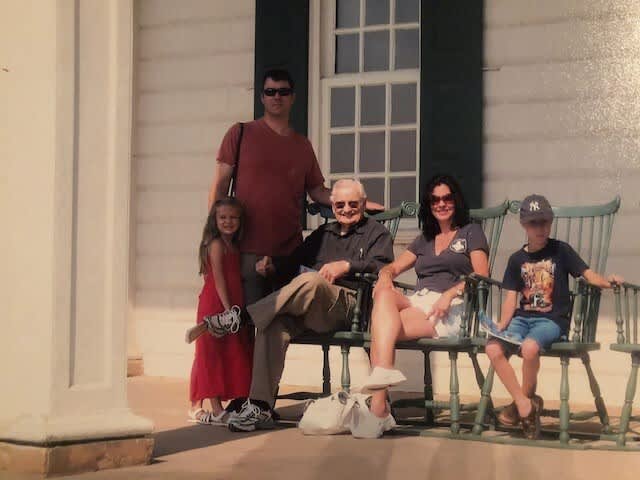

Michele Treacy and family with her late father Col. Lester Marlon Romine

Courtesy of: Michele Treacy

Michele Treacy lost her father at the beginning of the pandemic. However, a delayed tax refund has prolonged the grief she and her family are feeling and prevented them from finding closure.

Treacy’s father, Col. Lester Romine, 91, passed away at the beginning of March 2020. As he’d named Treacy, 57, his executor, she filed his paper tax return on time in July 2020.

She and her three siblings were eager to receive his $2,300 federal refund to finalize and close his estate, yet Treacy is still working with their attorney over a year later.

“I promised my dad before he died that I would take care of this for him,” said Treacy, who lives in Kinnelon, New Jersey. “I’m trying to honor his legacy and my promise to him.”

More from Personal Finance:

Your tax return preparer may not be regulated. How Congress may change that

Tax refunds and stimulus checks delayed by identity fraud crossfire

Some parents still confused about how monthly child tax credit payments work

Treacy’s family is one of the millions with delayed tax refunds this year.

By the end of the 2021 tax filing season, the IRS had processed 135.8 million returns, down from 145.5 million the previous year, according to Taxpayer Advocate Service, an independent office within the IRS.

Some of the backlog has been caused by the high volume of returns with stimulus payments and other credits needing manual review, Taxpayer Advocate Service reported.

But there were still 10.1 million unprocessed individual returns as of Aug. 20, according to the IRS. The agency’s website said returns requiring “special handling” by an employee may take up to 120 days to process.

“It’s been very frustrating for our clients,” said Larry Harris, a certified financial planner and director of tax services at Parsec Financial in Asheville, North Carolina.

These snags are common when there’s a final tax return with a refund, he said.

While final returns for those who’ve died may follow the same process as those for living taxpayers, Harris said there’s an extra step when a deceased taxpayer has a refund. That’s because these returns include Form 1310, which must be paper-filed, causing further lags.

“These situations create a lot of angst for clients when they’re waiting for the refund to close out the estate,” Harris added.

Although many IRS offices were closed due to Covid-19, Treacy called about once per month. She received little information, however, about her father’s pending refund and eventually filed a grievance with Taxpayer Advocate Service.

Still, there were no updates, even after checking the status through the Where’s My Refund tool.

With millions of overdue refunds, usage for the IRS tool spiked to more than 483 million through May 2021, according to Taxpayer Advocate Service’s mid-year report. However, many taxpayers couldn’t get updates on when to expect their refund or what was causing the delay.

I think it’s fair to say it’s a crisis that really needs some attention.

Larry Harris

Director of tax services at Parsec Financial

Moreover, the IRS received a record number of phone calls — more than 167 million during the 2021 filing season — and only 7% of taxpayers reached an agent, according to the same report.

“I think it’s fair to say it’s a crisis that really needs some attention,” Harris said.

The IRS did not immediately respond to a request for comment.

Since 2010, IRS funding has been slashed by 19%, according to the Center on Budget and Policy Priorities.

The agency lost more than 33,378 full-time workers between 2010 and 2020, according to its 2020 fiscal year report, and although it has boosted the workforce since 2019, staffing has remained below 2010 levels.

President Joe Biden called for $80 billion in IRS funding over the next decade to combat tax evasion. However, the Senate dropped a proposal for $40 billion from the infrastructure bill after pushback from Republicans.

Although the Senate’s budget solution framework mentions an offset of “IRS tax enforcement,” it’s unclear whether lawmakers will sign off on the billions of funding Biden proposed.

Finding closure

After tapping her personal accountant for guidance, Treacy finally learned her father’s refund was flagged for fraud due to identity theft concerns.

It’s a common issue for estates, said Mary Kay Foss, certified public accountant and CPA faculty at CalCPA Education Foundation in Walnut Creek, California.

“With an estate, [the IRS] can’t talk to the deceased person,” she said. “And so when they’re dealing with a third party, they’ve been very cautious it seems.”

Although Treacy had filed the necessary forms, such as her father’s death certificate, trust and more, she needed to visit her local Taxpayer Assistance Center to resubmit paperwork, verify her identity and prove she is the executor.

Two weeks after her second visit, Treacy was elated to receive the $2,300 refund check by mail.

“I guess the three hours I spent at the taxpayer assistance office helped,” Treacy said in an email.

With the refund in hand, she said she has finally reached the final step in the process: working with an attorney to close her father’s estate.

One of the issues with prolonged estate closings is the deceased’s assets may generate income. If the estate earns above a certain threshold, the family may need to file another tax return, said Foss.

Since the IRS pays interest on tardy refunds, it may bump some estates above the threshold, depending on the size of the return.

However, Treacy has spoken to her attorney and believes the interest from her father’s return may be below the minimum.

“It’s kind of like that last nagging bit of 2020,” Treacy said. “I think once we get this done, we can put that in the rearview mirror once and for all.”

With so much loss during the pandemic, she worries other families may be facing similar challenges but urges them not to give up.

“The squeaky wheel gets the grease,” she said. “Call once a week to ask where your refund is and follow up on any requests for needed forms or identification in a timely manner.”