August is among the worst months of year for the stock market. Here’s how to play it.

On Wall Street, August is off to a solid start, but the month tends to accompany a bout of turbulence in equity markets.

The month is associated with the worst performances for the Dow Jones Industrial Average DJIA,

The research outfit said that from 1988 to 2020 average declines for the benchmarks ranged from 0.4% for the Russell 2000 to 0.8% by Dow. For the Nasdaq Composite, meanwhile, August ranks as second-worst, with an average gain of 0.2% over the same period, with September being the worst month for the technology-heavy index.

To be sure, a year ago, in the midst of the COVID-19 pandemic, August produced stellar returns across the board as investors bet on an eventual rebound in pandemic-plagued markets.

However, last year’s uncharacteristically strong performance, which saw monthly gains of over 9% for the Nasdaq Composite and over 7% for the Dow and S&P 500, doesn’t mean the long-term trend has changed.

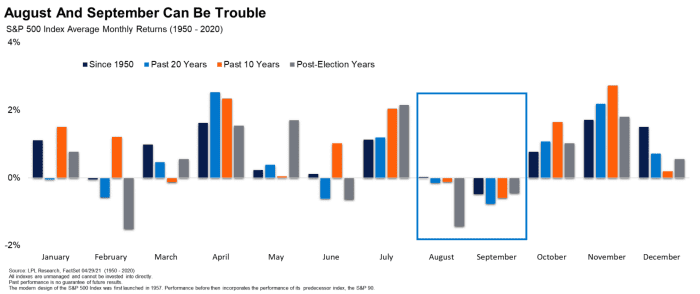

“As shown in the LPL Chart of the Day, August and September have been historically two of the weakest months of the year,” wrote Ryan Detrick, chief market strategist for LPL Financial, in a Monday research note.

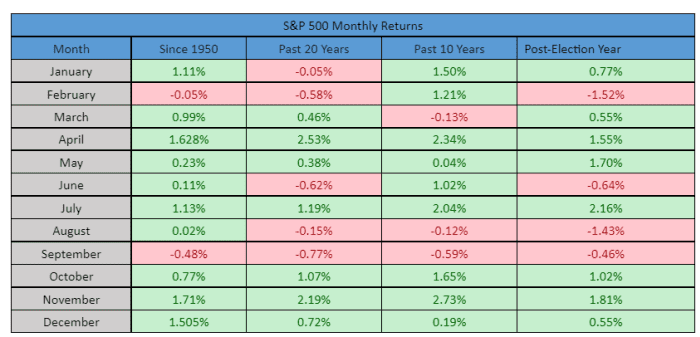

Check out the monthly returns on average since 1950:

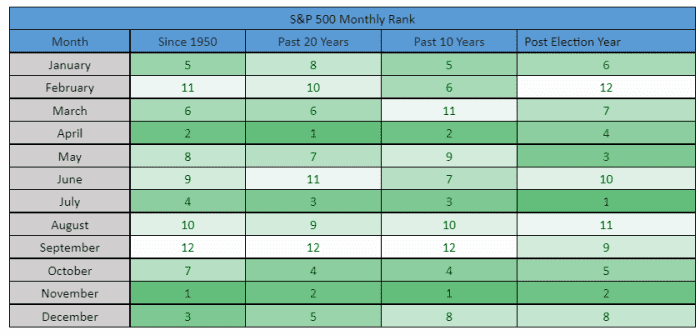

Here are the historical rankings by month via LPL:

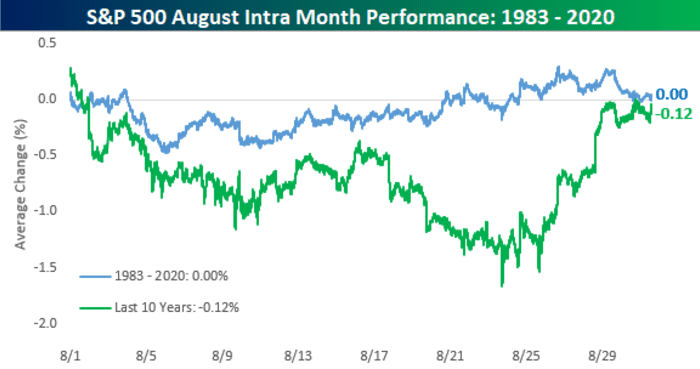

The folks at Bespoke Investment Group put a finer point on the underperformance for August, especially after a strong year-to-date performance, as has been enjoyed in 2021.

“Since 1983, the weakest August returns tend to come in years where the S&P 500 was up over 10% YTD heading into the month,” the researchers note.

The markets performance thus far has come on the back of stellar earnings results as American corporations rebound from COVID-19, but there are lingering fears that the U.S. has reached or is near peak earnings and economic growth.

Read: Get ready for peak earnings growth as second-quarter results kick off this week

So how to play the turbulent stretch?

Jeff Hirsch, editor of the Stock Trader’s Almanac, said that the first nine trading days of August tend to be the most prone to weakness while the rest of the month is better. That said, he warns that the expirations of futures and options contracts toward the end of the month tend to create a fresh bout of chop in August, heading toward September, another rough patch for stocks.

“The end of August tends to be weaker when traders evacuate Wall Street for the summer finale,” Hirsch wrote.

“Expiration week is down more than half the time since 1990, with some sizable losses,” he said.

Stock Trader’s Almanac indicated that bullishness prevails in the market, however. “Bullish forces continue to persist. The Fed remains easy and accommodative. More fiscal stimulus is likely from Washington as Congress nears finalizing the deals on infrastructure and spending,” the data company wrote. But it cautioned that outperforming second-quarter earnings and the spread of the Delta variant of COVID-19 “is a concern and poses a threat to the bull and the economic expansion.”

“Political wrangling here in the States and geopolitical machinations around world could also knock the market off course momentarily,” Stock Trader’s Almanac wrote, while noting that its outlook for the S&P 500 sees a push to the 4500-4600 range or even higher.

Strategists continue to recommend investment prudence, especially with the benchmark 10-year Treasury yields TMUBMUSD10Y,

Bespoke Investment Group also points to a strong 2021, even if the next two months are a bit bumpy, noting that that final stretch of the year tends to be strong when the months leading up to August also have been healthy.

“While the average and median returns for August may be lackluster, the final four months of the year have seen an average gain of 5.94% (median: 8.03%) with gains 12 out of 14 times (85%). That’s pretty consistent,” the analysts wrote.