Stocks, U.S. Futures Fall as China Data Sours Mood: Markets Wrap

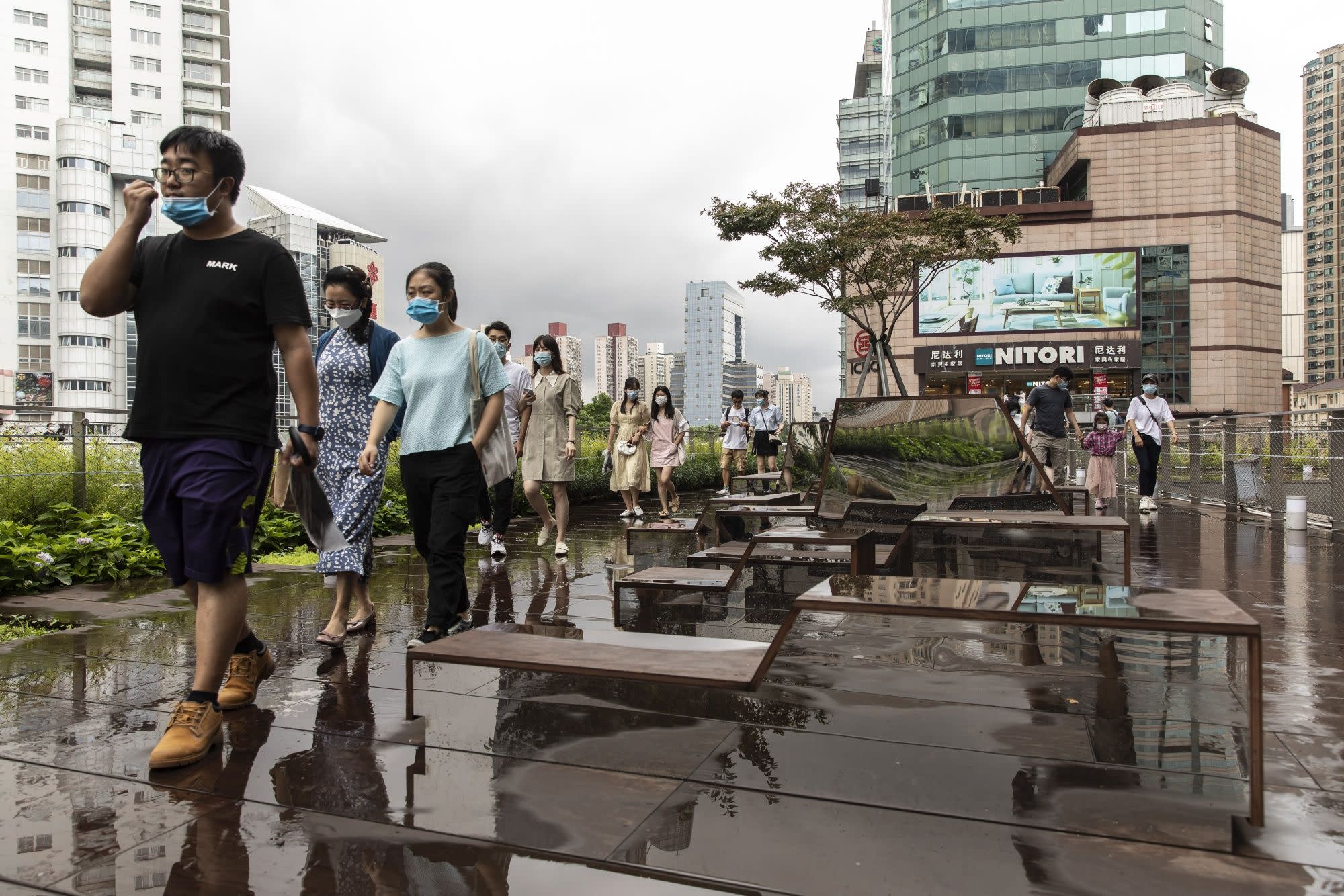

(Bloomberg) — U.S. stock-index futures fell and the dollar rose as weak Chinese data and the spread of the coronavirus delta variant sparked worries the global economic rebound is faltering.

Contracts on the S&P 500 Index declined 0.3% after the underlying gauge notched up another record high on Friday. Commodities declined after Chinese retail sales and industrial output data showed activity slowed. Alibaba Group Holding slid in premarket trading after China’s state media criticized the online-game industry.

With Asian economies under stress from a resurgent pandemic and U.S. consumer sentiment near a decade low, investors are turning to signals from the Federal Reserve to sustain market momentum. A town hall by Chair Jerome Powell on Tuesday may act as a precursor to the Fed’s Jackson Hole symposium in late August, providing clues on whether a recent string of strong U.S. data qualified as adequate progress for the central bank to consider tapering stimulus.

“Shares remain vulnerable to a short-term correction with possible triggers being the upswing in global coronavirus cases, the inflation scare and U.S. taper talk,” said Shane Oliver, head of investment strategy and chief economist at AMP Capital.

Treasuries were higher, though they trimmed gains with the 10-year yield giving up a drop of as much as three basis points. In addition to the town hall, traders will also be watching the Federal Open Market Committee’s latest minutes this week as competing views on the persistence of inflation spurs bond-market volatility.

Equities in the U.S. and Europe hit records last week, bolstered by vaccine rollouts. But the continued risk from the delta variant pushed European stocks lower on Monday. The benchmark Stoxx Europe 600 Index broke a 10-day streak without a loss, with energy and commodity stocks the biggest drags on the gauge.

Faurecia SE shares jumped 9.4% after the French auto supplier agreed to take over Hella GmbH in a deal that would create the world’s seventh-largest cap-parts maker.

Alibaba lost 1.9% in early New York trading. China should tighten regulations of online games to ensure they don’t misrepresent history, state media reported after a government-controlled agency criticized the industry earlier this month.

Bitcoin traded around $47,400. Its second-day gain helped crypto stocks to rise in premarket deals. Riot Blockchain added 2.5%. Crude oil dropped for a third day as the resurgent pandemic hurt prospects for global demand.

Here are some events to watch this week:

U.S. Federal Reserve Chair Jerome Powell hosts a town hall discussion with educators TuesdayChina’s top legislative body, the National People’s Congress Standing Committee, begins a four-day meeting in Beijing TuesdayU.S. retail sales are due TuesdayReserve Bank of Australia minutes are scheduled to be released TuesdayReserve Bank of New Zealand policy decision and briefing by Governor Adrian Orr WednesdayFOMC minutes released WednesdayBank Indonesia rate decision and Governor Perry Warjiyo briefing Thursday

For more market analysis read our MLIV blog.

These are the main moves in markets:

Stocks

Futures on the S&P 500 fell 0.3% as of 6:47 a.m. New York timeFutures on the Nasdaq 100 fell 0.3%Futures on the Dow Jones Industrial Average fell 0.3%The Stoxx Europe 600 fell 0.5%The MSCI World index fell 0.2%

Currencies

The Bloomberg Dollar Spot Index was little changedThe euro fell 0.1% to $1.1782The British pound was little changed at $1.3862The Japanese yen rose 0.3% to 109.28 per dollar

Bonds

The yield on 10-year Treasuries was little changed at 1.27%Germany’s 10-year yield advanced one basis point to -0.46%Britain’s 10-year yield advanced one basis point to 0.58%

Commodities

West Texas Intermediate crude fell 1.3% to $67.57 a barrelGold futures were little changed

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.