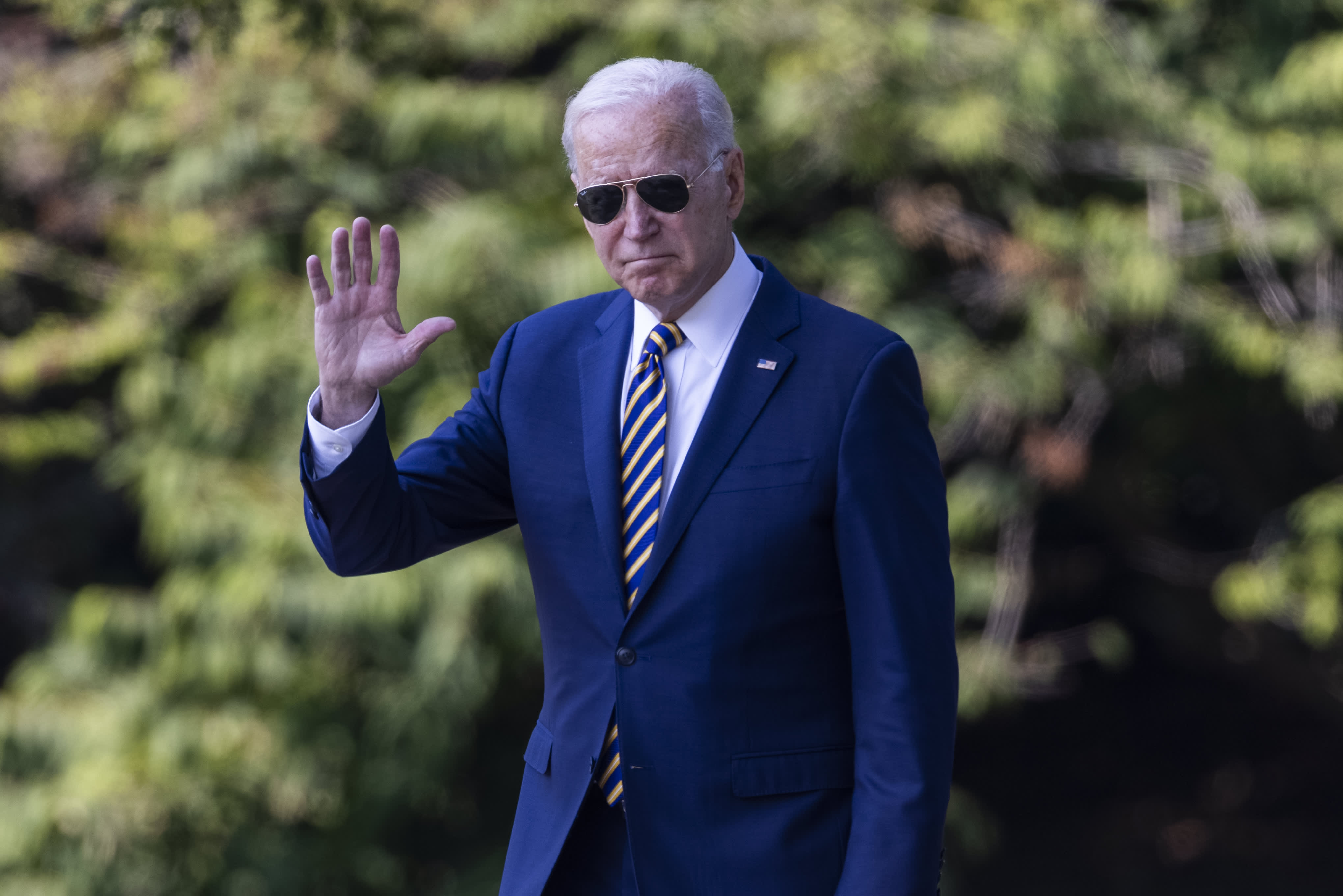

U.S. President Joe Biden walks on the South Lawn of the White House before boarding Marine One in Washington, D.C., U.S., on Wednesday, July 28, 2021.

Bloomberg | Bloomberg | Getty Images

WASHINGTON — The Treasury Department announced Thursday that it will expand tax credits to employers who give workers paid time off to get Covid-19 vaccines, to include time for workers to take family members to get vaccinated.

According to a release from the agency, “eligible employers can claim tax credits equal to the wages paid for providing paid time-off to employees to take a family or household member or certain other individuals to get vaccinated, or to care for a family or household member or certain other individuals recovering from the vaccination. Comparable tax credits are also available for self-employed individuals.”

The announcement builds upon a provision included in the Biden administration’s $1.9 trillion Covid-19 relief law known as the American Rescue Plan. The Internal Revenue Service and Treasury Department explained in April that that certain employers could qualify for the credit for providing time off for each employee receiving the vaccine and for any time needed to recover from the inoculation.

The ARP tax credits are available to small and midsized employers that pay sick and family leave for leave through Sept. 30, 2021.

The paid leave credits are tax credits against the employer’s share of the Medicare tax. The tax credits are refundable, which means that the employer is entitled to payment of the full amount of the credits if it exceeds the employer’s share of the Medicare tax.