Morgan Stanley’s Slimmon Says Buy Reopening Before Too Late

(Bloomberg) — When clients call Andrew Slimmon for advice on how to position their portfolios given the rapid spread of the delta variant, he tells them in no uncertain terms:

Prepare for an economic recovery, and soon.

Slimmon, who oversees about $7.5 billion at Morgan Stanley Investment Management, says it’s not unusual to see economic hiccups this time of year. Going forward, “people will turn a little bit more optimistic,” which bodes well for equities that have sold off due to Covid-related worries. Rates could bottom in the coming months and recover in the fourth quarter as well, he added.

“The opportunity set is in those stocks that got hit the most, namely the cyclical stocks, the energy stocks, the reopening stocks — those are the ones that are down the most,” he said in an interview.

Slimmon is scooping up shares of casino, cruise ship, restaurant and theater companies. He’s also partial to retail real estate investment trusts that have been hit hard amid fears consumers will once again avoid stores and malls like they did during the depths of the coronavirus outbreak.

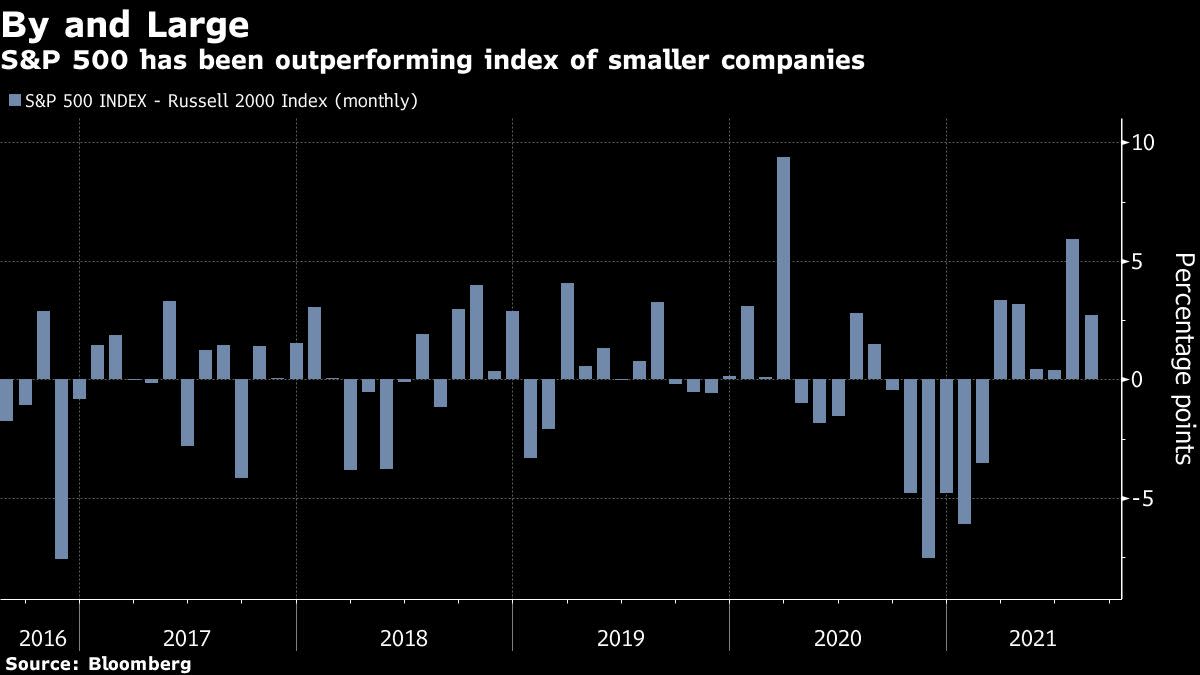

His advice runs counter to recent market sentiment as investors pile into defensive plays. Growth stocks — like the tech shares that outperformed their market indexes during the pandemic — are on pace to beat their cheaper value counterparts for the third month in a row, while small-cap equities have slid roughly 6% since hitting a high in mid-March.

Meanwhile, an equal-weighted version of the S&P 500 Index, wherein megacap hegemony is reduced, has lagged the cap-weighted index by more than four percentage points since mid-May.

The dynamic was on display Monday, when the Nasdaq 100 gained 1.5%, the most since early June when the delta variant started spreading. The Russell 2000 gained 1.9%, after one of its members surged 189% when Pfizer Inc. agreed to buy it.

Slimmon notes that the market is forward-looking, and investors shouldn’t keep chasing defensive stocks such as utilities, or technology shares that are near record highs.

“That’s not where the opportunity is right now,” he said. Rather, he’s looking at companies that are off 20% to 30% from their peaks earlier this year.

“I would not be selling on Covid worries — that’s already happened. What you have to think about is will we get through this? Will we have a better fourth quarter, which is historically what happens?” Slimmon said from Chicago. “Someone that says to you in the fourth quarter, ‘Well, I’m optimistic because the Covid variant’s behind us’ — my response would be, ‘Well then you should have been buying those stocks in August, not in October.’”

The senior portfolio manager has the track record to back up his reopening call: His U.S. Core Portfolio is beating 94% of its peers this year and is topping the S&P 500’s gain, Bloomberg data show.

Slimmon is also noticing big differences in investor behavior compared with last year. In mid-2020, clients who’d booked significant gains were calling him to ask about whether another Covid wave could derail the market’s recovery. That’s one of the reasons behind the volatility seen this time last year.

This go-around, those conversations are very different.

“The call we’re getting is, ‘When is a pullback coming? I have too much cash on the sidelines, I’m looking to invest into a good opportunity,’” he said. “This is one of the reasons why I don’t think we’re getting much of a pullback.”

(Updates with Slimmon’s portfolio performance in 2021 in 11th paragraph)

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.