Square’s Afterpay acquisition proves Jamie Dimon is right to fear ‘increasingly smaller role’ of Wall Street

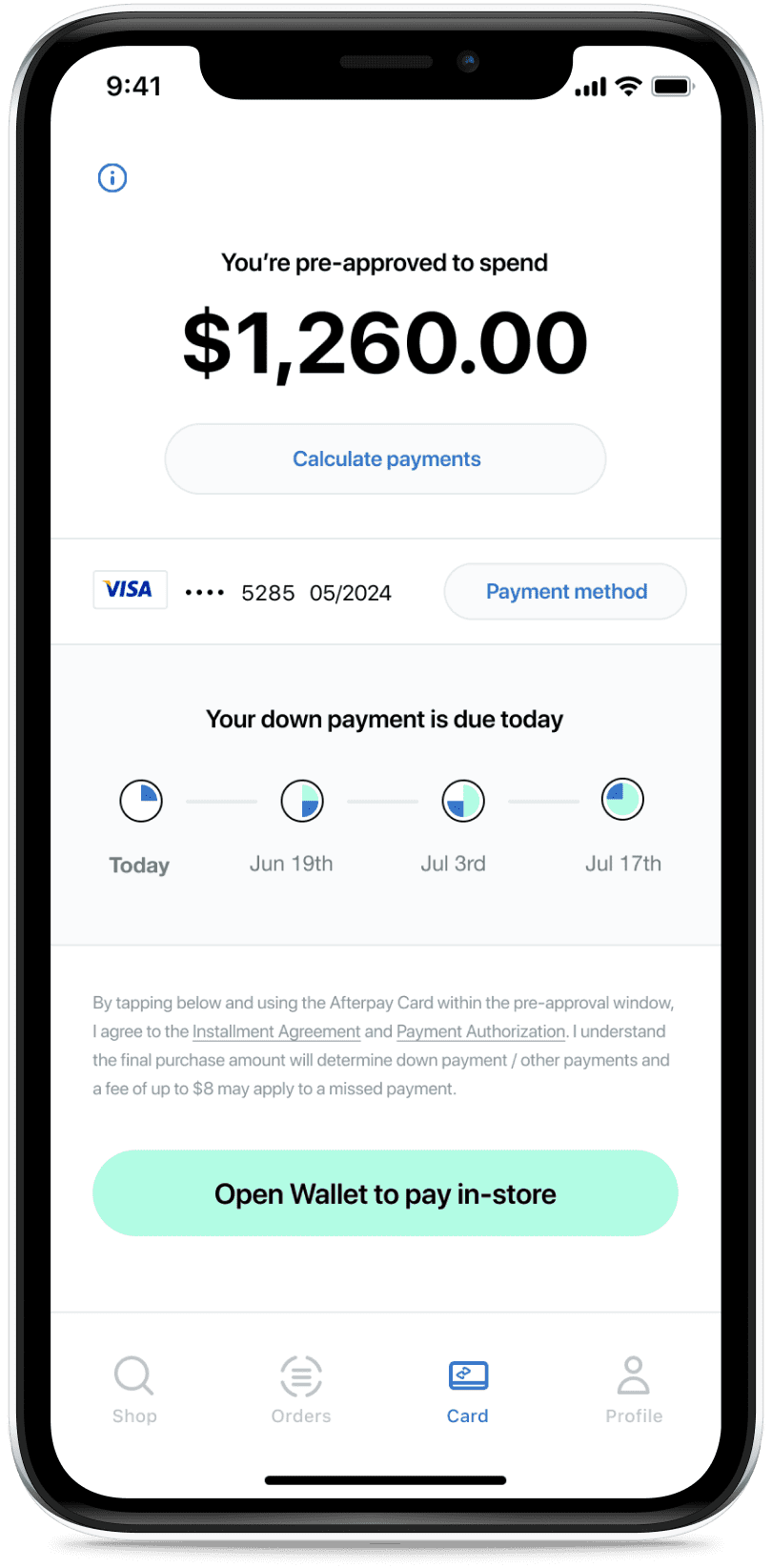

Afterpay’s buy now, pay later platform allows users to stagger the cost of purchases up to $1,500.

Afterpay

BNPL — it’s the latest series of letters taking Wall Street by storm. But what does it mean? And why are consumers raving over it?

Like layaway plans of old that are now called point-of-sale loans, BNPL (or “buy now, pay later”) lets shoppers break purchases into equal installment payments without interest or fees. It even allows them to use a debit card, which can make expensive items seem affordable. The lenders typically partner with retailers like Macy’s, Walmart and Peloton to offer their services.

