Lomiko Metals releases PEA for La Loutre in Quebec

Initial capital costs were estimated at C$236.1 million, with C$37.7 million budgeted for sustaining capital over the mine life. The study estimated the after-tax net present value using an 8% discount rate at C$185.6 million, based on a graphite concentrate price of $916 per tonne, and an after-tax internal rate of return of 21.5%. Initial capex could be paid back in just over four years.

La Loutre “has shown it has the potential to become a highly profitable graphite mine in one of the most prolific producing regions in Canada”

Paul Gill, Lomiko CEO

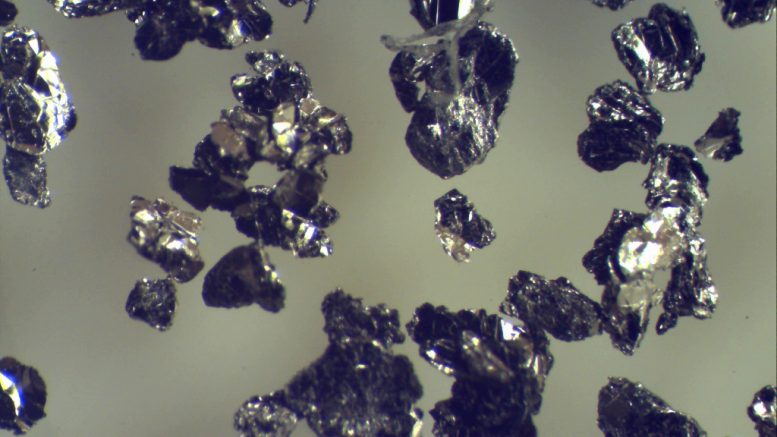

The early-stage study was based on 23.2 million measured and indicated tonnes grading 4.51% graphite for 1.04 million tonnes contained graphite and inferred resources of 46.8 million tonnes grading 4.01% graphite for 1.9 million tonnes of graphite.

La Loutre “has shown it has the potential to become a highly profitable graphite mine in one of the most prolific producing regions in Canada,” Paul Gill, Lomiko’s CEO said in a press release, adding that “with further drill programs, we will continue to add to and upgrade resources as we seek to move the project forward towards production.”

The 2,509-hectare project comprises two zones: the Electric Vehicle zone and Graphene-Battery zone. The names reflect the potential applications for the graphite from each zone, the company said.

The company says it aims to make La Loutre a cornerstone mine for its future growth in the province and, with the support of a strong treasury, plans to commence a preliminary feasibility study and environmental impact studies while continuing to explore the geological potential of the property.

Lomiko’s other asset in Quebec, Bourier, is about 450 km northeast of the town of Val-d’Or and could potentially provide a new source of lithium.

(This article first appeared in The Northern Miner)