The brief history of meme stocks suggests betting against Robinhood is foolhardy

A band of merry retail investors has been spicing up the normally dull days of August.

Wednesday’s meteoric rise in Robinhood HOOD,

Read: Robinhood’s big day proves it’s the first meta–‘meme stock’

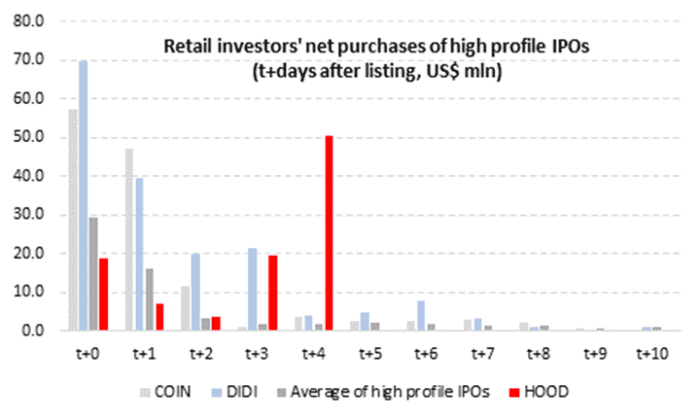

Our call of the day from VandaTrack, a tracker of individual investor purchases, offers a glimpse at just how far that push might go for Robinhood, which just a week ago suffered a disastrous debut. Note, the stock is down Thursday after the company said shareholders will sell 98 million shares.

“Robinhood has only seen US$100 million in retail purchases this week. If retail investors start withdrawing money from tired meme stocks to buy HOOD, there is still room for the move to continue,” said senior strategist Ben Onatibia and analyst Giancomo Pierantoni in a note on Thursday. VandaTrack provides daily data on retail investors’ net purchases of US single stocks and ETFs.

In January short squeeze, retail investors spent $352 million on net purchases of GameStop GME,

VandaTrack data also shows HOOD was the third-most purchased stock — $50.5 million — on retail platforms Wednesday. A total of $467 million buys and sells for that stock placed it fourth in volume behind a mega S&P ETF SPY,

In a separate note, Onatibia and Pierantoni observed that retail buying of U.S. equities is at its lowest since May, which is partly due to summer vacations and a lack of sector-specific stories to get excited about. Tech is one category that has seen flows improving, at the expense of cyclical stocks.

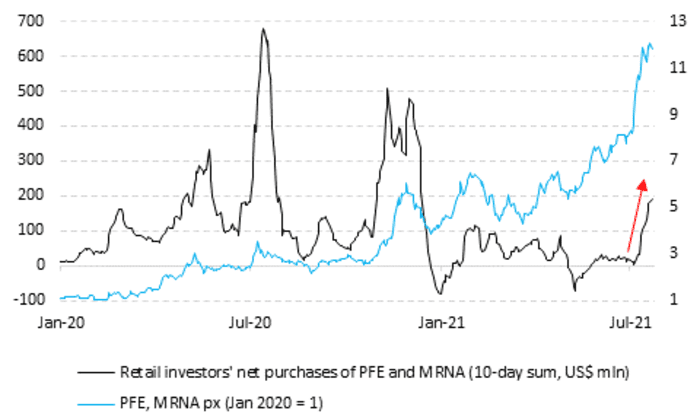

Vaccine manufacturers such as Moderna and Pfizer have also seen a jump in retail buying, they noted.

“Over the past 10 days, they have seen combined net inflows of US$180 mln, the largest amount since the results of the clinical trials were published in November. The rise in global cases of the delta variant, the imminent FDA approval and the rise in vaccine prices have all coalesced to turbocharge the rally,” said the pair.

Shares of Moderna, which just reported a big profit beat and 199 million doses of its COVID-19 vaccine sold, have climbed over 300% this year, though mMRA rival BioNTech BNTX,

Read: These 20 tech stocks boosted sales by up to 152% while also expanding profit margins

Weekly jobless claims and an EV-auto pledge

Earnings are rolling in from Cigna CI,

Uber shares UBER,

China gaming stocks — Tencent 700,

Shares of GM GM,

A day ahead of nonfarm payrolls, the latest weekly jobless claims are ahead, along with the June trade balance.

The markets

Goldman Sachs hiked its S&P 500 SPX,

The chart

Random reads

Spanish engineers make water out of nothing at all.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.