The view from England: New research identifies gold for fools

Gold enthusiasts abound at the moment, citing it as an investment vehicle for the inflationary times ahead. Unfortunately for these gurus the precious metal’s attributes have not always been borne out historically. Admittedly, an ounce of gold in 1500 would have cost only £2, compared with £1,300 per oz. at the moment, but (measured in British pounds) gold has been a horrible investment for much of the past 500 years.

The purchasing power of gold suffered particularly badly in sterling during the 16th and 17th centuries. Between 1489 (when the Royal Mint issued the first Sovereign coin, fixing £1 at 0.5 oz.) and 1717 (when Isaac Newton fixed £1 at 0.235 oz.), gold’s nominal value more than doubled to £4.26 per ounce. During the intervening 228 years, however, the real (inflation adjusted) value had slumped from over £1,200/oz. (measured in current money) to barely £200 per ounce.

Much of the reason for this slump in purchasing power was the influx of gold to Europe from Spanish conquests across South America. One Englishman to benefit from the shipment of precious metal across the Atlantic was Sir Francis Drake (1540-1596), who is best remembered for robbing Spanish galleons. He was also, however, the first Englishman to see the Pacific Ocean (1573) and then sail across it as part of his circumnavigation of the globe (1577-1580).

Drake’s exploits against Spanish treasure ships made him a hero to the English, and Queen Elizabeth I’s half-share of the cargo in 1580 surpassed the rest of the crown’s income for that entire year. Unsurprisingly, he was considered a pirate by the Spanish, who put a price of 20,000 ducats on his head (worth over $4 million in current dollars). This Venetian ‘Duke’s Coin’, introduced in 1284, contained 3.55 grams of 99.5% pure gold, and was the world’s most popular coin for five centuries.

In the new research, it has been discovered that there is a third, previously unrecognised, way that gold can occur

During the 18th and 19th centuries, and most of the 20th, gold maintained a stable real price (from a British perspective), trading at around £300/oz. in current money. It is only during the relatively recent past (since the U.S. came off the gold standard in 1973) that gold has been more than just a store of wealth, and outpaced inflation.

The higher valuation of gold in the past 50 years makes more exploitable the discovery of a new kind of ‘invisible’ gold in the mineral pyrite (FeS2). The research, led by Denis Fougerouse (a research fellow at the School of Earth and Planetary Sciences at Curtin University in Perth), was peer reviewed by The Geological Society of America and published on June 24 in the Geology publication of GeoScienceWorld.

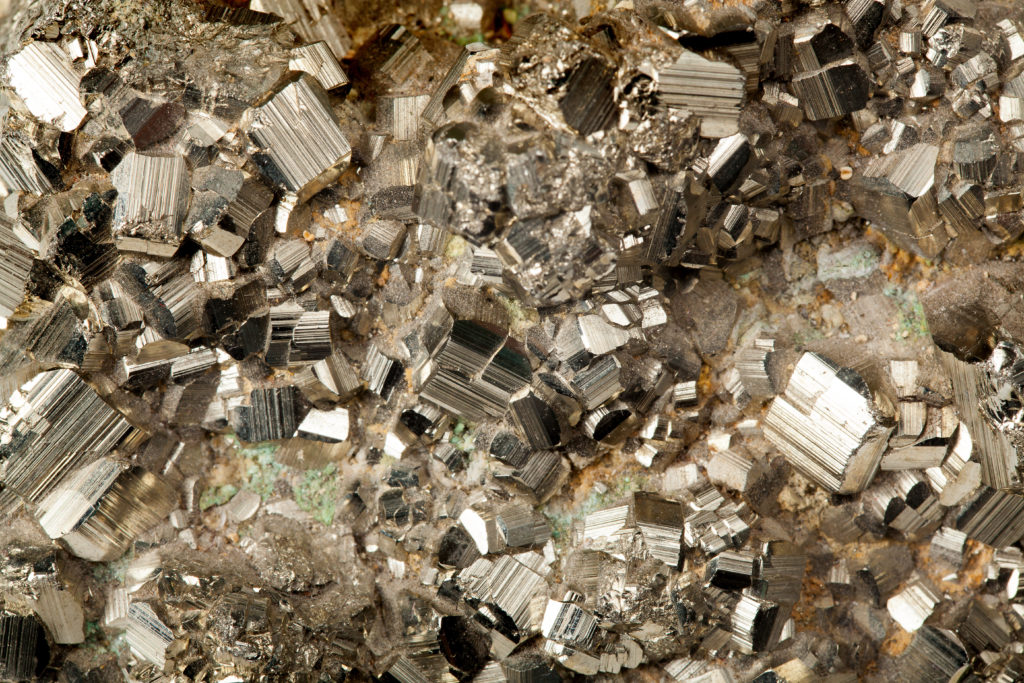

Fougerouse has presented an overview of the findings through Australia’s independent online publisher ScienceAlert. He noted that pyrite was historically nicknamed Fool’s Gold because of its deceptive resemblance to the precious metal. Ironically, pyrite crystals can contain small amounts of real gold, although it is notoriously hard to extract.

In the 1980s, researchers discovered that the gold in pyrite came in different forms — either as discrete metallic nanoparticles or structurally bound in the crystal lattice as a finely mixed sulphide-gold alloy.

In the new research, it has been discovered that there is a third, previously unrecognised, way that gold can occur. Fougerouse explained that gold has now been identified in nanoscale dislocations, and this represents “a new style of invisible gold.” When the pyrite crystal is forming under extreme temperature or pressure, it can develop tiny imperfections in its crystal structure that can be ‘decorated’ with gold atoms.

This research provides an insight into how mineral deposits form, and may also help miners more efficiently extract gold from pyrite. Dislocation sites within crystals could potentially offer an enhanced partial leaching, or a target for bacteria to attack and break down the crystal, releasing the gold in a bio-leaching process. This would potentially reduce the energy consumption necessary for extraction.

Moreover, the researchers claim that accurate quantification of the invisible-gold deformation microstructures could lead to “processing options tailored to highly deformed gold deposits in polymetamorphic terranes commonly hosting orogenic-type gold deposits.”

Fougerouse argues that although these ideas are untested, they “definitely merit investigation.” He concludes; “If it helps pave the way for more sustainable gold-mining methods, then perhaps Fool’s Gold isn’t so foolish after all.” I am sure this is true, but it’s not as evocative imagining Sir Francis stalking Spanish ships for a cargo of pyrite.

Dr. Chris Hinde is a mining engineer and the director of Pick and Pen Ltd., a U.K.-based consulting firm he set up in 2018 specializing in mining industry trends. He previously worked for S&P Global Market Intelligence’s Metals and Mining division.

(This article first appeared in The Northern Miner)