But BNPL — which in the U.S. grew 215% year over year in the first two months of 2021 — is no longer for big-ticket items like furniture or Peloton bikes alone. It’s become increasingly popular for smaller items online, and is being quickly adopted by merchants and payment companies. In fact, a wave of major companies are suddenly letting people finance everything from video game consoles to hair products in smaller, monthly payments.

More than half of U.S. consumers have used a “buy now, pay later” service, according to a study published earlier this year by Ascent. The majority of those surveyed used it to avoid paying credit card interest, or buy something “not in their budget.”

Last year companies in the space facilitated upwards of $20 billion in U.S. transactions, according to management consultants Oliver Wyman. That number is only expected to grow. Consumers will spend an estimated $680 billion globally using point-of-sale installment payments over e-commerce channels by 2025, according to research from Kaleido Intelligence.

As a result, payment players and fintechs from PayPal to American Express have been rushing to launch their own version of BNPL products for online items that cost in the low hundreds of dollars.

On Sunday, Square announced plans to buy Australian fintech company Afterpay, which lets customers pay in four interest-free installments and pay a fee if they miss an automated payment. Its 16 million customers will eventually be able to manage installment payments directly through Square’s Cash App. The deal is expected to close in the first quarter of 2022.

In an interview with CNBC’s “Squawk on the Street” Monday, Square CFO Amrita Ahuja said the company sees the acquisition as an opportunity to create a “more powerful ecommerce platform” that appeases growing consumer interest in “transparent buying opportunities” and offers new ways for merchants to serve their customers.

Affirm, a two-time CNBC Disruptor 50 company, is one of the better-known public providers offering the option to finance items in smaller, monthly payments. Klarna, Mastercard, Fiserv, Citi, and J.P. Morgan Chase are all offering similar loan products. Apple is planning to launch installment lending in a partnership with Goldman Sachs, Bloomberg reported last month.

“I think it’s unequivocally a giant validation of this entire category,” Affirm co-founder and CEO Max Levchin said of the Afterpay acquisition on CNBC’s “Closing Bell” Monday afternoon. “As recently as a handful of newscasts ago you would hear people go ‘oh, it’s just a feature,’ and that the credit card industry would ‘eventually catch up’ … the world is changing, credit cards are going to be the losers in this deal and this is a giant validation of what’s going on.”

Last year, Affirm partnered with Shopify to offer a interest-free, zero-fee payments program for online customers.

Some have concluded that the appeal of BNPL is generational. Research from consumer spending data firm Cardify.ai found that Gen Z and younger millennials account for more than 80% of BNPL transactions.

“Their sweet spot is young adults, particularly those who want to buy something now and don’t necessarily have the money on hand,” said Ted Rossman, an analyst at CreditCards.com. “These individuals are often wary of debt and may not have a ready alternative such as a credit card.”

Still, BNPL loans aren’t free of financial risk. Two-thirds of those who have used the financing said it caused them to spend more money than they would have otherwise, a LendingTree survey of 1,040 Americans found. Almost half said they wouldn’t have made their purchase if they didn’t have the option to finance.

While young people in particular are serving as a driving force in their adoption, “a substantial number of Baby Boomers rely on some sort of fintech account, contradicting the general perception that digital tools are exclusively for younger people,” according to a 2020 McKinsey & Company survey. The consulting company found that fintechs are “catching up with traditional banks in terms of customer trust.”

The growth of ecommerce has also helped some institutional players like Citizens Bank, which recently expanded the reach of its checkout loan offerings. Last year, Macy’s, the largest U.S. department store operator, signed a deal to invest in Swedish payments group Klarna in a five-year partnership between the two companies under which Macy’s customers could choose to make payments in four equal, interest-free installments at the online checkout.

Klarna, a regulated bank, touts itself as an alternative to credit cards, an industry the company views as detrimental to consumers. The company, which ranked No. 5 on last year’s CNBC Disruptor 50 list, makes money by taking a fee from merchants each time a customer makes a transaction. It says merchants that use its service often see an increase in sales as a result.

“There are other players out there that you can be a little bit more worried about whether they will be able to sustain their margins,” Klarna co-founder and CEO Sebastian Siemiatkoswski said on CNBC’s “TechCheck” Monday morning.

“We’re close to PayPal’s size, so that’s not necessarily something I worry about for us,” Siemiatkowski added.

Even Jamie Dimon, JPMorgan Chase chairman and CEO, listed fintech as one of the “enormous competitive threats” to banks in his annual shareholder letter released earlier this year. “From loans to payment systems to investing, they have done a great job in developing easy-to-use, intuitive, fast and smart products.”

This, in part, is why “banks are playing an increasingly smaller role in the financial system,” he said.

—CNBC’s Kate Rooney contributed to this report.