Clorox Plunges Most Since 2000 as Pandemic Boom Fades Away

(Bloomberg) — Clorox Co. plummeted the most in more than two decades after forecasting a decline in sales, casting doubt on Chief Executive Officer Linda Rendle’s all-in gamble that the maker of disinfecting wipes and bleach would hang on to the pandemic-driven customers it picked up over the last year.

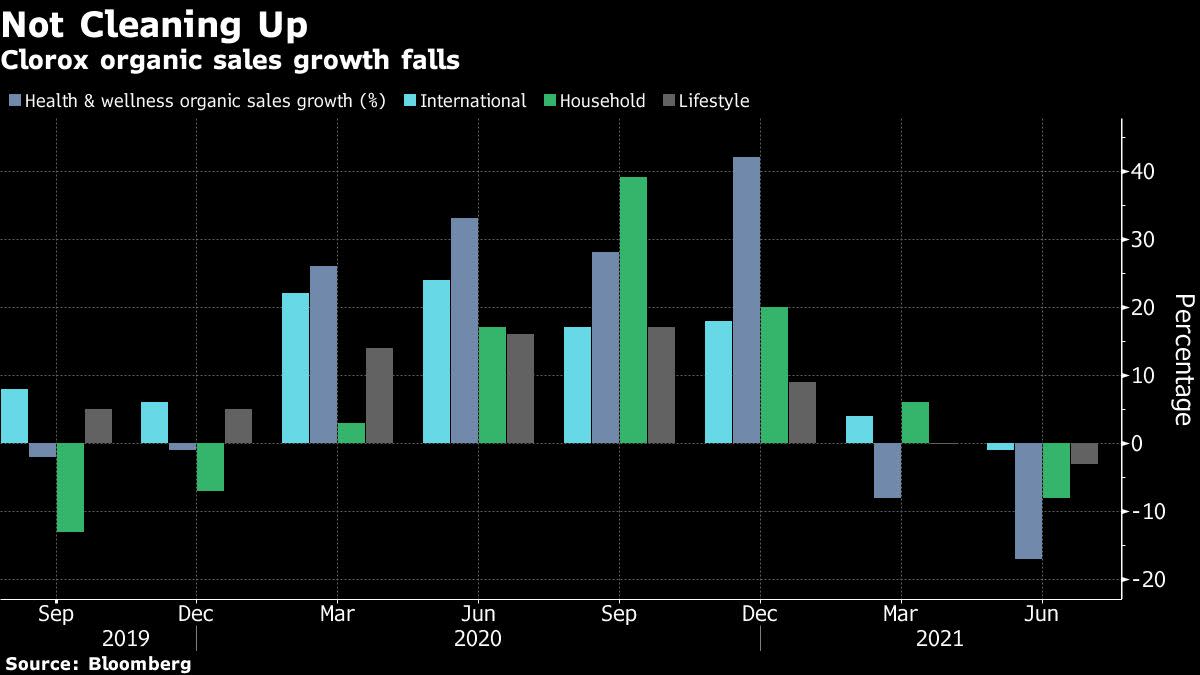

The company, which also sells Glad trash bags and Kingsford charcoal, posted sales of $1.8 billion in its fiscal fourth quarter, below the lowest analyst estimate. Clorox expects organic sales, which strip out items like currency swings and acquisitions, to decline by 2% to 6% in the current fiscal year, with “uncertain” consumer demand playing a central role in the expected performance.

The stock fell 10% at 11:57 a.m. in New York on Tuesday and was down as much as 12% earlier, the biggest drop since 2000. The shares had already declined 10% in 2021 through Monday’s close.

Clorox’s tone represents a dramatic shift from Rendle’s March comment that consumers’ behavior would be “sticky,” a belief that led the company to boost its production capacity for wipes. In Tuesday’s report, the company said falling sales “were due primarily to the deceleration of shipments from peak levels during the Covid-19 pandemic” and a faster-than-expected slowdown in the health and wellness segment, which includes cleaning products. That slowdown was accompanied by a surge in costs for freight and raw materials.

“The company is confronting generational inflation and unpredictable demand for its products,” Wells Fargo analyst Chris Carey said in a research note. “This creates a need to be conservative around guidance and we think CLX is setting an outlook it believes it can hit.” However, that outlook was well below Wall Street expectations, Carey said.

Clorox’s guidance is a warning to investors about the bumpy road ahead for consumer-products companies that enjoyed a boom during the onset of the pandemic. Organic sales dropped 10% in the three months ended June 30.

Clorox reported sales decreases in all but one segment. The largest decline was 17% at the health and wellness unit. Household products, which include trash bags, charcoal and cat litter, also fell by 8%, with the company citing “moderating consumer demand.” In the lifestyle segment, which includes Hidden Valley salad dressing and Brita water filters, revenue dropped 3% on the same trend.

What Bloomberg Intelligence Says

“Clorox’s 4Q total revenue miss shows that new CEO Linda Rendle needs to urgently address the balance of investment in effective innovation and advertising costs vs. the current inability to retain U.S. household penetration that was built up through the pandemic.”

— Mike Dennis, testing and home-care analyst

Click here to read the research.

Profitability was eroded by “higher manufacturing and logistics costs and lower sales” — illustrating the challenge of rising inflation, which has sparked companies to push through round of higher prices in recent months. Clorox’s gross margin dropped to 37.1%, its narrowest in more than a decade.

In response, Chief Financial Officer Kevin Jacobsen said Clorox is “prioritizing strong execution of the plans we have in place to rebuild our margins,” which includes price increases in “key areas.”

Clorox’s results stand in contrast with those of Procter & Gamble Co., which last week warned investors of $1.9 billion in higher commodity and transportation costs in its fiscal-year guidance. However, while P&G sees sales growth cooling over the next 12 months, the company is emerging from the extraordinary pandemic period in a stronger position.

(Updates with shares in third paragraph, additional details.)

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.