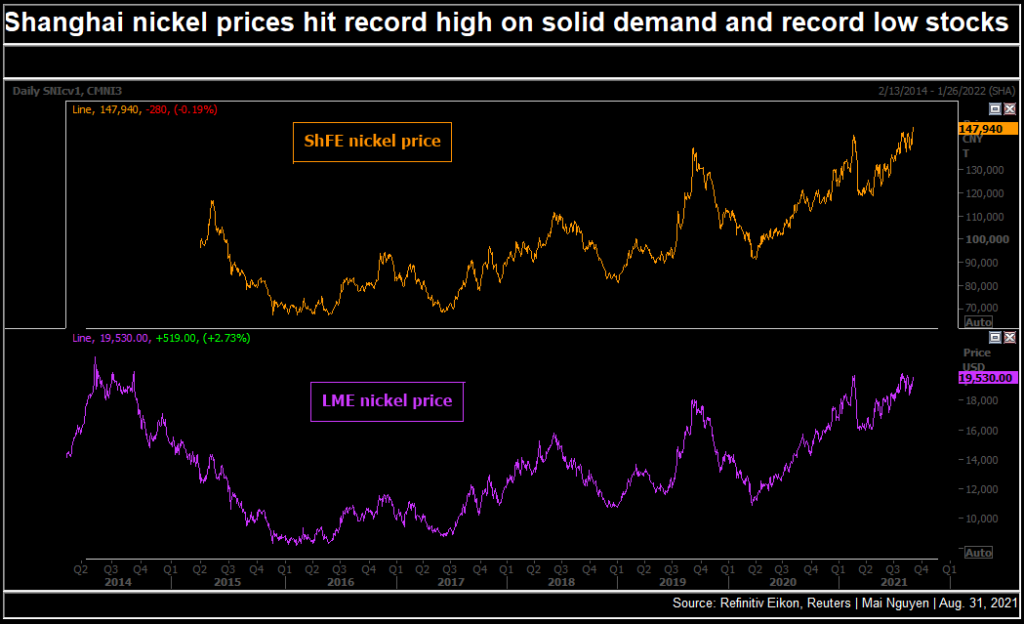

Nickel price soars to record in Shanghai on strong demand, low stocks

[Click here for an interactive chart of nickel prices]

“Orders for stainless (steel) product extend to the end of the year, primarily due to the strong post-lockdown rebound in demand and covid-19 related disruption to distribution. Shipping delays have forced consumers to post orders well ahead of need,” Andrew Mitchell, head of nickel research at Wood Mackenzie, told Reuters.

