U.S. Stock Futures Fluctuate; OPEC+ Spat Spurs Oil: Markets Wrap

(Bloomberg) — U.S. equity-index futures struggled for direction, and crude oil traded above $75 per barrel, as investors weighed the potential for a more hawkish tilt at the Federal Reserve and OPEC+ tensions over oil production.

Contracts on the S&P 500 Index slipped after the benchmark index notched up another record on Friday. West Texas Intermediate crude rose for a fourth time in five days as the United Arab Emirates held out against an extension of output increase by the OPEC+ alliance. European stocks swung between gains and losses amid concern over Covid risks to the economy.

The U.S. jobs report Friday signaled the economy is gaining steam but not at a pace that would prompt the central bank to taper stimulus quickly. Fed watchers awaited June meeting minutes due Wednesday to gauge how far divisions among members have widened on the tapering time line. U.S. stock and bond markets remain closed for the July 4 Independence Day holiday.

“Today’s public holiday suggests trading will be quiet, although the Fed story will very much re-emerge on Wednesday evening when investors pore through the minutes of the pivotal June 16th FOMC meeting,” ING Groep strategists including Chris Turner wrote in a note. “Before then, we expect much focus on the commodity complex.”

Oil continued its inflationary surge above $75 a barrel with the bitter spat between Saudi Arabia and the UAE leaving the global economy guessing how much oil it will get next month. It has forced OPEC+ to halt talks twice already, with the next meeting scheduled for Monday.

While the jobs report eased concerns about the Fed’s hawkish pivot last month, central banks around the world are beginning to pull back from from the emergency stimulus they deployed to fight the pandemic-driven global recession. For instance, the Reserve Bank of Australia is expected to pare back some stimulus at its Tuesday meeting despite ongoing curbs against a recent Covid-19 flareup.

Meanwhile, a gauge of China’s services industry slowed sharply in June following virus outbreaks in some parts of the country and weaker new orders. The survey shows a deeper downturn in services than the official non-manufacturing gauge released last week.

Shares in British retailer Wm Morrison Supermarkets Plc jumped 11% to the highest price since 2018 as a takeover battle intensified. Investors will watch Didi Global Inc. when U.S. markets reopen after China expanded a cybersecurity probe.

Here are some events to watch this week:

Reserve Bank of Australia policy decision TuesdayFOMC minutes WednesdayThe Group of 20 finance ministers and central bankers meet in Venice on FridayChina PPI and CPI data released on Friday

These are some of the main moves in markets:

Stocks

The Stoxx Europe 600 was little changed as of 10:48 a.m. London timeFutures on the Nasdaq 100 fell 0.1%Futures on the Dow Jones Industrial Average were little changedThe MSCI Asia Pacific Index rose 0.1%The MSCI Emerging Markets Index was little changed

Currencies

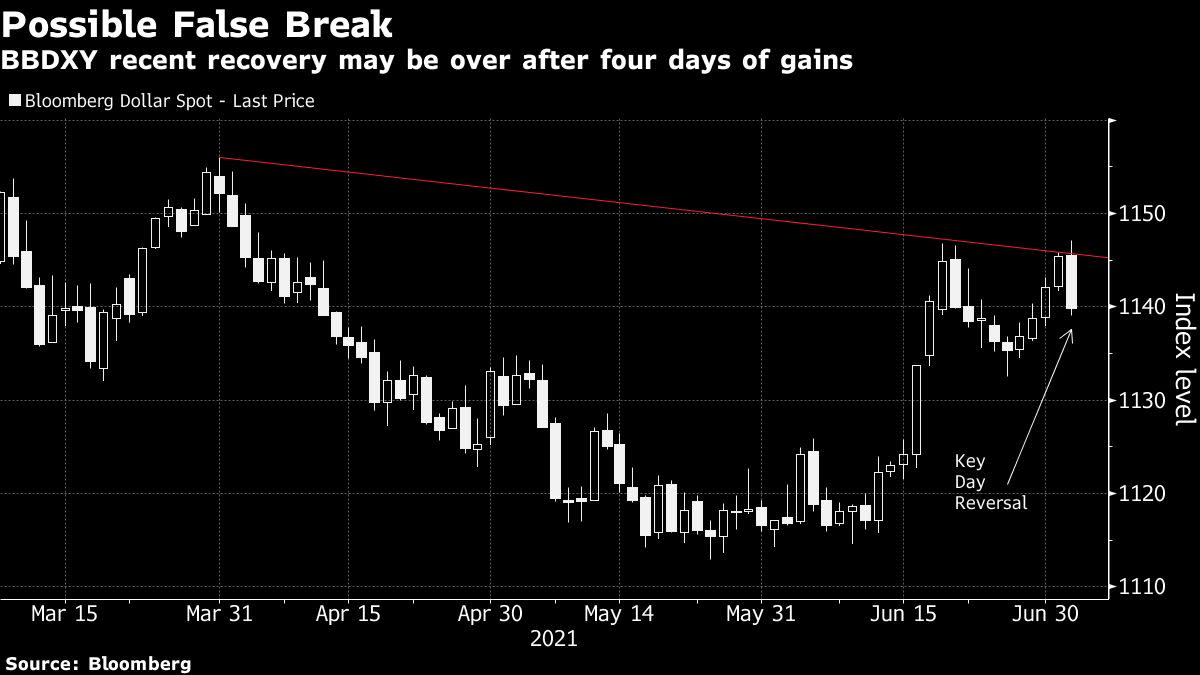

The Bloomberg Dollar Spot Index was little changedThe euro rose 0.1% to $1.1878The Japanese yen rose 0.2% to 110.83 per dollarThe offshore yuan rose 0.1% to 6.4627 per dollarThe British pound rose 0.2% to $1.3858

Bonds

Germany’s 10-year yield advanced one basis point to -0.22%Britain’s 10-year yield advanced two basis points to 0.72%

Commodities

Brent crude rose 0.4% to $76.47 a barrelWest Texas Intermediate climbed 0.3% to $75.45Spot gold rose 0.3% to $1,792.38 an ounce

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.