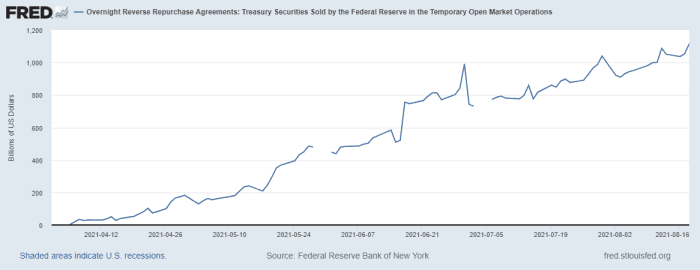

Overnight demand for Fed facility hits record $1.12 trillion Wednesday

Demand for the Federal Reserve’s reverse repurchase program hit a new high on Wednesday as banks, money-market funds and other financial players parked some $1.12 trillion in the facility overnight.

With low- and negative-yielding rates across the globe, demand for the facility has skyrocketed since April as financial players have sought havens to park cash and low-risk assets, without eroding their value.

Trillions of dollars’ worth of pandemic aid has rolled out in the U.S. to help bolster households and communities, but also to rekindle the economy by keeping credit conditions loose.

“Almost all the cash disbursed over the last three stimulus rounds, and then the money people aren’t spending, are all sitting on the sidelines,” said Jim Vogel, an FHN Financial fixed-income strategist.

“And as everyone has cash, and as we get deeper into the debt-ceiling-limit talks, the prospect of more Treasury bills is more distant,” Vogel told MarketWatch in a phone interview.

Read: Can Democrats raise the debt ceiling alone and avert a market meltdown?

Large-scale asset purchases by the Federal Reserve and other central banks during the pandemic have been blamed for tamping down bond yields and draining supply of Treasurys from markets.

Germany’s 10-year government bond yield TMBMKDE-10Y,

The Fed’s overnight repo facility has emerged as a powerful tool for the central bank to keep a grip on short-term rates.

“The story is less about how much money is at the Fed, than where rates would be if the Fed hadn’t opened this program,” Vogel said. “We might have negative T-bills if we didn’t have this program. We might have lower 2-year Treasury yields TMUBMUSD02Y,

To that end, the Fed’s overnight repurchase facility began paying a rate of 0.05% in June on assets, up from 0% previously, as part its broader strategy.

That’s when demand for the facility really took off.

Fed facility sees demand soar

Federal Reserve Bank of New York

Pressure on U.S. stocks over the past few days also might be playing a role in the increased demand for the Fed’s facility of late, said Glenn Havlicek, chief executive and co-founder of GLMX, which provides technology to repo trading desks.

“Even with relatively small changes in the market, liquidity is having to find a home right now,” Havlicek said, in a phone interview. “It’s no surprise to see this kind of demand.”

Stocks closed lower for a second straight day Wednesday, with the Dow Jones Industrial Average DJIA,

Read: ‘Most’ top Fed officials backed taper to start this year, minutes of July meeting show

The minutes also pointed to the more-than-$200 billion jump in demand for the Fed’s reverse repo program after its June rate increase for the facility.

“Government money-market funds also increased their participation in the facility amid a continued decline in Treasury bills outstanding and downward pressure on overnight rates,” the minutes said.