas, like cashless tips and contractor payments.

DailyPay, which counts ADP and Ultimate Kronos Group among its partners, said it’s chosen a different route. Nearly 90% of its users have indicated that they don’t want to switch their bank accounts, so the company doesn’t offer checking or savings accounts, instead sending earned wages to consumers’ existing accounts.

“Consumers have a gajillion choices,” he said. “What we’d rather do is build seamless connectivity.” Depending on the arrangement, employees, employers, or a combination of both will pay a fee when users access wages early, but DailyPay doesn’t charge for its savings features.

The end of the two-week pay cycle: How every day can be payday

Marcon cautions that while on-demand wage programs can help people avoid relying on exploitative short-term lending options, there is also the potential for abuse if workers immediately spend all of their earned wages such that they still must turn to predatory lending to manage their liquidity. “While many of the offerings provide constraints or customization to prevent abuses, we do note that some individuals could further deteriorate their financial position by abusing on-demand pay,” he wrote in a note to clients.

The focus on earned-wage access may be missing the point, suggests Jon Schlossberg, the founder of Even, a fintech player that works with PayPal Holdings Inc. PYPL,

Even’s goal is to get its users to become regular users of financial-planning and savings tools so that if an emergency were to hit, the workers would have money to fall back on without having to tap their wages early, according to Schlossberg. The company recently launched employer-sponsored savings funds and is optimistic that an option for automatic savings will get more users to stash money away for a rainy day.

“The way you help people not use short-term credit products is to [help them] have more money,” he said.