Mining

120-year chart shows commodities have never been this undervalued

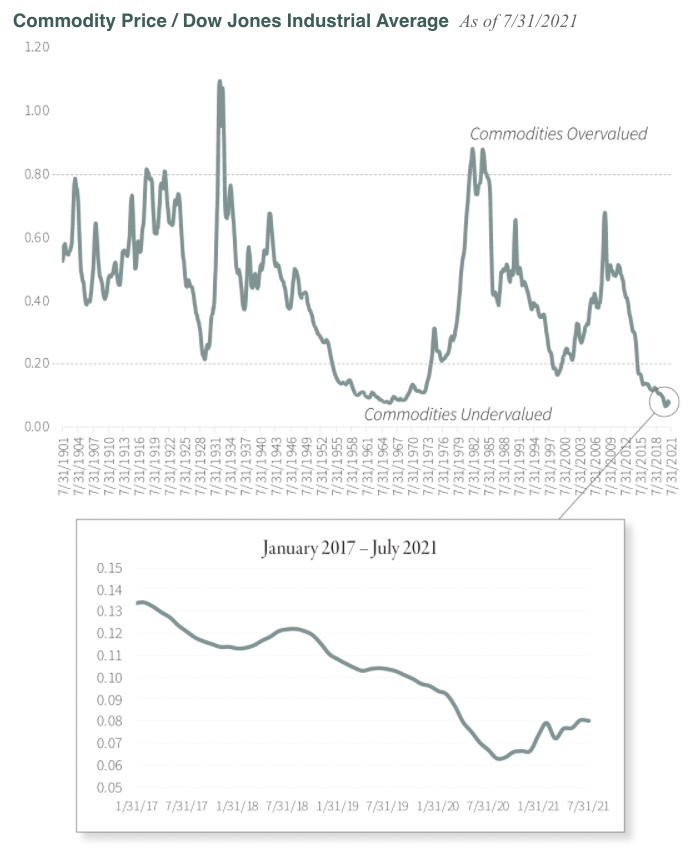

Despite the uptick in metals and mineral prices over the past year, there is still a yawning gap and “real assets have never been as undervalued relative to financial assets,” according to the authors.

The chart shows other major bottoms occurred in 1929, 1969, and 1999 and like those cycle nadirs present an “excellent time to establish real asset positions,” according to G&R:

“Prior catalysts have all been monetary related. This time likely as well.”

In May, G&R made the case for a $30,000 copper price as supply comes under pressure from depletion at the world’s major mines. G&R’s latest research is headlined: The IEA Ushers in the Coming Oil Crisis