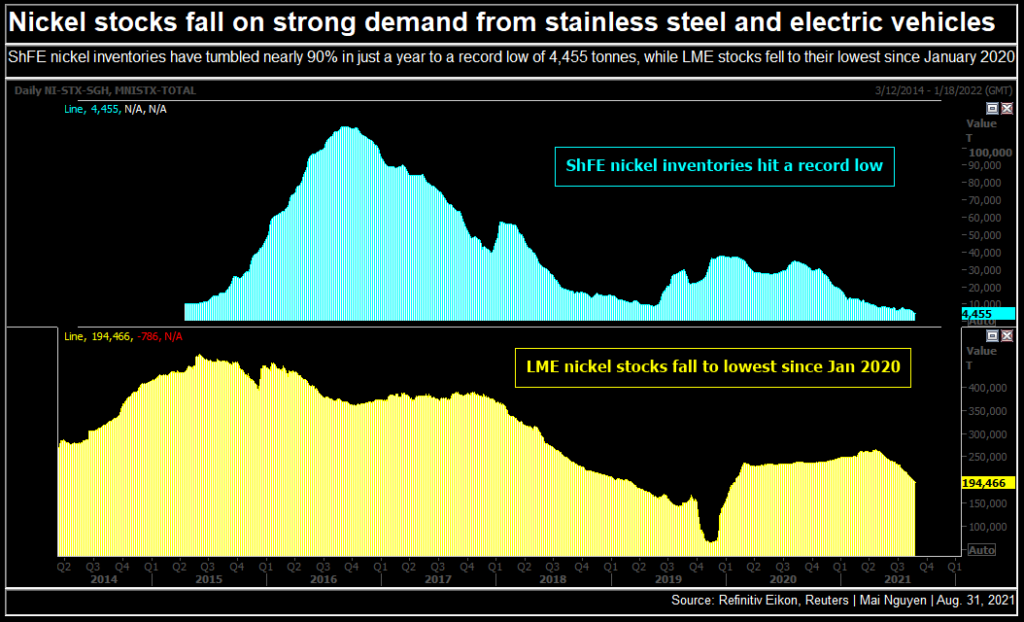

“At the same time expansion of the electric vehicle (EV) fleet is supporting a near doubling of nickel precursor chemical production in China,” said Mitchell, adding that global nickel demand is seen rising by almost 18% in 2021 from last year. Stainless steel and EV batteries are the top nickel consuming sectors.

On the supply side, refined nickel inventories in ShFE warehouses hit a record low of 4,455 tonnes, down 89% from a year earlier. Stockpiles in LME warehouses, too, fell to their lowest since January 2020 at 194,466 tonnes.

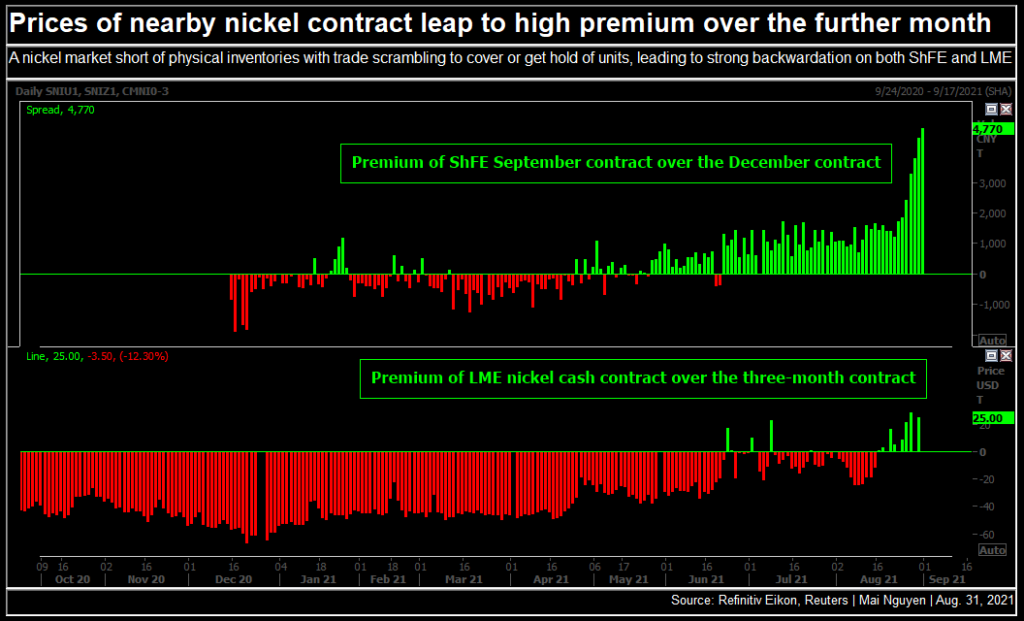

According to a China-based nickel trader, the high Tuesday prices were partly due to a short squeeze in the market.

“Here is a market short of physical with trade scrambling to cover or get hold of units and which also exhibits a positioning short by our estimate,” Alastair Munro of Marex Spectron said in a note.

However, nickel might face pressure for the rest of the year due to calls to trim stainless steel output in China on excess supply and power rationing at a time when macroeconomic data is subdued, Wood Mackenzie’s Mitchell said.

A wave of automotive cutbacks due to semiconductor chip shortages is likely to reduce nickel demand in the fourth quarter and extend into 2022, he added.

Wood Mackenzie forecast LME nickel prices to fall to $18,000 a tonne on average in the fourth quarter, from $19,050 in July-September, with an average just over $18,000 for the whole of 2021.

(With files from Reuters)