Stay bullish and buy dips in the S&P 500 because it will keep grinding higher, says this strategist

The S&P 500 was set to start Monday lower, coming down from fresh records reached on Friday after a bumpy week of trading on Wall Street.

That grind higher should continue, with the blue-chip index heading for more highs ahead, according to financial newsletter The Kobeissi Letter in our call of the day.

Published by Adam Kobeissi, the newsletter noted that the latest record was reached after “not the most eventful” week in terms of fundamentals — “but a lack of developments is generally bullish in a market with sentiment as bullish as it is.”

There are some minor bearish factors facing the S&P 500 SPX,

Looking past this, “we have the Fed’s continued supportive measures and record levels of investor optimism fueling the push higher for the S&P 500 and we expect it to continue,” said Kobeissi.

The index is using short term pullbacks — even of just 1% or 2% — to trap new short positions and force them to cover their shorts, ultimately buying back into the rally, the strategist said.

“This is why the steady grind higher has been proliferated and we also expect this to continue, meaning dips are great opportunities to increase long exposure in this market,” said Kobeissi.

The index just about touched 4,370 points on Friday, and, from a technical perspective, the group of strategists believes this move has momentum to push to 4,400 points before the next short-term pullback occurs.

“We have shifted back to a bullish outlook for the S&P 500,” said the strategist. “We continue to believe that shorting this market is a dangerous game and dips are readily buyable in these conditions.”

The tweet

The buzz

Tesla TSLA,

ByteDance, the Chinese owner of popular social media video app TikTok, indefinitely put on hold its intention to list offshore, after it was warned about data security risks by government officials earlier this year, The Wall Street Journal reported. Chinese regulators have recently cracked down on U.S.-listed tech groups, like ride-hailing app Didi DIDI,

“Black Widow” enjoyed the best domestic opening weekend for a film since before the COVID-19 pandemic, Walt Disney DIS,

China will take “necessary measures” in response to the U.S. blacklisting of several Chinese companies over their alleged role in human rights abuses against Uyghurs and other Muslim minority groups. The U.S. Department of Commerce said on Friday that 14 companies added to its Entity List “enabled Beijing’s campaign of repression, mass detention, and high-technology surveillance” in the Xinjiang region.

Billionaire septuagenarian entrepreneur Richard Branson accelerated the tourism space race on Sunday, launching more than 53 miles above the New Mexico desert with five crewmates from his Virgin Galactic SPCE,

The markets

U.S. stock market futures YM00,

The chart

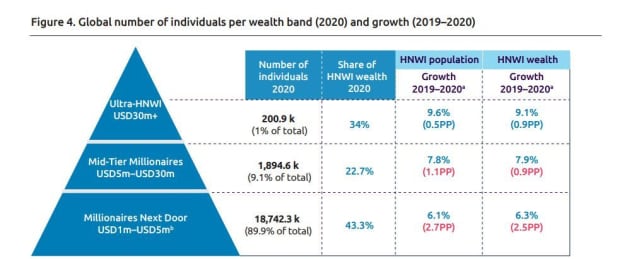

More than 200,000 people around the world have a net worth of more than $30 million, representing 1% of the population of millionaires but 34% of the group’s wealth, according to Capgemini’s World Wealth Report.

Our chart of the day, via Michael Batnick of the Irrelevant Investor financial blog, shows Capgemini’s dive into the millionaire cohort to look at the dynamics of wealth distribution within the rich.

Random reads

Mamma mia, Mario: An unopened copy of Nintendo’s 1996 “Super Mario 64” game sold at auction for $1.56 million. Talk about a diverse asset.

A woman in China deliberately ran 49 red lights in her ex-boyfriend’s car, racking up fines in revenge after he left her for another woman, according to a report.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.